Assets vs. Liabilities: Basic Financial Concepts You Should Master

It doesn't matter if you're an artist, a scientist, or simply not interested in numbers; money is a tool we all use daily to eat, dress, or even to cover a health emergency. Understanding the most basic financial concepts is not an option, but a necessity for making smart decisions and not being controlled by your finances.

Below, we will explore some essential terms we often hear but don't always fully understand. Mastering these ideas is the first step to programming your mind for prosperity.

Income, Expenses, and Cash Flow: The ABCs of Money

Income: Is all the money that comes into your pocket. This includes your salary, business profits, sales commissions, or any other source of money.

Expense (or Outflow): Is all the money that leaves your pocket. Your spending habits define your financial situation. Wasting money on unnecessary things or to show off can be the main reason you fail to reach your financial goals.

Cash Flow: Is the difference between your income and your expenses. The main goal of personal finance is to have a positive cash flow. The easiest way to start is by reducing your expenses, which helps you gain control over your habits and emotions.

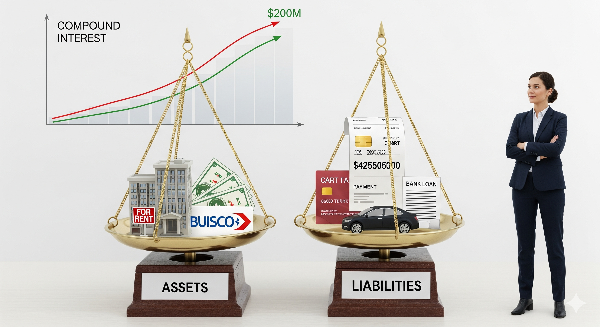

Assets and Liabilities: The Key Difference

The heart of financial education lies in this distinction.

Asset: Anything you buy or acquire that puts money into your pocket. For example, a car you use as a taxi, a property you rent out, or a hot dog stand that you put to work for you.

Liability: Anything that takes money out of your pocket. The clearest example is your credit card debt, which forces you to pay monthly fees and interest.

The Trap of "Supposed Assets"

This is a fundamental concept for your personal financial control. A "supposed asset" is something that the bank considers an asset for accounting purposes, but which is a liability for you because it generates expenses instead of income.

The most common example is the house where you live. Although the bank considers it an asset (because it can use it as collateral if you fail to pay a loan), for you it is a liability, since it generates constant expenses like maintenance, utilities, taxes, and, if you bought it on credit, the mortgage. The same applies to the car you use for personal purposes.

The Power of Debt: Good Debt vs. Bad Debt

Not all debt is bad. The key is what you use it for.

Bad Debt: Is a loan you take out to buy things that will not bring you any economic benefit, only expenses. For example, going into debt to buy a luxury car that does not produce income or to buy electronics you don't really need.

Good Debt: Is a loan you use to acquire something that will generate income greater than the cost of the debt. A perfect example is buying a house on credit to rent it out, where the tenant's rent covers the mortgage and leaves you with a profit.

Income That Works for You and the Snowball Effect

Once you have a positive cash flow, your goal should be to use that money to build assets that generate passive income. Passive income is what you receive without having to be physically present to produce it, such as rent from a property or dividends from a stock portfolio.

To accelerate wealth creation, you must understand compound interest. Unlike simple interest, where you earn the same amount year after year, compound interest adds the interest earned in one period to your initial capital so that the next year you earn interest on a larger base. This "snowball effect" is the most powerful force for the long-term growth of your wealth, as it makes your money work for you exponentially.