Bitcoin Holds Steady: No FOMO, No FUD

BTC's price at $118,394 and a key indicator hint at moderate gains that might just catch you off guard.

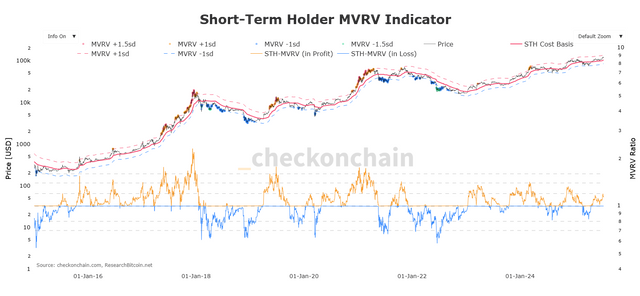

Everyone in the crypto sphere's got their eyes glued to Bitcoin's latest moves. A deep dive into the Short-Term Holder MVRV (STH-MVRV) indicator – a go-to tool for understanding how newer, more active investors are feeling – is shedding some serious light on the current market vibe. With BTC's price hovering around $118,394, folks who've moved their coins in the last 155 days (that's what "short-term holder" means in crypto-speak) are seeing green. But here's the kicker: it's not the kind of over-the-top euphoria that usually signals a big correction is just around the corner.

Bitcoin's sitting pretty with moderate gains based on STH-MVRV. See how BTC's on-chain data shows a healthy market, minus the crazy hype. / CheckonChain

The Secret Sauce Behind Trader Behavior

The STH-MVRV, a metric developed by pros like CheckonChain, essentially shows us the relationship between Bitcoin's market price and the average price these short-term holders actually paid for it. If that number is above 1, it means, on average, these investors are in profit. Right now, this indicator sits at 1.1363. That translates to decent, but not crazy, profits for the "newbies" in the Bitcoin game.

What Did the Fresh Faces Pay to Get In?

The cost basis for STHs – basically, the average entry price for these investors – is pegged at $103,879. Comparing that to the current $118,394 price, it's clear these folks are sitting pretty. But before you start thinking they're about to dump their bags, hold up! There aren't any signs of a massive sell-off brewing.

Where Are We Headed? Chill Vibes, Not Wild Swings

The current market isn't showing any signs of overheating. That STH-MVRV of 1.1363 is well below the "euphoria zone," which kicks in around $137,857 (MVRV +1sd). This means while people are making money, the market isn't caught up in the kind of speculative frenzy that typically leads to a big dip. There's still room for prices to climb before people start thinking about cashing out big time.

And on the flip side, the idea of capitulation – you know, that panic-selling moment – is totally off the table. The current price is way above the MVRV -1sd of $84,751. So, short-term investors aren't staring down huge losses that would force them to sell their Bitcoin at a discount.

Bitcoin's Next Move: Steady Climb or Big Jump?

Bottom line? The STH-MVRV analysis suggests Bitcoin is in a healthy spot, with short-term investors sitting on moderate gains. We're not seeing signals of an overbought market or a panicked sell-off. The STH cost basis of $103,879 is acting like a solid floor, and the distance from that euphoria threshold means there's still gas in the tank for potential upside. The market seems to be in a consolidation phase or making a gradual move up, without extreme pressure from either buyers or sellers. But hey, it's crypto, so staying sharp is always the name of the game.

Disclaimer: This analysis uses public data and on-chain metrics; it's not financial advice. The crypto market is super volatile, and all investments come with significant risks.

Upvoted! Thank you for supporting witness @jswit.