Banks Are Crooks, Inventing Money as Loans to Profit on Interest Payments

What do you think about interest payments from bank loans? Or, what do you really know about interests payments from bank loans? If you never got a loan, it's where you borrow money, and then you have to pay back more than what you borrowed. A simplified version is let's say you borrow $100 at 15% interest. That means you have to pay back $115. It gets more complicated with different types of interest, but forget about all that for this explanation.

Source

Is there anything wrong with this? Is it completely "above board" and legit?

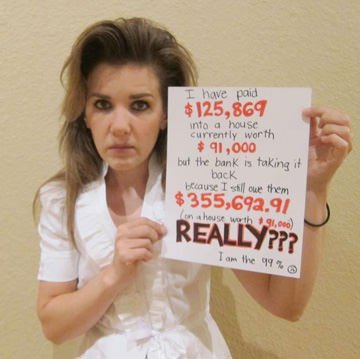

There have been pictures floating around in recent years about people's financial woes. Especially since the 2008 financial crisis hit. Many people were offered loans that they couldn't afford, packages as high-grade loan packages for investors to buy the debt and make money off of the interest. But these people couldn't pay back the loans, and the investors who purchased the debt ended up holding a bag of shit.

This happens with loan sharks and gangsters in movies, where they sell someone's debt to another bad guy, and someone becomes their debt-slave to pay them back. For some reason is not allowed int he black market of gambling and borrowing money, but when it's done in the "legal" world, everything is ok.

Here is an image I had saved 2 years ago, of someone who exemplifies how they are getting screwed by interest rates, to pay back debt that keeps climbing from interest rates they can't pay back in full or on time. Their house is worth $91,000, and they have already paid $125,869 of the mortgage. They are losing their house to the bank now because they still owe the bank $355,692.91.

Imagine that? You borrow money and you already paid back more than your house is worth, yet you still owe more than 2x what you already paid, and more than 3x what the house is worth! Then the bank gets to take your house when you already paid the value of the house.

This is how interest on loans fuck people over.

The scam is worse than that though, because you need to understand how banks get the money for the loan and then charge you interest for it. Here is a big con of our times.

When a bank gives you a loan, they aren't giving you money from their pockets, from their account, or from anyone's deposit or savings account. No one's accounts drops in value with all the loans a bank makes. They money is still there for everyone to see and potentially take out. The bank plays a ledger magic trick to give you the loan, and essentially invents money that didn't exist. They create money out of thin air by your promise to pay them back in the future.

They create a negative book entry for a loan, and it gets deposited into your bank account. The money didn't come from anywhere really, it was invented and put into your account as digital numbers than you can then take out as cash. So you have to pay back money that they don't even take form somewhere else to give you. That's one thing.

The next thing is they charge you interest on money they didn't even take from their own profits, from their own deposit or savings accounts for their customers. They only have a liability to the debt if you fail to pay, but lucky for them, you put some collateral on the line, like your house. You have to pay them back based on the promise you are going to pay them. And when you do in full, then their negative ledger entry balances out, as if nothing ever happened. They don't make money from the bank loan itself, that is just $100,000 out, and $100,000 back in at some point in the future. The interest is where they make the money. If interest rate go up, then people get screwed and can't pay their monthly requirements.

They don't give you any money that they have, and you have to pay it back, plus interest which is the profit for them. And if you don't pay them back, they get to confiscate your property that actually has value and they can sell it to balance their books again.

And then, even if you paid $90,000 of the $100,000 loan, plus all the interest over years that is maybe $33,000 more, you don't get extra time to pay off your house. Basically, you were just paying rent on your house, $90,000 of rent. And because you hit hard times, with a job loss or whatever, they decide too bad, we're taking your house from you because you don't actually own it. You can be almost there, but need some time to pay it back fully, but they don't care, and they will take your house, even if you already paid 90% of it. It's crazy! Plus, you already gave them 1/3 of the house value in interest payments, so you paid over $120,000 for you $100,000 mortgage, and they still don't give a shit.

This is the society we live in. An institution can loan you money they don't have by creating it out of thin air as a negative book entry with your promise to pay it back to balance out the book entry. And meanwhile, they make a profit from you paying them interest on the money they didn't even take from anywhere. It's not even their money. They just have this magical power to do what we can't and invent money that isn't taken from anywhere.

Why can't we do the same? Put a negative book entry, invent money, and pay ourselves back in 10-20 years, and have no interest to pay on top of that? It would save everyone a lot of money, and banks would not be in business.

And then the banks get bailed out with "legally" stolen money called taxes in order to keep them afloat when they fail. Yet, the tax payers don't get the same break of getting bailed out when they fail. That's justice.

Source

We are enslaved to the banking cartel. Look into the so-called "Federal" Reserve Bank to see how much you're being enslaved if you live in the USA. The book "The Creature from Jekyll Island" is a good source.

Thank you for your time and attention. Peace.

If you appreciate and value the content, please consider: Upvoting, Sharing or Reblogging below.

me for more content to come!

me for more content to come!

My goal is to share knowledge, truth and moral understanding in order to help change the world for the better. If you appreciate and value what I do, please consider supporting me as a Steem Witness by voting for me at the bottom of the Witness page.

In fact, if they take that money from somewhere, do you want to know where? they take it from their bank account, from mine, and from the money they have under the mattress, basically, the credit is a money transfer, they take a fraction from each of us and they give it to the person who receives the credit, how? by means of inflation, when giving money to someone emitting new money, what they really do is to remove all of us purchasing power silently. This is the way bankers run the economy.

Suppose there are 100 people, and each of them has 1 dollar, then the Banker comes and gives a loan of 20 dollars to an entrepreneur (which in this case is going to represent the corporatocracy), and he injects those dollars into the economy, which generates inflation, assuming that he spends the money in a distributed way, all prices will rise 20%, that is, the dollar would have depreciated 20%, it is as if it were really worth 0.80 cents of the original dollar. But then, since inflation would be very high, that is to say 20%, what the State does is raise taxes, suppose that it raises taxes to 0.17 cents per person, thus raising 17 dollars, which the State will then pay to bank of course. In this way inflation is only 3%, because 17 dollars were withdrawn from the economy, and it ends up generating enormous inequality, since the entrepreneur who gave him the loan ends up taking a substantial wealth.

In fact, I wrote about it in a recent publication: The hand of the invisible men: How the social hierarchy works.

Here I also leave a video that talks about the credit process that caused the crisis of 2008 and is very good, and well explained.

Yes, I was going to add a bit about the larger inflation issue and how that devalues the currency and makes money less valuable, a hidden tax. But it was long enough ;) Thanks for adding this info.

In Steem, there is a 9.5% annual inflation. That newly minted STEEM and SBD is given out as rewards for content creators. What do you think about that?

I think that in the case of Steem and SBD we can not talk about inflation, since there are no goods and services assessed in Steem and in SBD. In the case of these cryptocurrencies we can speak of appreciation and depreciation of their value, and this depends on the supply and demand of Steem and SBD that exists in the Exchange.

Inflation simply refers to the growth of the money supply. You could argue that STEEM is not sound money because new STEEM coins are minted out of nowhere as rewards for content creators and curators. Exactly the same way, in fractional reserve banking new money is created every time a loan is issued to be used in creating something of real-world value someone is willing to pay money for to go towards paying the loan back. Inflation of the money supply is not the problem of the fractional reserve banking.

The problem is that the banks have too much power over everyone else. and they have been shown to abuse it many cases. But with stable money supply and price deflation, it is not easy to create an expanding economy. Price stability is impossible if the supply of new money is not made to match the supply of new value.

The amount of money can remain exactly the same, but if the demand for money decreases, an inflation scenario can arise, that is, a general increase in prices in relation to a given currency. What does this mean? Although the main cause of inflation is the issue of money, this is not an absolute condition in itself, because it needs to be compared with the demand for money.

Actually, it does not matter only the new units of SBD that are issued, what matters is the amount of Steem and SBD that is bought and sold in the Exchange, of course, the higher the amount of Steem and SDB issued, the more it is likely to increase. volume in the Exchange and consequently the price is affected.

But the price of the Steem and the SBD does not necessarily have to be lowered by the fact that it is issuing new units, in fact, it has not done so, but it has increased its value despite having a growing mass.

When the SBD reached $ 14, it was the result of a boom in cryptocurrencies, which caused the demand of the altcoins to increase, among them the SBD, which caused the price to rise a lot. The decrease in the price that the SBD had later, was not due to the issuance of new units of SBD, but was due to the excess supply and the decrease in SBD demand in the Exchange.

I already noted the difference between supply and price inflation.

The argument still stands that supply inflation may be called theft for the same reasons as price inflation - even moreso because it is 100% under the control of the issuer.

Now, the headline on this thread is not effective criticism of the banking system because money supply inflation is desirable. Allowing banks to keep interest as income is also fine in principle because banks are businesses that have operating costs: staff, IT infrastucture and office space etc. It is also normal and acceptable that they keep some of that as profit for shareholders.

The most potent argument against the banking system is, in my opinion that they've become too large to fail. This creates a moral hazard. Because they know that the government is forced to bail them out, they will take larger risks they would otherwise take.

Well, yes, that way you're right.

The problem with the bank is not that they charge interest, the problem is that the money they lend has not been saved. In a healthy economy, a free market economy, people must save money, part of that money people are willing to invest, so they deposit it in an interest-bearing account, in this way, the bank can lend that money to a greater interest, and that's how they earn their share. Now, none of that happens, what they do is totally immoral and is a theft to all of us.

But the important thing is to understand that they do not do it to obtain money, they do it because it is their way of governing us. The socialist economies run the State and the Market with legislations and controls that are easy to see for people who are attentive, but this system, this credit system, is really very intelligent, since it allows them to direct the economy just as they do these other interventionist governments, but in a silent way, no one notices, not even the employees who work in their financial institutions do, the points are very difficult to connect because they are not on the table but below it, so they do not occur account that those who issue the credit are part of the same group that receives them.

In the free market, consumers are the ones who decide how the economy is conducted, but they have created this illusion, the illusion that we live in capitalism, but no, they take the power of consumers and give it to themselves.

Under that system, no new money gets created. If there is economic growth, there can't be price stability, or vice versa.

This is the drum that needs to be pounded every day, the banksters are at the top of the pyramid of global corruption.

We are absolutely enslaved to the banks, our productivity is the collateral given to the banks when the government takes out loans that it doesn't have to take.

Government is entitled to create debt free money and put it into circulation, but the banksters bought the corrupt politicians in 1913 to pass the Federal Reserve Act and every politician since then has been their boot-licking lackey.

There is a reason the economic and financial system is not taught in schools, because everyone who comes to understand how the system works realizes everyone has been betrayed and is being enslaved by unscrupulous and immoral people.

Like Henry Ford said, "It is well enough that people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning."

Yup, govt can create it itself, without interest, but it doesn't, as it's all a banker scam to be the owners of the world ;) Economists are idiots and deny the reality ;)

You nailed the point my friend. Banks are looting common men while they are doing everything to increase profit of big corporate.

For example in India corporate sector has not paid more than 150 billion USD to banks which they borrowed from banks. This has become Non Preforming Assets for banks.

Many industrialists have left the country while declaring their company bankrupt. They even not paid salary to their employees. Legally they are not liable to repay the loans, their company is liable but companies' total capital is not more than one to ten percent of the total value of money which they have borrowed. Banks are becoming bankrupt while rich are flourishing. Hard earned money of common men is becoming a tool to make rich richer.

This is a vicious cycle. I have a lot to say but a comment has its limitation. I'll write on it in my post someday.

Jeez, that's a lot! They get money, for free essentially, as they don't even pay it back in the end... people do the work and don't get paid for their work done... what a sham!

This is one of new age robbery method.

It all starts here. The wars, the conflicts, the corruption.

The debt based banking system (compound interest) is theft on a scale much bigger than any other - in the entire history of our world.

......and we think the banks arn't going to try and control crypto..?

(That sounds about as naive to me, as hippy feeling safe because he's a pacifist, as the storm troopers knock down his door...😂)

There is a war coming - in some form or other. (hopefully 'other')

Info war first, gotta change minds or else physical war won't be in our favor ... :/

Physical war?.....mmmm...

info war....active war.......then physical.

Win the 'active' part , and there will be no need for the physical part...

Just need to keep the 'infowar', part up.

https://steemit.com/blog/@lucylin/woodworm-chapter-1

The whole concept about money is imagination and financial institutions are just agents for government to control people's lives. Banks operates on the principle of Time Value of Money (which says that today's money is worth more in tomorrow). Interest on loans have become a normal practice for any loan provider. A person who do business wants some profit and give out loan is no different. Even with the imaginary formulation of these loan money by banks they still tell the world that there is recession: no money to give out. And I ask myself what a world we live in.

It's a crazy world indeed. I think you meant today's money is worth more than tomorrow's money, since the money gets devalued.

The situation isn’t improving. Someone I know got a mortgage on a 340,000$ house that their combined income is maybe 60k. That’s not including paying student loans, bills, car, everything else. 2008 will happen again except the next time it’s going to be much worse. Now, far more than in 08, the student loan bubble is also included in this disaster. Eventually all of these horrible spending and lending practices will explode and the tax payers will foot the bill yet again.

Yup, the correction in grounded reality never happens,just more fantasy bubbles get created to keep the dream alive in the clouds of unreality :/

The system is so corrupt and in need of a complete revolt. That's my hope for what crypto can become. The banks have been abusing individual people for too long, interest rates are constantly going up, whenever the banks make mistakes, they just print more money. The system is broken. After learning more about the back dealings that went on in 2008 which hurt millions of innocent citizens and the banks getting completely bailed out, my faith in the system has been forever lost

Yes, free crypto outside of government of bank control can liberate us further. The only thing that keeps the fantasy propped up is faith. People have faith in the value of the money, even though it's not even worth what it currently is...

I wrote about the horrid policy that is fractional reserve banking a couple of weeks ago:

https://steemit.com/finance/@jdh7190/the-true-definition-of-inflation-the-federal-reserve-system

It is crucial that we understand how this system works, and why cryptocurrency is a potential solution.

Another great article @krnel.

Thanks ;)

Let's run through a scenario. In nov when bitcoin was booming you wanted to buy bitcoin. You had no money so you asked your friend for some money. He doesnt believe in unrealistic gains so he wont buy bitcoin himself but he will loan you 15k at 10% interest. You buy 1 coin but market crashes and 1btc is now worth 5k. Now tell me who should bear the burden of that loss. You or your friend. If your 15k turned into 150k, would you pay him more than 10%. Now replace your friend with bank.

If you borrow and someone gives you their money, then you pay them back as that's the reciprocal deal made ;) Corporations get bail outs and don't play the game fair like regular people. Similar to bidbots and not playing the game fair on Steem ;)

There will be people who dont pay so thats where the concept of interest and bail outs come in. There are also running costs. For bidbots, its a different story because they are charging for assigning money from reward pools. I wrote a post on bid bots last night that you might find interesting :https://steemit.com/crypto/@mightypanda/bid-bots-for-noobs

let's see how crypto will change this system, crypto should become a big competitor to fiat currencies. But I think banks take money from the people who hold their money there, they bet that everyone is not going to decide to withdraw all the money at the same day.

That's only why the money is there for everyone. It's called a run on the bank if everyone wants their money, and guess what, all the money isn't there. It's been invested in other places for the bank to make money. They don't have all of people's money in the bank itself. It's a scam.