Flair Dex is Introduce an Automated market maker

The automated market creator Flair Dex. If you're looking for an upgrade from the current crop of decentralized exchanges (mostly uniswap forks), look no further than FlairDex and its plethora of enhancements.

- Supports both Stable Swaps and Uniswap Style volatile swaps.

- Dex with minimal Fees of just 0.2 percent for volatile pairs and 0.04% for stable pairs, some of the lowest in defi.

- Support uniswap style LP and curve-inspired Gauges for a better and decentralized liquidity incentivization.

- Allows permissionless access to create bribes on any LP pools.

- Fully Decentralised from day one, with ve tokenomics. ve Holders control the protocol, revenue, and token emissions.

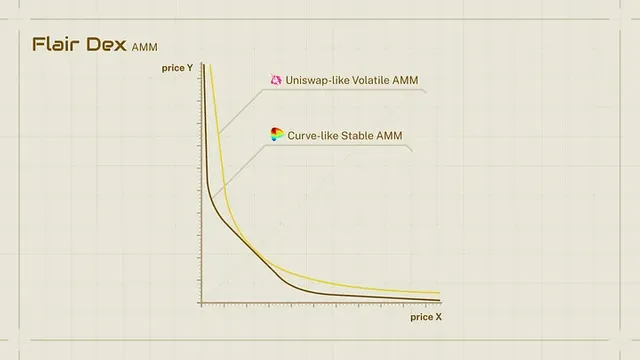

Volatile and Stable AMM

Flair Dex liquidity pools support one of two different price invariant formulas to accommodate either stable or volatile liquidity pairs.

Volatile Pools

x × y = k

The Volatile Pools use a Uniswap v2 style constant-product curve which is the industry standard for non-correlated pairs, such as WETH and USDC.

Stable Pools

x³y + y³x = k

The Stable Pools make use of a hybrid price invariant curve that is based on Curve Finance's Stable Swap. This particular curve is most effective when applied to highly correlated assets such as stablecoins. By utilizing the StableSwap invariant, which has a substantially reduced slippage rate for stablecoin trades in comparison to the constant product invariant, Curve is able to make stablecoin deals that are incredibly effective.

Protocol Fees and Incentives

The initial swap fee for flair dex is just 2% for volatile pairs and 0.04% on stable pairings, among the lowest available in DeFi; 80% of this fee goes to the liquidity provider, while the remaining 20% is put to the treasury for continued protocol development.

Gauges and liquidity Pools:

Liquidity providers will not be paid swap fees if both tokens in a liquidity pool's pair are whitelisted by veFLDX holders for staking in gauges and receiving FLDX emissions rewards. Liquidity providers hedging gauges count on making money primarily from FLDX releases.

However, veFLDX Lockers who voted to reward a specific gauge with emissions will be credited with 100% of the swap fees from the liquidity pair for which they cast their vote. A liquidity pool will be entitled to all the swap fees it earns, but will not be responsible for any FLDX emissions if it is not whitelisted to stake in the gauge.

FLDX Emissions

The initial supply of $FLDX is 100M.

Weekly emissions start at 5M $FLDX (5% of the initial supply) and decay at 1% per week. ve Lockers receive a percentage of emissions to prevent dilution of their voting powers.

Bribes

Convex popularized the idea of bribes and eventually came to dominate a sizable portion of Curve's voting power. As more and more people looked to maximize their CRV payouts, some protocols recognized they could increase their protocol and on-chain liquidity by offering incentives to holders of veCRVs to vote for their pool.

Those that vote for a gauge can claim any bribes that have been attached to it, and Flair Dex allows this behavior natively. Only voters in that pool get bribes, and the size of the bribe is directly related to the voter's percentage in the pool.

Following the epoch switch, these payouts will be made available for the claim in accordance with each voter's voting power ($veFLDX).

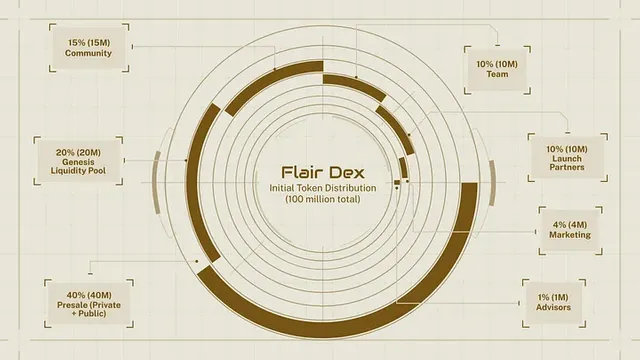

Initial Tokenomics

$FLDX doesn’t have a fixed total supply. For a proper launch, initial sustainability, and for providing sufficient liquidity for (FLDX/USDC) we are starting with an initial token distribution of 100 Million tokens.

- Team (10%) => 10M Tokens

50% (5M Tokens) => Allocated to initial team members with vesting.

50% (5M Tokens ) => Locked as $veFLDX for 4 years, will be used by the team for voting to drive emissions to key protocol pairs such as $FLDX-$USDC and to support ongoing protocol development. - Advisors (1%) => 1M Tokens

- Launch Partners (10%) => 10M Tokens => Will be distributed as $veFLDX (locked for 4 years) to protocols supporting us during the launch phase and migrating their liquidity.

- Community (15%) => 15M Token

Airdrop(10%) => 10M Token => 10% of initial tokens will be allocated to early supporters and initial users of the protocol.

Bug Bounty (1%) => 1M Tokens

Launch Partner’s Community (4%) => 4M Tokens =>Will be distributed to regular users of partner protocols. Users will be chosen based on behaviours that promote long-term stability of said protocols, such as: locking, stacking, holding, participating in governance, and continuing to support despite the challenges faced. - Marketing (4%) => 4M Tokens

- Presale (Private + Public) (40%) => 40M Tokens

- Genesis Liquidity Pool (20%) => 20M Tokens

Links

Website: https://www.flairdex.xyz/

Docs: https://docs.flairdex.xyz/

Twitter: https://twitter.com/FlairDefi