Tokenization of Real World Assets

The world is filled with a lot of assets both tangible and intangible. Considering them as options for investments, some of the assets are explored and most of them are unexplored largely because of the lack of liquidity. A lot of people who own these lucrative assets find themselves impeded by the illiquidity of the assets in opening them up for prospective investors.

Even the most lucrative of the assets that have a clearly tangible value have difficulties in getting liquidated just because of its high value. What made the asset great in the first place has become its own curse. It looked like some big investments like commercial real estate would be confined to a few high-level investors and might not get liquidated in the short-term!

However, the answer or solution for the situation came in the form of tokenization!

What is tokenization?

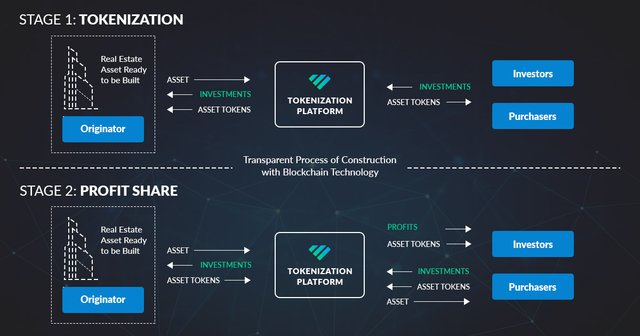

Tokenization is the act of splitting anything tangible into discrete tokens without losing the ‘tangible’ attribute. Each token represents the asset either in value or in ownership.The tokens are stored on the blockchain which is a transparent and immutable digital ledger. The very mention of the word blockchain has created a dubious shroud of uncertainty and mistrust among people. In fact, it should be the blockchain that ascertains the trust factor.

How are asset tokens different?

Blockchain and tokens, when mentioned in the same sentence, would immediately bring up the memories of Initial Coin Offerings (ICO). ICOs are utility tokens that did not possess a value but rather a ticket to access a product or a service.

ICOs were not in the ambit of any legal frameworks to regulate them. However, when the token is backed by an asset, the asset becomes security. Automatically, any security should come under the scrutiny and legal compliance requirements of the Securities and Exchanges Commission (SEC) and other financial authorities. This regulatory bodies or any other similar organizations subject to a country's jurisdiction protects the interest of the investors.

What are the fields that can take advantage of tokenization?

This is literally a billion-dollar question! Earlier, high-value assets like fine art and commercial real estate were considered highly illiquid. However, with tokenization taking over, liquidity is effectively addressed - the ‘asset’ that was unaffordable has now been made into ‘tokens’ that are relatively affordable.

The same can be said about many hotels and companies that are looking for capital investments. An investor who buys a security token backed by an asset automatically enjoys the status and the privileges of a shareholder.

On one side, tokenization is increasing the liquidity of high-value assets. On the other side, tokenization is also making the landscape of investments more democratic. The scope of investing in high-value assets like real estate and fine art is no longer confined to a few hundred investors who have access to that much of capital. The option to invest has been made available to the lowest level of investors who can buy a fraction of the ownership and still reap the benefits of out of it.

Questions might arise if high-value investors will get affected by tokenization. Come to think of it, tokenization only makes the asset more liquid. Tokenization has attenuated the intensity of deterrents for high net-worth investors (HNIs) - the compliance with the Security Laws has made it safer and dependable. This would mean that even high-value investors have a greater probability to get the profits quicker than earlier. Although the profits might not be as quick as in ICOs, the added liquidity increases the relative swiftness of seeing returns in securities. The ROIs are quicker than traditional securities, but with the same promises of compliance and protection of interests. In addition to this, the HNI investors also get to diversify their portfolio. Instead of investing their entire capital in a single asset, they can invest them in multiple projects, so they do not have to put all the eggs in a single basket.

Is tokenization the future?

The world economic forum has predicted that in another 10 years, 10% of the entire wealth of the earth will be in the form of cryptocurrencies and tokenized assets... That opens the floodgates to about $10 trillion worth of assets.

With so much potential, all that is needed is the legal assistance to tokenize an asset and also the technical support. Companies like Blockchain App Factory have the expertise to create your asset tokenization platform which could transform high-value assets into tangible tokens that can be stored and traded over the secure blockchain.

If you have an asset and would like to tokenize it or if you look forward to building an asset tokenizing platform, drop in an inquiry with Blockchain App Factory and we will take you through the process that will pave the inroads into the world of tokenization and blockchain.

Congratulations @vfuser! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Vote for @Steemitboard as a witness to get one more award and increased upvotes!