Retail Bitcoiners Sold Coins in Recent Rally

The massive sell-off by small Bitcoin investors could be slowing the price escalation as institutions establish themselves in the market.

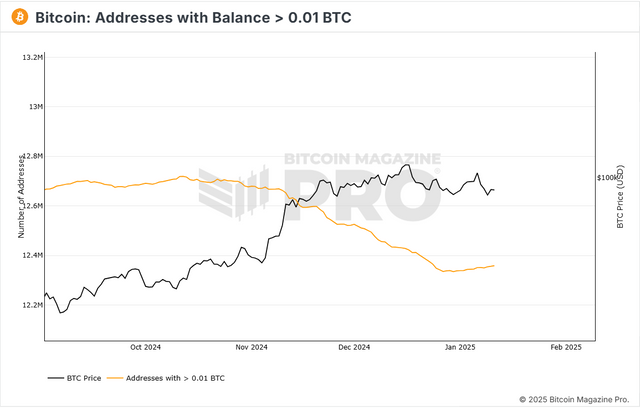

Amid the recent bullish wave in the cryptocurrency market, retail investors made a surprising decision: selling a significant portion of their Bitcoin holdings. Data from Bitcoin Magazine Pro reveals a notable reduction in addresses holding smaller amounts of this cryptocurrency. This move could be affecting the upward trend that was being projected after Donald Trump's electoral victory.

Drop in Bitcoin retail addresses

Since November 5, addresses holding 0.01 BTC decreased by 2.50%, from 12,675,742 to 12,358,579. This represents a loss of close to 320,000 addresses, suggesting that retailers took advantage of the price increase to capitalize on profits. Similarly, addresses holding more than 0.1 BTC fell by 2.24%, dropping from 4,573,124 to 4,470,590.

The behavior of these investors becomes a relevant factor, as the collective actions of this group, which represent the majority within the Bitcoin ecosystem, seem to limit the price escalation at a critical moment.

Institutional interest on the rise

In contrast, the number of addresses holding more than 100 BTC experienced a resounding increase of 8.48%. This indicates a change of trend towards the big market players. They went from 16,393 to 17,783 addresses in the same period. The accumulation of Bitcoin in this segment suggests that institutions and exchange-traded funds (ETFs) are taking the lead. While small investors liquidate, institutions seem to be accumulating the cryptocurrency, with ETFs reaching a total of 1.47 million BTC in custody.

There is also a drop in wallets with more than 10,000 BTC, which went from 100 to 97, which represents a decrease of 3%. This phenomenon could be related to the movement of BTC from centralized platforms to self-custody wallets.

Price consolidation and future trends

Despite the downward pressure in recent weeks, Bitcoin began to stabilize since the beginning of January, achieving a slight rebound in the number of addresses holding this cryptocurrency. After reaching highs of $108,000 in mid-December, the price is currently in a consolidation phase around $94,400. This level coincides with the 50-period moving average.

The latest data indicates that the selling force of recent weeks shows signs of weakening, which could give way to a possible recovery. According to CheckonChain, the selling volume shows signs of less aggressiveness in recent sessions. This lull could be due to investors looking forward to the US inflation data due out this week.

The current scenario illustrates an interesting dichotomy between retail movement and growing institutional interest in the Bitcoin market. While small investors liquidate their positions to lock in profits, big players seem to be forming a solid foundation for future investments. The next few days will be crucial in determining the future direction of Bitcoin's price action.

Disclaimer: This information is for informational purposes only and does not constitute financial or investment advice. Always conduct your own research before making investment decisions.9

Upvoted! Thank you for supporting witness @jswit.