Bitcoin Takes a Breather: Is the Crypto Party Over, or Just a Quick Nap?

Uncle Sam's Inflation Report Keeps the Fed on Edge and Puts the Brakes on Bitcoin's Hot Streak

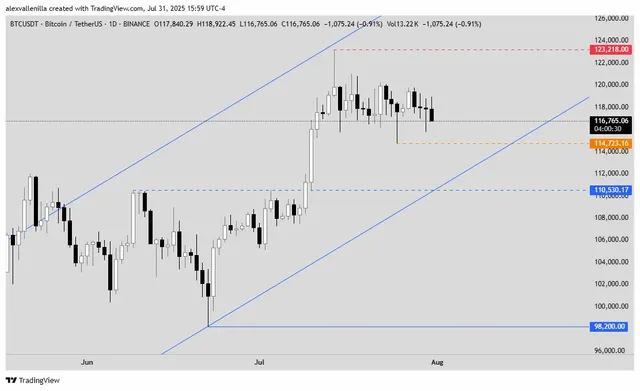

Bitcoin's price just saw a slight dip, trading down at $116,765 USDT with a modest 0.91% loss at the time of this report. This little shake-up comes on the heels of fresh inflation data out of the U.S. While the numbers aren't spiraling out of control, they're hinting that the Federal Reserve (the Fed) might not be slashing interest rates as fast as everyone on Crypto Twitter was hoping.

Bitcoin dropped slightly! Find out how persistent US inflation is impacting BTC's price and if it's a risk asset or digital safe haven. / TradingView

Inflation: The Uninvited Guest That Won't Leave?

The latest consumer price reports have definitely got the markets feeling a bit antsy. The Core Personal Consumption Expenditures (PCE) Price Index, which is basically the Fed's go-to for checking inflation's pulse, clocked in at 0.3% month-over-month. That was right on target, but the year-over-year number, 2.8%, edged past the 2.7% forecast. This tells us that those underlying price pressures are still simmering, even if they're not boiling over.

Then there's the headline PCE Price Index, which includes everything, even those wild swings in energy and food prices. That one bounced back to 2.6% year-over-year, hitting its highest point in three months. So, yeah, inflation isn't exactly rolling over and playing dead.

What's the 411 for the Fed (and Your Portfolio)?

The Fed's in a tricky spot. With inflation stubbornly hanging around (especially that 2.8% Core PCE), hitting their 2% target feels like a long road trip. This could mean they'll keep interest rates higher for longer, or at the very least, pump the brakes on any aggressive rate cuts that investors might have been pricing in. And in the financial world, higher rates usually mean less love for "risky assets" – cough, cough, crypto – because borrowing money gets more expensive.

Bitcoin: Digital Gold or Just Another Tech Stock? The Existential Crisis Continues

Bitcoin has always been a bit of a chameleon. On one hand, it's often seen as a risk asset, doing its dance in sync with tech stocks. On the other, some folks swear it's "digital gold," a safe haven when fiat currencies start looking shaky.

In this current economic vibe, with interest rates staying elevated and global liquidity potentially tightening up, Bitcoin's risk-asset side is flexing harder. Holding BTC becomes more "expensive" when you can get a decent return on safer investments. That means we could see some downward pressure or sideways movement for Bitcoin's price, especially if the overall market mood turns sour on riskier plays.

Now, if inflation really gets out of hand, or people start losing faith in traditional money, then Bitcoin's "digital safe haven" narrative might gain some serious traction. But for now, it's taking a backseat to its sensitivity to market risk.

Stuck in a Rut or Gearing Up?

Right now, Bitcoin has been grinding sideways for 17 days, chilling between a high of $123,000 USDT and a low of $115,000 USDT. Even with this sideways action, it's still rocking an intact uptrend on the daily chart since April 7th.

Thursday's dip came with low trading volume. What does that mean? It's like when everyone at a party suddenly gets quiet – not many people are making big moves. Low volume on a price drop often suggests that the selling pressure isn't super strong, so it might not be the start of a massive crash. Investors seem to be in "wait-and-see" mode, looking for a clear breakout – either up or down – to spark some real volatility and create fresh opportunities to jump in or out.

Navigating the Vibe Check

The crypto market, and Bitcoin especially, is in a classic holding pattern. The tug-of-war between a resilient economy and stubborn inflation will call the shots for the Fed, and that'll set the tone for all risk assets. Keep your eyes peeled for the next batch of economic data, because in the crypto game, every single number matters.

Disclaimer: This article is not financial advice. The cryptocurrency market is wild, so do your own research before making any investment moves.

Upvoted! Thank you for supporting witness @jswit.