Aussie left the pack. Forecast as of 14.09.2022

Monthly Australian dollar fundamental analysis

Before the release of US inflation data, the Australian dollar, just like stock indices, oil, and other assets, expected a slowdown in consumer prices would force the Fed to turn dovish. As a result, the acceleration of core inflation caused the worst AUDUSD collapse since March 2020, when the pandemic began.

Historically, the Aussie has always been unstable, with a global recession approaching. The fact that US inflation is not moving towards the 2% target indicates that the Fed's job is far from done. The 4.5% federal funds rate increases the risks of a recession in the US economy. Europe will face a sharp economic slowdown due to the energy crisis, and China due to COVID-19. Australia will avoid recession as in 2008-2009 thanks to good trading conditions, increased population growth and a strong labor market. However, this is unlikely to help the AUD.

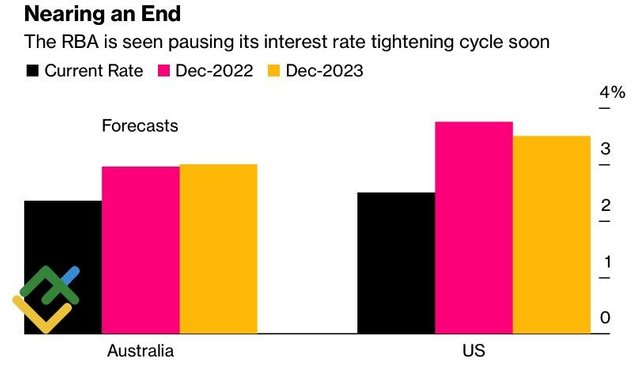

RBA and Fed rate forecasts

For more information follow the link to the website of the LiteForex

https://www.litefinance.com/blog/analysts-opinions/aussie-left-the-pack-forecast-as-of-14092022/?uid=285861726&cid=58534