CRYPTO 101: How is the price of bitcoin determined?

After reaching its lowest price on February 6 at $ 6094, the price of bitcoin rebounded sharply (around $ 9000 at the time of writing). Altcoins follow the movement with a very strong growth of the top 100. The total capitalization of the cryptocurrency market has risen to 445 billion dollars, having recovered more than 166 billion in four days.

This decline has caused many investors to panic, especially those who have recently returned and are seeing the market fall for the first time.

HODL !!

We see this word everywhere in a downturn. No, it's not a typo. This term appeared on the Bitcoin forum in 2013 in a discussion entitled "I AM HODLING". It is commonly accepted that it means "Hold on for dear life", "Hang on like your life". Why hang on when the market goes down? This situation has highlighted the lack of knowledge about the market mechanisms of the general public which has often sold at a loss. To answer the previous question, we will look at the general market situation and try to dispel some of the vagueness in explaining how a price is determined.

State of the market

We can see through the curves that the same movement is repeated for several years: a rise in December followed by a decline in January.

Bitcoin's progression curve in December was parabolic and therefore had little chance of lasting. Several factors have been responsible for this tremendous increase:

- Bitcoin media

Every day, media articles from around the world announced a new ATH (All Time High) for Bitcoin. "Experts" were invited every day on the TV sets, making a continuous bid in their predictions (Bitcoin to $ 1 million!).

- Massive entry of private investors

This permanent advertisement has attracted millions of people to the exchange platforms. The number of registrations per day was so high (100,000 registrations per day announced on certain platforms) that the main exchange platforms (Coinbase, Kraken, Binance, etc.) suspended registrations or significantly lengthened the time required for the verification of identity information.

- Lack of education of new

It is important to explain here the meaning of the term FOMO that we use regularly. FOMO means English Fear Of Missed Opportunity (Fear Of Missing An Opportunity). By dint of hearing every day through the media that Bitcoin was going to reach $ 1 million, new entrants had only one idea in mind: jump on the train at all costs before it left without them. It is in these conditions where the brain goes to sleep and prices explode. This rise in prices was not based on technical developments or massive adoption of cryptocurrencies. It was pure speculation.

How is a price determined?

The price of cryptocurrencies has a huge volatility. A rationale for traditional exchange trades does not hold here. One reason is that 99% of the 1516 cryptocurrencies on the market do not have the technology they are promoting. We are still at the beginning of the blockchain revolution. The capitalization of cryptos represents above all the potential and the trust that investors give them. The market is extremely speculative; We are in a bubble like the Internet in the 2000s. Talking about the bubble is not necessarily negative: it is a necessary step to bring money to the sector and the serious projects that need this funding. The best way to take advantage of the situation is to understand this situation first.

When the price of Bitcoin plunges as it did at the beginning of the week, we could regularly hear that "investors were withdrawing all their money". It's not exactly that. And if I showed you that in the absolute, only 1 dollar can be enough to move the whole market?

What is the price?

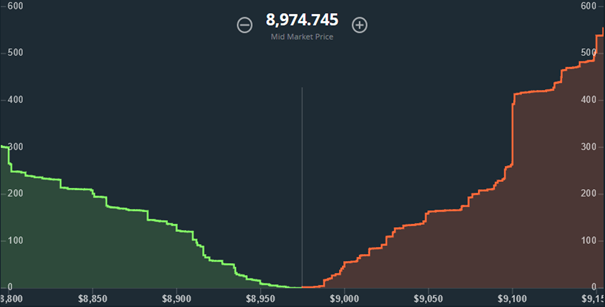

Price is a point of balance, for a market, between supply and demand as illustrated in the following graph.

Depth of the market, source: GDAX

We have green orders and red orders. On this chart, the equilibrium point is 8974.745.

In our example we will take $ 10,000 to make it simpler. This means that at the last sale, the price was $ 10,000 for 1 bitcoin.

On the sell side, we have 1 sell order for 1 BTC every $ 1,000, from $ 11,000 to $ 99,000.

On the buyer side, we have 1 purchase order for 1 BTC every $ 1,000, from $ 9000 to $ 1.

If you want to buy 1 bitcoin, there are two options:

You are patient and want a better price. You exceed the current best purchase price (for example $ 9001) and you expect a seller to accept it.

You want to buy quickly and accept the lowest selling price at $ 11,000.

In the first case, the price does not move.

In the second case, you have moved the equilibrium point. The price is now $ 11,000, the best purchase price is $ 10,000 and the best selling price is $ 12,000. As long as no offer matches these prices, the price remains at $ 11,000.

Let's take a look at the capitalization of the BTC. There are currently 16,855,962 BTC in circulation.

Initial situation 16,855,962 * 10,000 = $ 168,559,620,000

Final situation 16,855,962 * 11,000 = $ 185,415,582,000

+16 855 692 000

With your $ 1000, you have increased the capitalization of the BTC by 10%, or $ 16,855,962,000. Not bad is not it ? Let me show you how to do even better with just $ 1.

The newspapers announce that the United States think to ban cryptocurrencies. Experts are invited on all TV sets to declare that it is there, this time for sure, the Bitcoin is over:

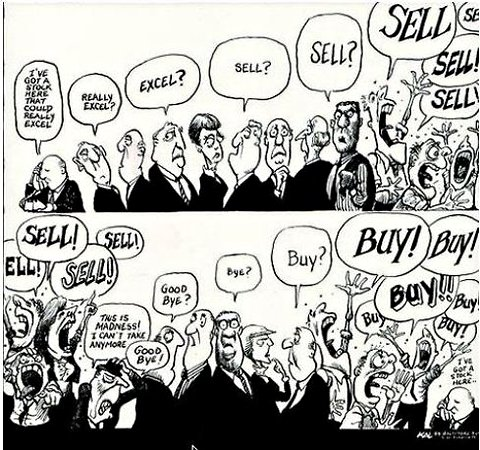

People panic: Those who had their $ 10,000 and $ 9,000 orders cancel their order.

José who had placed a $ 20,000 order is scared and decides to surpass the best selling price: He drops his order from $ 20,000 to $ 11,000.

Robert, who had his order at $ 12,000, sees José's maneuver and reacts:

He drops his order from $ 12,000 to $ 10,000

By seeing sales offers go down quickly, buyers who had positioned themselves at $ 8,000, $ 7,000, $ 6,000 and $ 5,000 are pulling out. The best offer to buy is now $ 4,000.

On the sellers' side the race continues between José and Robert. They each take turns taking turns until the best selling price drops to $ 5,000.

We note that at this point, the price has plummeted while NO sale has occurred since the $ 11,000. Technically, the price of the BTC is still displayed at $ 11,000 and the capitalization at $ 185 billion.

- José can not stand it anymore, it's cracking. He had bought his BTC on the advice of his hairdresser to become a millionaire, not to lose money! He decides to save what he can and accepts the best offer to buy: He sells the equivalent of $ 1 in BTC to $ 4000.

A transaction has taken place, the price is updated:

José managed to increase the price of Bitcoin from $ 11,000 to $ 4,000 with a single dollar.

The situation described is deliberately extreme. It illustrates, however, that the only thing that has changed is the perception of investors. The lower price does not mean that investors have withdrawn their money, but that the opinion has changed. This is happening in the market today. Weak hands panic and sell. This phenomenon is self-sustaining. As in our example with Robert and Jose, panic pushes unsuspecting investors to fight to sell cheaper than others. Meanwhile, smart shoppers wait patiently for sellers to kill each other so they can buy at the lowest price.

Choose projects you believe in, with a serious team and see you again in five years. Wait for the right moment to buy and HODL. There are a lot of rumors circulating in the market and the variations can be spectacular. If you did your research at first, you can address these variations serenely.

For beginner investors, the simplest strategy is the DCA (Dollar Cost Averaging): This technique consists in buying a fixed amount at a fixed interval, without worrying about the price. In the long term, the DCA is a safe strategy that generally allows for a favorable average price.

I am sorry, but this is so unnecessarily confusing and convoluted and fictitious at best.