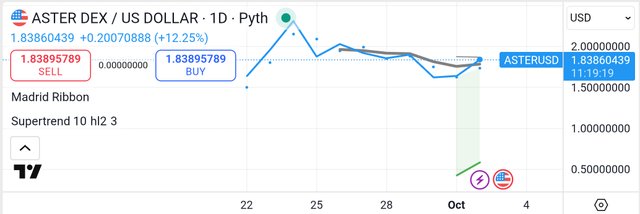

[New Token] 1 ASTER = $1.83 USD - How it's allowing users to collateralize perpetual trades with yield-generating assets?

Aster DEX is a sophisticated, hybrid decentralized exchange (DEX) that integrates both spot and perpetual futures trading. From a technical analysis viewpoint, the platform has recently demonstrated bullish market momentum, as evidenced by the Madrid Ribbon indicator displaying a sustained green uptrend pattern. This suggests robust price consolidation and strong buyer support.

A key architectural innovation in Aster is its enhanced capital efficiency model, allowing users to collateralize perpetual trades with yield-generating assets (like Liquid Staking Tokens). This permits simultaneous earning of passive yield and active trading exposure. Complementing this, technical indicators show building market sentiment, with the SuperTrend indicator beginning to flash a definitive buy signal, reinforcing the observed positive trend in the market.

For professional traders, Aster incorporates critical features to ensure fair execution. To actively combat Maximal Extractable Value (MEV) attacks and front-running, the DEX utilizes Hidden Orders within its Pro Mode interface. This privacy-preserving feature prevents the disclosure of large order sizes to the public order book, thereby protecting strategies and minimizing adverse market impact.

About Aster DEX (ASTER)

Aster DEX is an advanced decentralized exchange (DEX) that combines both perpetual futures and spot trading functionalities within a unified, multi-chain architecture. Positioned as a direct competitor to centralized exchange (CEX) derivatives platforms, Aster focuses on delivering a professional-grade trading experience while preserving the self-custody ethos of Decentralized Finance (DeFi). The platform's native utility and governance token is $ASTER.

Unique Technical Features and Architectural Components:

Revolutionary Capital Efficiency via Yield-Bearing Collateral: This is a core differentiator. Aster enables users to post yield-generating assets, such as Liquid Staking Tokens (e.g., asBNB) or its proprietary yield-bearing stablecoin (USDF), as margin collateral for perpetual trades. This mechanism allows traders to simultaneously earn passive income from their collateral while actively engaging in leveraged trading, significantly enhancing capital utilization.

Privacy-Centric Trading with Hidden Orders: To mitigate Maximal Extractable Value (MEV) exploitation, front-running, and liquidation hunting prevalent on transparent blockchains, Aster incorporates Hidden Orders in its Pro Mode. These limit orders remain invisible to the public order book until execution, obscuring large-volume trading intent and protecting professional traders' strategies.

Dual-Mode User Interface and Execution:

- Simple Mode (1001x Mode): Designed for retail users, this mode offers streamlined, one-click execution for perpetuals with leverage up to 1001x, and is built to be MEV-resistant.

- Pro Mode: Caters to experienced traders with a full-featured, order book-based interface, multi-asset margin, advanced order types (e.g., grid trading, stop-limit), and access to crypto-settled stock perpetuals (e.g., AAPL/USDT).

Multi-Chain Liquidity Aggregation: Aster operates across multiple major Layer 1 and Layer 2 networks, including BNB Chain, Ethereum, Solana, and Arbitrum. Its infrastructure facilitates seamless, cross-chain trading without requiring manual asset bridging by the user, aggregating liquidity for deeper market depth and reduced friction.

Future Architecture - Aster Chain: The roadmap includes the development of Aster Chain, a proprietary Layer 1 blockchain optimized for high-performance derivatives trading and planning for integration of Zero-Knowledge Proofs (ZKPs) to achieve truly private yet verifiable on-chain transactions.

The $ASTER token underpins the ecosystem, providing holders with governance rights, fee discounts, and protocol revenue-sharing through staking rewards.

Disclaimer: This is not financial advice; cryptocurrency and DeFi are high-risk, so do your own research and consult a professional before investing.

Assisted by https://gemini.google.com/.

See also:

- Reversteem: merges the strategic thrills of classic Reversi with the decentralized power of Steem blockchain, letting you duel friends through blockchain-recorded games

- @steem.amal: Charity At Your Fingertips

- Maximize curation rewards: follow our trail! Maksimalkan reward kurasi: ikuti trail kami! トレイルをフォローし、キユレーション報酬を最大化!

- Pi Network - Crypto Pertama Yang Dapat Ditambang Di Ponsel

- Piネットワーク — スマートフォンでマイニングできる最初の暗号通貨

Upvoted! Thank you for supporting witness @jswit.