Bitcoin's Soaring! What's Pushing It Past $123,000 and Driving Institutional Hype?

The crypto king is shattering barriers, open interest is exploding, and big-money players are all-in. Are we witnessing Bitcoin's golden age?

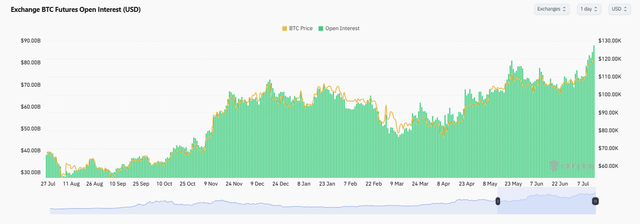

Bitcoin just keeps blowing the financial world's mind. In an absolutely wild bull run, the cryptocurrency has smashed its own record, zooming past the $123,000 mark. This massive milestone comes with a telling detail: Bitcoin's open interest (OI) has shot up to a new all-time high of $87.85 billion, according to Coinglass data. This explosion isn't just about excited individual investors; it also clearly signals growing confidence from major institutions in this digital asset.

Bitcoin breaks records, surpassing $123,000! Open interest soars and institutional investment boosts the cryptocurrency. Is this the dawn of a new era? / Coinglass

###What's the Deal with OI Skyrocketing as Prices Climb?

Open interest (OI) basically tells you the total number of futures or options contracts that are still active and haven't been closed out yet. When an asset like Bitcoin sees its OI jump significantly while its price is also on the rise, that's a huge signal.

Simply put, it means a ton more money is flowing into the market through derivative contracts, with more traders opening "long" positions (betting the price will go up). Many see this as a strong indicator that the bullish sentiment is legit and that market players are pretty confident the price will keep climbing. It suggests the current rally isn't just a quick "pump and dump" driven by short-term trading, but actually has broader, potentially more lasting support.

Speculation and Big-Time Investors: A Dynamic Duo

A mix of factors is fueling this incredible climb. Global economic uncertainty has certainly revved up speculation that Bitcoin, which many view as "digital gold," will keep gaining value. But beyond just individual speculation, institutional investment is playing a major role.

Net capital flowing into Bitcoin ETFs is hitting fresh highs, which really highlights the growing acceptance and demand from huge funds and corporations. More and more companies are adding Bitcoin to their balance sheets, looking to diversify their assets and jump on the growth potential of this digital currency. This corporate demand is a key force pushing the price up and giving Bitcoin even more legitimacy in the global financial scene.

Disclaimer: The information in this article is for educational and informational purposes only and shouldn't be taken as financial advice. Investing in cryptocurrencies comes with high risks, and you could lose all or part of your capital. Always chat with a financial professional before making any investment decisions.

Upvoted! Thank you for supporting witness @jswit.