The Flaws in Goldman Sachs’ Bitcoin Thesis.

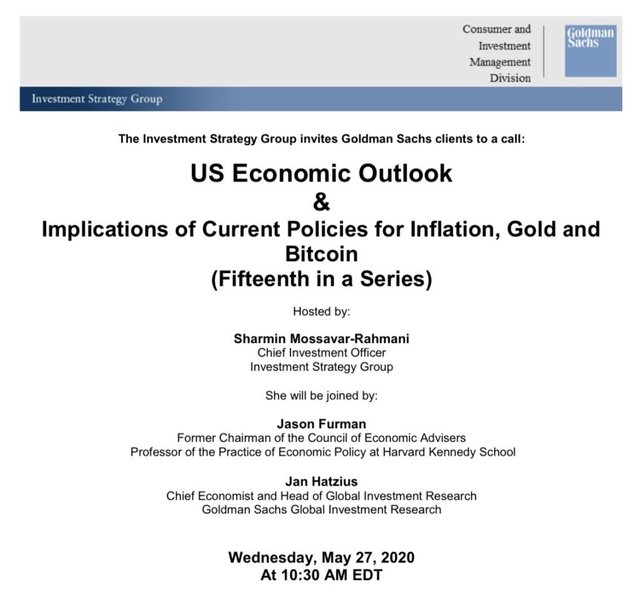

I read and listened to Bill Barhydt, Founder and CEO of Abra on his take about Goldman Sachs latest report against Bitcoin. Goldman Sachs’ draw the ire of many crypto communities when it slammed Bitcoin as an investment and refused to accept it as an asset class during Goldman Sachs’ investment advisory call.

Bill Barhydt summarizes in Abra’s blog Goldman Sachs attack against Bitcoin:

- Item1 Bitcoin does not generate cash flow like bonds.

- Item 2 Bitcoin does not generate any earnings through exposure to global economic growth.

- Item 3 Bitcoin does not provide consistent diversification benefits given its unstable correlations.

- Item 4 Bitcoin does not dampen volatility given historical volatility of 76%. Goldman points to March 12 when bitcoin fell 37%.

- Item 5 Bitcoin does not show evidence of hedging against inflation.

And if I may add Goldman Sachs also labeled Bitcoin as means to illicit activities such as guns, drugs and the like. Bitcoin is like the money of course you can use it for good or bad intentions you may have. Goldman Sachs also compared Bitcoin to the Gouda tulip bubble of 1636-37. Another slide from the call noted that Bitcoin has been used in Ponzi schemes and ransomware attacks (last year there were 1,000 such attacks costing $7 billion).

What I think though is that Bill Barhydt summarizes it this way.

It’s their financial incentive, for their client base to not want to put 10% of their assets in Bitcoin.” — Bill Barhydt

Goldman Sachs is Intentionally Ignorant.

Goldman Sachs is not ignorant of what and how can Bitcoin benefit us all. But they chose to draw shades on Bitcoin during their report expecting people to just being ignorant (some will be) or just take their words for it (very dangerous). JP Morgan Chase got away with it before, when their CEO called Bitcoin a “fraud” then later regretted it. Now JP Morgan Chase is the bank of choice for CoinBase and Gemini.

Barhydt, called Goldman Sachs as part of the system. A predatory system that manipulates inflation to take advantage of the people and the government.

“Goldman’s position in the traditional global financial system means that philosophically, the investment bank will naturally be opposed to Bitcoin, which after, all offers an alternative to Wall Street and central bank issued government-backed money. Every government-backed currency has failed, Goldman received millions from The Trouble Asset Relief Package [from the U.S. government]….they are part of the system,” stated Barhydt

It is very informative and a delight to hear high ranking people take a stand against a manipulative institution. If you care to hear it, here is a recorded podcast by WhatBitcoinDid as hosted by Peter McCormack with Bill Barhydt, Founder and CEO of Abra. Enjoy!

Get my FREE EBOOK in PDF file: The Most Straightforward Step By Step Guide On How To Create Professional Blog Or Website.

Visit my blog , I am sharing tips and strategies about making money online. Click the image below.