Bitcoin Stumbles as US Economy Flashes Red Flags: Is the Bull Run on Pause?

The Crypto King takes a hit after a key services report signals a slowdown.

Bitcoin (BTC), the undisputed leader of the crypto world, just got a reality check from some less-than-stellar US economic data. The top digital currency slipped a modest 0.80% to close at $144,129 USDT on the Binance exchange. This drop is a fresh reminder that Bitcoin, despite its "digital gold" narrative, is still heavily influenced by the same old market forces and its own wild volatility.

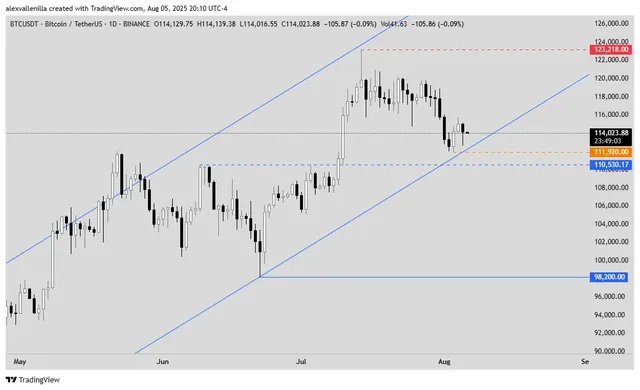

Bitcoin retreats as the US economy slows due to the ISM Services PMI. We analyze the Fed's reaction and the cryptocurrency's technical trend. / TradingView

The trouble started with the latest ISM Services PMI report, a key health check for the US services sector. The number came in at 50.1, missing both the forecast (51.5) and the previous month's reading (50.8). While still technically in "expansion" territory, this slowdown confirms that the economic engine is losing steam—and it’s not just in manufacturing anymore. This has investors hitting the brakes and getting a lot more cautious.

The Fed: Stuck Between a Rock and a Hard Place

This services sector slump sends a loud and clear message to the Federal Reserve (Fed). Analysts are now convinced the Fed will take a "wait and see" approach, likely pumping the brakes on any more interest rate hikes. Sure, a cooler economy could help bring down inflation, but don't expect the Fed to start cutting rates anytime soon. They'll need a lot more proof that inflation is truly beaten before making any moves.

Bitcoin's Chart: A Test of Strength

Despite the recent dip, Bitcoin's long-term technical analysis still looks solid. The price is holding above a key bullish trendline that’s been in play since April. However, traders need to stay alert. BTC recently tested a crucial support level at $111,920 USDT. If that line breaks, the next stop could be a retest of the main uptrend on the daily chart. In a "risk-off" mood, investors are quick to dump volatile assets like Bitcoin to protect their portfolios, which could intensify the selling pressure.

What's Next for Bitcoin?

Bitcoin is at a real crossroads. On one hand, its long-term bullish trend and its reputation as a safe haven are compelling. On the other hand, its price is proving to be a punching bag for every new piece of US economic news. The next moves from the Fed and the ongoing health of the US economy will be the biggest factors determining where BTC goes from here.

Disclaimer: This article is for informational purposes only and is not investment advice. Cryptocurrencies are extremely volatile. Do your own research and consult with a professional financial advisor before making any investment decisions.

Upvoted! Thank you for supporting witness @jswit.