Bitcoin and Cryptocurrency Trading: 5 Things to Avoid Absolutely!

The innovative technology behind Bitcoin (BTC) and cryptocurrencies offers investors the opportunity to achieve substantial returns, but also entails very high risk. Investments are a personal choice, but let us not be conditioned by people who have become rich thanks to cryptocurrencies. It is not a road all downhill, as many may think.

The most common and simplest assets to exploit are often complex from a bureaucratic and exhaustive point of view, and the volatility of traditional markets is not as high as that found in the cryptocurrency sector. In our case we know that just a device connected to the Internet to start trading in complete autonomy.

In the case of traditional markets, there are institutions that check if investors have enough experience to start trading and if they really understand the risks they face. Even in online betting, platforms provide automated tools to avoid losing too much capital, governments regulate this to protect consumers.

But in the world of cryptocurrencies, nobody is warned and there are no limits.

Here are 5 things to avoid absolutely when you approach this kind of market:

1) Cryptocurrencies are NOT a strategy to get rich quickly

It is absolutely understandable that when a market registers + 10%, + 15%, + 20% and in many cases even figures that exceed 50%, there are many new investors who want to join it.

But cryptocurrencies are not a quick scheme to get rich. All this is shown by the fact that, as the percentage increases just shown can be recorded, the opposite is also true.

Most cryptocurrencies have lost more than 90% from its highest level ever reached (ATH). And this example is very clear to understand how much gold is not shining.

Since it is a highly speculative and manipulated market, there are certainly some people who have become very rich (and they are few), while others have lost everything (and they are many more).

History teaches us that an asset can not grow forever, sooner or later it will crash and as far as Bitcoin (BTC) has happened several times in history.

The graph below shows a small rise that registered Bitcoin in 2013:

Except for the fact that it was not a little jump, but it was a real accident. It looks like something small compared to today's market, but if we go to enlarge the image we will notice several things:

The peak in 2013 was driven by speculation, people were injecting money into Bitcoin (BTC) because it was a revolutionary new currency, and then the market literally crashed from a global high of $ 15.7 billion since the December 5, 2013, to a minimum of $ 3.3 billion on January 15, 2014. A decline of 79%. Many claimed that it was the death of Bitcoin (BTC) and cryptocurrencies.

It took almost two years to resume the climb.

All this can still happen, just because nobody knows what will happen tomorrow. We must never invest more than we are willing to lose. Following this reasoning, the investments made should be long-term, and in the long term they also mean 3-5 years, because the biggest bear market we have experienced is more than two years.

Those who invested in Bitcoin (BTC) in December 2013 and did not panic during the collapse, had to wait until early 2017 to return to profit. Over three years. Of course you may be lucky, and enter a momentarily bullish phase that leads you to generate big profits, but there is no guarantee.

The emotional component is very strong and don't keep repeating to yourself: "If i bought Bitcoins when they were worth 5 $...", because you probably would have sold them when they had reached 10 $, thus generating a profit of 100%, yep... NOTHING compared to the potential profit!

2) DO NOT do day trade

First let's see the "lifestyle" that is created by going on day trading. I suppose many of those who are reading this article already have a job, so if you decide to do day trading, you will do it during your work (if you are allowed) or in the evening and on weekends.

If you trade at work, you will most likely end up neglecting it, becoming basically a huge distraction. What will happen is that your career will suffer a lot, and your performance in trading too. You will not be able to do both effectively.

If you do it in the evening, or the weekend, you will potentially overlook something else important, like health or family, and especially your life itself.

The problem with day-trading is that the market can operate irrationally in the short-term, and you will have to fight your emotions, such as fear and greed, to "survive".

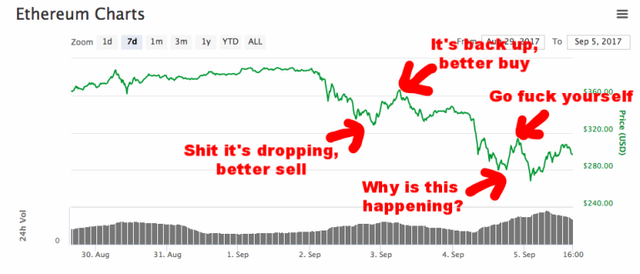

The chart below shows perfectly the experience that day-trading operators must have. We never really know what the market will do in the short term, so emotions will cause us to buy and sell exactly at the wrong times.

3) The problem of Margin Trading

Wait... i'm not telling you to not trade on leverage, i do that myself to increase my profits and to tarde with a small capital BUT what i'm telling you is do not over leverage! don't trade on high leverage such as 300x or 1000x...

Cool? alright, let me tell you why...

Margin trading is done by borrowing money on the same investment platform, and doing a "leverage" operation. For example, if you want to leverage 10x, for every dollar of price increase initially treated you will have a cash return of $ 10. Similarly, for every dollar lost, compared to the initially agreed price, there will be a loss of 10 dollars.

When you over leverage you can incur in a margin call:

A margin call is the broker's request to the investor for other money, or the request for the sale of some assets, to cover the losses arising from the leverage. This occurs when the value of the account falls below a minimum threshold, usually calculated by the broker itself.

If you can not cover your losses, your "trade" is closed and you lose your investment.

5) Safety is the most important thing. Do not ignore it, never.

Thisr is a factor that investors in the stock market should not fear, but is one of the key points for anyone entering the cryptocurrency market. What makes trading and trading in this market easy is, among other things, the possibility of finding security flaws.

There are hackers all over the world trying to break into computers and exchanges to steal cryptocurrencies, and it happens every day.

The issue of security must be taken very seriously; a distraction can make you lose all your resources.

Just do a simple search on Reddit to find a myriad of hacking cases. People who did not set up two-factor authentication on an exchange, or people who clicked on a link to a spam e-mail and went against phishing.

That's it!

We invite you to join us on our public telegram group where we share our daily forex analysis: https://t.me/BeSomebodyFX

Plus feel free to follow us on youtube as well to learn more about investing and forex trading: http://bit.ly/BeSomebodyFX

JayRally from BesomebodyFX.com