Institutions Accumulate BTC at a Frantic Pace

The number of Bitcoin "dolphins" has skyrocketed 17% in one year, driven by the "Trump Effect" and crypto deregulation. Prepare for a potential unprecedented bull run!

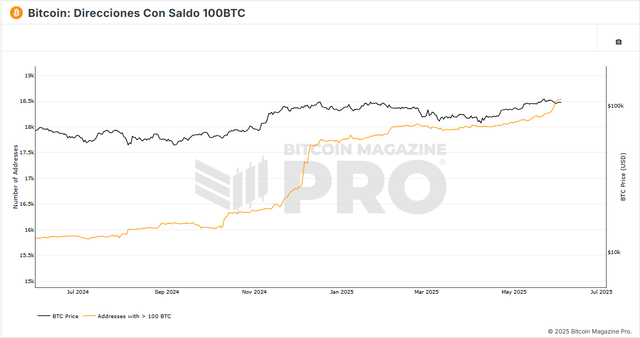

The ever-vibrant and constantly evolving cryptocurrency market is witnessing a phenomenon that could lay the groundwork for Bitcoin's next major bull run. On-chain data from Bitcoin Magazine Pro reveals a stunning increase in the number of addresses with significant BTC balances, commonly known as Bitcoin "dolphins." This is understood as an accumulation of BTC by institutions. This massive accumulation behavior, which has accelerated significantly, suggests unwavering confidence in the future of the leading digital asset and a possible preparation for an imminent appreciation in its value.

Between June 3, 2024, and June 3, 2025, the number of addresses holding more than 100 BTC increased substantially, from 15,831 to 18,545 addresses / Bitcoin Magazine Pro

The Silent Accumulation of Bitcoin Giants

Between June 3, 2024, and June 3, 2025, the number of addresses holding more than 100 BTC increased substantially, from 15,831 to 18,545 addresses. This increase represents an impressive +17.14% in a single year, a figure that has not gone unnoticed by market analysts. Bitcoin "dolphins," while not reaching the threshold of "whales" (generally defined as holdings of more than 1,000 BTC), represent high-level investors who, collectively, move considerable volumes and often anticipate major market trends.

This accumulation pattern has several key implications:

Vote of Confidence from Large Investors: The steady increase in the number of these large BTC holders is a clear indicator that institutions, public companies, and high-net-worth individuals are strengthening their Bitcoin positions. This reflects a deep conviction in the long-term value of BTC as a digital store of value and an inflation-resistant asset.

Positioning for Future Bullishness: Historically, periods of large-scale accumulation of BTC have preceded significant bullish phases. These strategic players are securing their assets off exchanges, in cold wallets, with the intention of holding them long-term and capitalizing on future price increases.

Supply Constraint: As more Bitcoin is accumulated by these large holders, the supply of BTC available for trading on the markets is reduced. If demand remains the same or, as expected, increases, this planned shortage will exert natural upward pressure on the price.

Market Maturity: The willingness of more entities to hold large amounts of Bitcoin long-term underscores the growing maturity and acceptance of the cryptocurrency market within the global financial landscape.

Among the most prominent "dolphins" and "whales" are public companies such as MicroStrategy, Tesla, Marathon Digital, Riot Platforms, Galaxy Digital Holdings, and Coinbase Global, Inc., which have adopted Bitcoin as part of their treasury strategy. Likewise, institutional investment products such as Bitcoin ETFs managed by giants like BlackRock are accumulating BTC for their clients. Other notable players include high-net-worth individual investors, major cryptocurrency exchanges (custodying client funds in cold wallets), and, interestingly, some governments that have acquired BTC through seizures or strategic purchases, such as El Salvador.

The "Trump Effect": An Unexpected Catalyst with Historic Potential

One factor that injected additional optimism and accelerated accumulation is the victory of President Donald Trump and his promises regarding cryptocurrencies. If the correlation is causal, we are looking at a powerful and potentially disruptive driver for Bitcoin adoption and price:

Regulatory Clarity and Deregulation: The promise of a US presidential administration to deregulate cryptocurrencies is a paradigm shift. Regulatory uncertainty has long been an obstacle to massive institutional investment. A friendlier stance could open the door for pension funds, sovereign wealth funds, and other large financial institutions to dive into the Bitcoin space without fear of an adverse regulatory environment.

The Vision of a US Bitcoin Reserve: The proposal that the United States could consider a Bitcoin strategic reserve is monumental. Not only would this legitimize Bitcoin at the highest level of government, but it would also entail a massive and sustained government purchase of BTC. The entry of a buyer of this magnitude would have an unprecedented bullish impact on the price and narrative of Bitcoin.

Positive Market Sentiment: The statements and policies of leaders of the world's largest economies have an immense psychological effect. A pro-crypto environment from the White House generates a climate of optimism and security that attracts an even broader investor base.

Outlook: Where is Bitcoin Headed?

The 17.14% increase in addresses holding more than 100 BTC in the last year, coupled with the acceleration of accumulation following President Trump's promises, paints a predominantly bullish picture for Bitcoin.

The underlying strength displayed by this accumulation by "dolphins" indicates a deep conviction in Bitcoin's long-term value. Add to this the political catalyst of favorable US policies, which could remove regulatory barriers and add a significant government buyer, and the potential for price creation is immense. The reduction in available liquid supply, combined with increased demand from large players, sets the stage for a strong bullish move in the medium and long term.

If these trends persist and political promises materialize, Bitcoin could be on the verge of a new phase of mass adoption and price appreciation, driven by large-scale accumulation by institutions and, potentially, governments. Monitoring these metrics and political developments will be crucial in the coming months.

Disclaimer: This article is for educational and informational purposes only and should not be considered financial advice. Investing in cryptocurrencies carries significant risks. Please conduct thorough research before making any investment decisions.

Upvoted! Thank you for supporting witness @jswit.