Bitcoin Spot Volume Plummets 80% in Seven Months

Is this the silence before the storm, or a strategic consolidation by the big players?

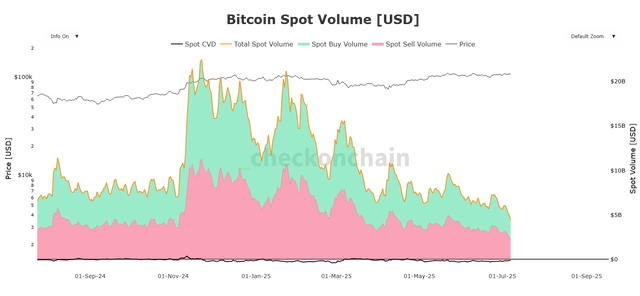

The cryptocurrency world is at a turning point. Although the price of Bitcoin (BTC) has defied all expectations, remaining above $100,000 in recent months and even reaching an impressive high of $111,477 in May 2025, a deep analysis of spot trading volume reveals a worrying reality: a precipitous 80% drop in the past seven months, according to data from CheckonChain. This dramatic contraction has left financial and trading experts perplexed, raising serious questions about the sustainability of BTC's current valuation.

Analysis of Bitcoin's spot market volume and price trends from late 2024 to mid-2025 is revealing / CheckonChain

The Price-Volume Paradox: What's Really Going On?

Since November 2024, when Bitcoin was trading at $98,938 with a volume of $22.47 trillion, the narrative of institutional demand driven by Bitcoin ETFs seemed unstoppable. Donald Trump's victory in the United States also injected initial optimism. However, current data from July 2025, with a volume of just $4.44 trillion, paints a very different picture, reminiscent of April 2024 levels. This disconnect between rising price and plummeting volume is a phenomenon that deserves our utmost attention.

A Snapshot of Bitcoin's Spot Volume Decline

An analysis of Bitcoin's volume and price trends in the spot market from late 2024 to mid-2025 is revealing:

November 2024: Volume reached $22.47 trillion with a price of $98,938.

January 2025: Despite a price increase to $104,184, volume was already showing a slight contraction to $21.18 trillion.

March 2025: A more noticeable decline brought volume to $15.56 trillion, with the price at $86,553.

April 2025: The decline continued, with volume at $10.87 trillion and a price rebound to $82,720.

May 2025: Volume dropped sharply to $9.62 trillion, even as the price reached its peak of $111,477.

June 2025: Volume continued its decline to $7.28 trillion, with a price of $107,305.

July 2025: The downward trend persisted, bringing volume to $4.44 trillion, while the price remained strong at $109,108.

This more than 80% contraction in volume, which has fallen from $22.47 trillion to $4.44 trillion in just over seven months, suggests a significant reduction in investor interest or trading activity.

Implications of Low Liquidity: Risks and Consequences

The sharp reduction in trading volume is not a minor issue and has several important consequences for the Bitcoin market:

Increased Potential Volatility: Low volume means fewer active participants, making the price more vulnerable to sudden movements, even with small orders.

Less Liquidity: It becomes more difficult to execute large buy or sell trades without significantly affecting the price, which can complicate entering or exiting positions for institutional investors and "whales."

Difficulty Confirming Trends: In technical analysis, a rising price with low volume is often viewed with skepticism, as it could indicate a less robust uptrend and be susceptible to a correction.

Higher Risk of Manipulation: Markets with low volume are more susceptible to price manipulation by a few large traders.

Consolidation or Lack of Interest: Declining volume can signal a consolidation phase before a major move, or simply a decline in overall interest in the asset, which could precede a correction.

Expert Verdict: Sustainability in Doubt?

The dichotomy between a Bitcoin price remaining at elevated levels and a drastic decline in its spot volume is a critical factor for blockchain traders and developers. While the current price is robust, the lack of participation and underlying liquidity could be a red flag.

It is critical for investors to closely monitor volume developments, as the sustainability of the current price level could depend on an eventual recovery in trading activity. Persistently low volume, despite a high price, could suggest a lack of market conviction or a silent distribution phase, which in the medium term could lead to a price correction if the volume trend does not reverse. Trading algorithm programming and blockchain data analysis will be crucial to navigate this uncertain landscape.

In short, although the Bitcoin price looks healthy, the underlying market's health, as measured by volume, is weak. This creates an environment of greater uncertainty and potential volatility going forward.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in cryptocurrencies carries significant risks. Always conduct your own research and consult a professional before making investment decisions.

Upvoted! Thank you for supporting witness @jswit.