Is a "Bear Market" Looming? Bitcoin's Bullish Trend is on Thin Ice

The world's biggest crypto is fighting to stay above water, and fresh inflation numbers aren't doing it any favors!

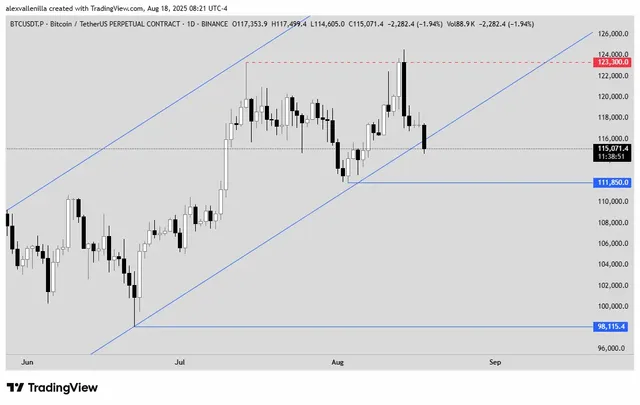

The price of Bitcoin (BTC) is currently testing a critical support line that could determine what it does next. After a week where it couldn't get past the $123,300 resistance, the top crypto has dropped. As of this report, it's trading at $115,071, showing a -1.94% loss during the Asian trading session. This dip comes right after new U.S. production inflation data came out higher than expected, souring the mood in the market.

Bitcoin price tests key support. US inflation drives the decline. Are we facing a bear market? Technical and financial analysis. / TradingView

The Bullish Trend: Is This the Tipping Point?

The bullish trend, which has held up since April, is a key trendline that acts as a floor for Bitcoin's price. If BTC drops below this line, it'll be a clear sign that the recent upward trend is losing steam. Such a move could send it sliding toward the next big support level at $111,850. The crypto community is on pins and needles, as a break below this line could kick off a deeper correction or even a full-blown bear market.

Inflation's Shadow

Bitcoin's slide got faster after the U.S. production inflation data came in way hotter than anyone predicted. Historically, when inflation heats up, investors often look for safe-haven assets. But in the wild world of crypto, worries about a potential recession can have the opposite effect. This uncertain economic outlook is really putting BTC's staying power to the test as an alternative to traditional financial markets.

Disclaimer: The content in this article is just for your information and shouldn't be seen as financial advice. Investing in crypto is super volatile and comes with a big risk of losing your money. Always do your own homework and talk to a financial pro before you make any investment decisions.

Upvoted! Thank you for supporting witness @jswit.