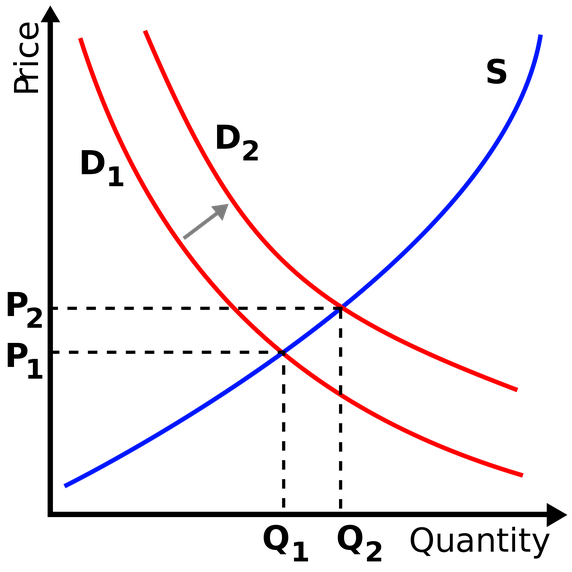

What happens to the price of Bitcoin if demand continues to rise while supply holds relatively constant?

As demand increases...it will command a higher price...but the quantity may be held constant as long as miners abide by those rules?

In my opinion, I believe the price of a single Bitcoin will continue to rise for the foreseeable future! I do not consider the supply to be scarce because of its endless divisibility. If there is a sudden spike in the price of Bitcoin (i.e. from an increase in demand caused by a sovereign state beginning to use it as a national currency for all domestic and international trade following an economic recession), then the Bitcoin network can decide the best course of action to take to ensure proper liquidity of the currency, good flow of capital without transaction processing delays, etc..The current version of Bitcoin abides by certain rules and guard rails which are governed by distributed consensus. One of those rules controls the number of decimal places that can be used for payment transactions. Currently, Bitcoins are only divisible down to 8 decimal places (FAQ); which is still 6 more decimal places than any fiat currency! Therefore, all computational calculations or formulas that are performed in satoshis will use integer arithmetic (equivalent to 1 satoshi = 0.00000001 BTC). A satoshi is the smallest unit of value that the Bitcoin network supports. Another common unit is the bit which is equivalent to one millionth (0.000 001) of a bitcoin. Bits are important to understand because some economists and financiers believe it to be the most logical crypto denomination to begin using in day to day transactions as it has two-decimal precision similar to fiat currencies (USD, CAD, Euro). Other forms of units (full list) that are relevant are:

- 0.01 BTC = 1 cBTC = 1 centibitcoin (also referred to as bitcent)

- 0.001 BTC = 1 mBTC = 1 millibitcoin (also referred to as mbit (pronounced em-bit) or millibit or even bitmill)

- 0.000 001 BTC = 1 μBTC = 1 microbitcoin (also referred to as ubit (pronounced yu-bit) or microbit)

One of the most fascinating aspects of crypto currencies, is that the Bitcoin network (miners and other partners with high computational hash power/contributing power users) can decide to add decimal places at any time as long as it decided upon using distributed consensus. Distributed consensus is actually a fundamental problem in distributed computing and any multi-agent systems, because there is a need for a formal process to agree on some data value that is required during some computational activity; this collective decision-making process (agreement between different people over what is true vs. false) is one of the most important innovations which made Bitcoin and other alternate coins work properly, allows for true peer-to-peer decisions, reduces our reliance on “too big to fail” banks who centrally control currency issuance and distribution, and eliminates the notorious double spending problem (spending the same token twice simultaneously)- this is a great overview of other distributed consensus protocols being used: Distributed Consensus Protocols. If the demand for Bitcoin and similar crypto currencies continues to rise (ceteris paribus), then it is difficult to project the impact on the price of a single unit of Bitcoin and even more hard to forecast how humans will react (humans sometimes act irrationally during economic recessions and this is statistically unpredictable); image below from Wiki.

This is why you often hear the terms ‘infinite divisibility’ associated with Bitcoin (even beyond its programmed limit issuance of 21M, which is set to take place in 2040). If the network decides to update the protocol that includes 32 decimal places, that would lead to the creation of a new base unit replacing a satoshi (i.e. satoshi = 100,XXX,XXX,XXXX unitA).It is important to remember that the public Blockchain is a free market. A free market in which the price of Bitcoin is determined by the laws and forces of natural supply and demand, and by its very nature is free from governmental intervention, central authority control and price-establishing monopoly. This system contrasts with a regulated market, because once the market reaches a point of equilibrium, the ‘true’ price of Bitcoin will be supported by high competition and continued commercialization of Bitcoin applications.