How Bank 11 Simplifies Access to Blockchain Technology for Everyday Banking

Bank 11 is not just another financial institution; it is a bold experiment and a catalyst for transformation in the rapidly evolving financial landscape. As the world enters a new era where traditional fiat systems are increasingly challenged, Bank 11 has emerged as a pioneer, offering a groundbreaking model that bridges decentralized and centralized financial systems. With an innovative CeDeFi (Centralized Decentralized Finance) approach, Bank 11 seamlessly combines the transparency, efficiency, and flexibility of decentralized finance (DeFi) with the security, compliance, and structure of traditional banking systems.

At its core, Bank 11 is not merely a bank—it is a vision for a post-fiat world where financial services are reimagined for the digital age.

Adapting to the Post-Fiat Era: The Rise of Hybrid CeDeFi

The financial world is undergoing rapid and unprecedented change. The rise of blockchain technology, cryptocurrencies, and decentralized finance is disrupting traditional banking and paving the way for a new era. To thrive in this post-fiat landscape, financial institutions must adapt quickly, embrace innovation, and build systems that integrate the best of old and new worlds.

Bank 11’s hybrid CeDeFi model exemplifies this adaptability. By acting as a bridge between the decentralized cryptocurrency ecosystem and traditional banking systems, Bank 11 offers customers a unique opportunity to access the benefits of both models. Decentralized finance provides openness, programmability, and efficiency, while centralized frameworks offer oversight, security, and compliance. Bank 11’s ability to integrate these systems into a single platform makes it a trailblazer in the financial world.

Unlike conventional neobanks or cryptobanks that serve as regulated gateways for fiat transactions, Bank 11 has taken a bold stance by eliminating the use of fiat money altogether. This decision represents a radical departure from traditional banking practices and positions Bank 11 as a forward-thinking institution uniquely suited for a post-fiat economy.

The Visionary Behind Bank 11:

Bank 11’s success is driven by the vision and expertise of its founder, Pavel Andreev, a seasoned entrepreneur with over a decade of experience in the financial and blockchain sectors. Pavel’s journey into the world of cryptocurrencies and blockchain began in 2016 when he started his consultancy career. His deep understanding of digital assets and passion for innovation laid the foundation for Bank 11.

As the creator of X-Eleven and the driving force behind Bank 11, Pavel Andreev has developed a platform that combines technical expertise with a visionary approach. His leadership ensures that Bank 11 remains at the forefront of financial innovation, setting new benchmarks for what a modern financial institution can achieve.

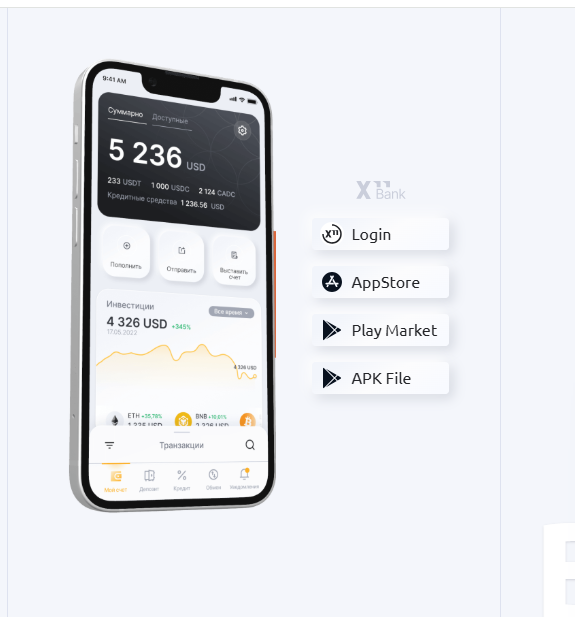

Bank 11’s Core Services

Bank 11 offers a range of services designed to simplify and enhance financial transactions for its users. Some of its key offerings include:

Crypto-Backed Loans

Bank 11 provides loans secured by cryptocurrency assets at a competitive interest rate of 13.5%. This service allows users to access liquidity without selling their digital assets, offering a practical solution for individuals and businesses alike.P2P Lending

Peer-to-peer lending on Bank 11 allows borrowers and lenders to connect directly, offering flexible terms that cater to individual needs. This approach eliminates intermediaries, reducing costs and making lending more efficient.Stablecoin Transactions

Bank 11 facilitates the purchasing of stablecoins with transaction fees as low as 1% or $1, making it an affordable and reliable option for users looking to access digital assets.P2P Exchange

Through its peer-to-peer exchange, Bank 11 enables users to convert assets into stablecoins with minimal fees, ensuring cost-effective and seamless transactions.Secure Escrow Services

For transactions that require additional security, Bank 11 offers escrow agreements with fees capped at 10%. This service ensures a high level of trust and security for both parties involved.

The Advantages of Banking with Bank 11

Bank 11’s unique model delivers a host of benefits that set it apart from both traditional banks and decentralized financial platforms.

Users benefit from a transparent fee structure where they only pay for the services they use. Hidden fees are eliminated, ensuring financial clarity. Additionally, the platform offers instant KYC verification, allowing users to complete the process in less than 24 hours.

Privacy is another critical aspect of Bank 11’s services. Transactions conducted on the platform are anonymous, as they are processed on a Proof-of-Stake (PoS) blockchain where no public transaction records are visible. Moreover, the platform does not hold client funds or disclose user information to third parties, ensuring a high level of confidentiality.

Transaction efficiency is another standout feature. With minimal fees (as low as 1% or $1) and transaction speeds of under 30 seconds, Bank 11 delivers a seamless user experience. Furthermore, the absence of transaction limits allows users to conduct both large and small transactions with ease.

The B11 Token: Powering the Bank 11 Ecosystem

At the heart of Bank 11’s innovative financial model is the B11 token, the native utility token that drives the platform’s operations and incentivizes its users. Designed with functionality and scalability in mind, the B11 token plays a critical role in ensuring the ecosystem operates seamlessly while rewarding active participation. Whether through facilitating transactions, encouraging staking, or enabling decentralized governance, the B11 token empowers users to engage with the Bank 11 ecosystem in meaningful ways.

Key Use Cases of the B11 Token

The B11 token is more than just a digital asset—it’s a multi-functional tool that integrates into every aspect of the platform. Here are its core use cases:

Paying Transaction Fees

One of the primary functions of the B11 token is as a medium for transaction fees. Whenever users interact with Bank 11’s decentralized applications (dApps) or conduct transactions on the platform, they are required to pay fees in B11. This creates an inherent demand for the token, as every action on the network relies on its usage.

This model ensures that the token remains at the center of the Bank 11 ecosystem, driving utility and maintaining its value as the platform grows and attracts more users.

Staking and Rewards

Staking B11 tokens offers users a way to earn rewards while supporting the network’s security and operation. Token holders can lock their B11 tokens into the system, helping to validate transactions and decentralize the network. In return, stakers receive a portion of transaction fees as rewards.

This staking mechanism creates a win-win scenario:

- Users gain a recurring revenue stream by contributing to the network.

- Bank 11 enhances the decentralization and security of its infrastructure by encouraging broad participation.

With a low minimum staking threshold, Bank 11 makes it easy for users of all levels to participate, ensuring the network remains robust and widely distributed.

Governance and Community Participation

The B11 token also serves as the key to decentralized governance within the Bank 11 ecosystem. Token holders gain voting power proportional to the amount of B11 they hold and stake, allowing them to participate in critical decisions regarding the platform’s future.

Governance proposals may include:

- Adjustments to network parameters, such as transaction fees or staking rewards.

- Upgrades to the core protocol to improve functionality or introduce new features.

- Allocation of ecosystem grants and funding to support development projects.

- Decisions on partnerships, integrations, and other strategic initiatives.

By empowering the community with governance rights, Bank 11 ensures that its platform evolves in a decentralized and democratic manner, aligning with the interests of its users.

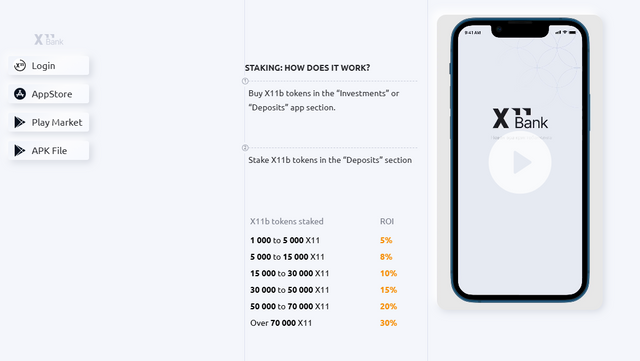

Staking Rewards: Incentivizing Long-Term Commitment

Staking is one of the most compelling features of the B11 token, as it provides users with an opportunity to earn passive income while supporting the platform.

How Staking Works

When users stake their B11 tokens, they effectively lock them into the network for a specific period, during which they contribute to validating transactions and securing the ecosystem. In exchange, they receive staking rewards, which are funded by a portion of the transaction fees collected on the platform.

The rewards are distributed pro-rata based on the amount of B11 staked, meaning users who stake more tokens receive a larger share of the rewards. This incentivizes long-term holding and active participation, creating a virtuous cycle of growth and stability for the ecosystem.

Benefits of Staking

- Passive Income: Users earn rewards without the need for active management, making staking an attractive option for long-term investors.

- Network Security: By staking their tokens, users help secure the network, ensuring it remains resistant to attacks and operational disruptions.

- Decentralization: Staking encourages broader participation, reducing the risk of centralized control and ensuring a fair distribution of power across the ecosystem.

Decentralized Governance: Giving Users a Voice

The B11 token enables a truly decentralized governance model, allowing the community to shape the future of Bank 11. This governance system ensures that decisions are made transparently and democratically, aligning with the interests of token holders.

How Governance Works

When a governance proposal is introduced, B11 token holders can vote on it using their staked tokens. Each vote is weighted based on the number of tokens held and staked, giving users a say in proportion to their commitment to the ecosystem.

Key Areas of Governance

- Adjustments to Fees and Rewards: Token holders can vote on changes to transaction fees, staking rewards, and other network parameters to ensure they remain fair and competitive.

- Protocol Upgrades: Governance allows the community to approve updates and enhancements to the platform, ensuring it stays ahead of industry trends and technological advancements.

- Ecosystem Funding: The community can allocate funds from the Bank 11 treasury to support new projects, partnerships, or initiatives that benefit the platform.

- Feature Additions: Users can propose and vote on new features or integrations that enhance the overall functionality and user experience of the platform.

By giving users direct control over the platform’s development, Bank 11 fosters a sense of ownership and collaboration, strengthening its community and ensuring its long-term success.

Why the B11 Token Matters

The B11 token is much more than a transactional tool—it’s the lifeblood of the Bank 11 ecosystem. By integrating essential features like staking, governance, and fee payments, the token ensures that the platform remains sustainable, secure, and aligned with the needs of its users.

As Bank 11 continues to grow, the role of the B11 token will only become more significant, driving innovation, empowering the community, and enabling the platform to scale its impact globally. Whether you’re a casual user or a committed investor, the B11 token represents a powerful opportunity to participate in the future of finance.

For more information link:

Website: https://bank11.io/

Whitepaper: https://bank11.io/whitepaper

Twitter: https://twitter.com/11Bank11

Medium: https://medium.com/@x_11

Author:

Forum Username: Dogani

Profile Link: https://bitcointalk.org/index.php?action=profile;u=3429369

BSC Wallet Address: 0xDc078E9D53C58B08995bF2aBa7F159Bc21822a90