Navigating Car Insurance in the UAE: Your Essential Guide for 2025

As the sun begins to rise over the tranquil deserts of the UAE, the roads become a vibrant tapestry of vehicles—a testament to the region's booming motoring culture. While UAE roads are a joy to navigate, ensuring you have the right car insurance coverage can feel daunting. With the arrival of 2025, the landscape of car insurance is evolving, bringing new regulations and opportunities for insightful drivers. Let’s embark on this journey together, unraveling the complexities of car insurance to help you drive with confidence and peace of mind. Read more: https://www.icartea.com/ar/wiki/car-insurance-in-the-uae-2025-guide.

Verifying Your Car Insurance Validity: A Quick Checklist for 2025

In the UAE, being a responsible driver means ensuring your car insurance is valid and up-to-date.

✅ Mandatory Checks for UAE Drivers

RTA's Digital Verification Portal:

Gone are the days of sifting through paper documents. The Roads and Transport Authority (RTA) offers a seamless digital platform to verify your insurance status quickly. Just enter your vehicle registration and Emirates ID number, and you can efficiently confirm your coverage in minutes. This digital ease is especially appreciated by tech-savvy drivers and families eager to stay compliant without hassle.

Physical Document Checklist:

While digital verification is a lifesaver, having physical copies is still advisable. Here are a few key items to check on your insurance certificate:

Expiry Date: Ensure your policy extends beyond December 31, 2025. A lapse in coverage can lead to fines or legal repercussions—concerns that resonate particularly with those who prioritize a secure driving experience.

Comprehensive Coverage Symbols: If you selected comprehensive coverage, confirm that your policy explicitly covers weather-related incidents. Given the UAE's occasional heavy rains and sandstorms, this protection can save both your vehicle and wallet.

Emirates-Based Insurer's Stamp: Verify your insurance provider is UAE-licensed, ensuring smooth claim processing and compliance with local standards.

Choosing the Right Insurance Plan for 2025

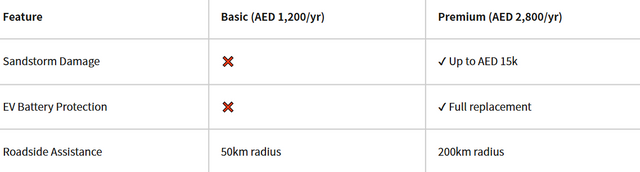

Selecting the right insurance plan is akin to picking the right set of tires for your car—it can make all the difference. Understand the distinctions between basic and premium coverage to make an empowered choice.

Highlights:

Sandstorm Damage Coverage: Essential for travel to desert areas, a premium plan can protect you against significant repair costs resulting from sandstorm damage.

EV Battery Protection: With electric vehicles gaining popularity, premium plans are stepping up with robust coverage for EV batteries, alleviating financial concerns over potential replacements.

Roadside Assistance: Opt for a plan that aligns with your travel habits. For daily city commutes, a basic plan might suffice, while extensive travel warrants the broader coverage of a premium plan.

Explore the Top 3 Emerging Add-ons for 2025

The car insurance landscape in the UAE is evolving, introducing innovative add-ons that cater to diverse driver needs:

Drone-Delivered Emergency Kits: Stranded on a remote road? Some forward-thinking insurers are rolling out emergency kits delivered by drone—ideal for adventurous male drivers or families concerned about safety.

AI-Powered Accident Analysis: Forget cumbersome claims processes. Upload accident photos via a dedicated app, and let AI streamline damage assessment and fault determination, saving you time and effort.

Solar Panel Coverage for EVs: With solar-integrated vehicles hitting the roads, specialized coverage for solar panel-related damages is now available, ensuring sustainability without the stress of potential losses.

7 Proven Ways to Save on Insurance in 2025

Who doesn’t love saving a little cash? Here are updated strategies to help you reduce your premiums:

Bundle Discounts: Many insurers offer significant savings when bundling car and home insurance—ideal for families.

Telematics Devices: Installing driving trackers can reward you with discounts based on your safe driving habits.

Loyalty Programs: Inquire about loyalty rewards from your insurer for remaining claim-free, like a free month after three years.

Increase Your Excess: Opting for a higher deductible can yield lower annual premiums, if you're comfortable with the risk.

Shop Around: Use comparison platforms to scour the market for the best deals, ensuring you don’t miss out on competitive rates.

Maintain a Clean Driving Record: Safe driving pays off—avoid infractions to keep your premiums low.

Consider Your Car's Value: If your car is older, third-party coverage could suffice, significantly lowering costs.

Future-Proofing Your Coverage: Trends for 2025

As we look ahead, staying informed about upcoming changes can help you remain well-protected:

Regulatory Changes:

Mandatory Flood Coverage (July 2025): If you live in the Northern Emirates, check that your comprehensive insurance covers flood damages.

Minimum Liability Limits Increase (December 2025): A rise in minimum liability insurance will enhance protection but could also affect premium prices.

Digital Insurance Wallets:

Utilize approved apps like the MoHRE Wallet to store all essential driving documents securely on your smartphone, ensuring you have everything at your fingertips when you need it.

The content above comes from Cartea, the most professional automotive platform in the Middle East. More info: https://ksa.icartea.com/ar.