Palladium Network: Merging Arbitrage with Real Assets for Investor Security

The blockchain industry has come a long way from speculative tokens and meme-driven price movements. Today, projects with real-world utility are stepping into the spotlight—delivering tangible value, financial sustainability, and long-term investor confidence. Among these new-generation platforms, Palladium Network (PLLD) stands out as a pioneer. By combining real-estate–backed NFTs with an automated arbitrage engine, Palladium introduces a hybrid model that reduces volatility, provides stable returns, and democratizes access to premium real estate ownership. Unlike many crypto tokens that rely solely on hype, Palladium anchors its ecosystem in tangible property value while enhancing liquidity through high-frequency trading strategies.

This blog will dive deep into what Palladium Network is, how it works, its buyback mechanisms, staking systems, and why it represents one of the most promising innovations in decentralized finance (DeFi).

What is Palladium Network (PLLD)?

Palladium Network (PLLD)—a pioneering hybrid ecosystem that merges real estate–backed NFTs with a sophisticated automated arbitrage engine. By anchoring digital value to tangible property ownership and enhancing liquidity through arbitrage-driven buybacks, Palladium offers investors a balanced, transparent, and sustainable path in the digital asset space. The Palladium Network (PLLD) is more than just another cryptocurrency—it’s a comprehensive financial ecosystem combining real estate, DeFi, NFTs, and arbitrage into one transparent platform. By uniting tangible value with blockchain efficiency, Palladium offers investors a balanced, rational, and sustainable pathway into digital assets.

With real estate tokenization, staking rewards, arbitrage-driven buybacks, exchange listings, and a growing ecosystem, Palladium has positioned itself as a pioneer in bridging traditional and digital economies. For those seeking stability in crypto without sacrificing growth potential, PLLD is a project worth watching closely.

How Palladium’s Hybrid Model Works

1. Real-Estate–Backed NFTs

Traditional real estate investment often requires significant capital, legal hurdles, and long holding periods. Palladium solves this by tokenizing properties into fractional NFTs.

For example, its first property—a scenic mountain cottage near a ski resort—is being tokenized and offered to the community. Investors don’t need millions to own a luxury property; instead, they can purchase fractional NFTs that represent their share.

Each NFT is tied to a real-world, income-generating property, ensuring that investors benefit not only from property appreciation but also from rental income and ecosystem rewards.

2. Automated Arbitrage Engine

Crypto markets are known for price inefficiencies across exchanges. Palladium leverages this by deploying a high-frequency arbitrage engine that scans and exploits price gaps.

Here’s the key part: a portion of profits from arbitrage is used to buy back PLLD tokens from the market. This constant buyback mechanism reduces circulating supply, anchors token value, and incentivizes long-term holding.

3. Buyback and Burn Mechanism

To further stabilize the ecosystem, Palladium channels arbitrage profits into buybacks of PLLD. Some of these tokens are burned, while others are redistributed to loyal community members through rewards and staking pools.

This system reduces volatility while rewarding long-term holders—creating a win-win environment for both investors and the token economy.

Key Features of Palladium Network

Real Asset Backing

Unlike most cryptocurrencies that exist purely on market speculation, PLLD is backed by physical real estate properties.Fractional NFTs

Investors gain direct ownership of properties through NFTs, lowering the barrier to entry for premium real estate investing.Arbitrage-Driven Buybacks

Automated trading profits fund continuous buybacks and burns, reducing volatility and supporting token price stability.Staking & Loyalty Rewards

Long-term PLLD holders benefit from staking rewards, ecosystem incentives, and community airdrops.Community-Governed Treasury

Investors participate in governance, helping shape which properties are tokenized and how treasury assets are managed.

Benefits of Investing in Palladium Network

- Asset-Backed Security: Your investment is tied to real properties, not empty speculation.

- Passive Income: Earn through staking rewards, rental yields, and arbitrage-driven buybacks.

- Liquidity Advantage: Tokenized ownership allows you to enter and exit investments seamlessly.

- Diversification: Access to multiple real estate markets without the heavy capital traditionally required.

- Community Power: Participate in governance decisions shaping the future of Palladium.

Real Estate Tokenization: Unlocking Property Access for Everyone

One of Palladium’s defining features is its real estate NFT model. Here’s how it works:

Property Selection & Due Diligence

Only high-quality assets undergo tokenization after rigorous legal, financial, and environmental assessments.Fractional Ownership via NFTs

Each NFT represents a proportional stake in the property, enabling low-barrier entry into real estate investment.Income Streams

NFT holders receive rental income and benefit from capital appreciation of the property.Legal Structuring through SPVs

Properties are housed within Special Purpose Vehicles (SPVs) to ensure compliance, asset protection, and clear title ownership.

Exchange Listing: PLLD on Poloniex

In a major milestone, PLLD is officially listed on Poloniex, one of the world’s leading cryptocurrency exchanges. This listing delivers:

- Global Accessibility – Exposure to millions of traders worldwide.

- Increased Liquidity – Easier entry and exit for investors.

- Legitimacy – Exchange listings signal credibility and progress.

Being on Poloniex highlights Palladium’s commitment to mainstream adoption and positions PLLD among recognized digital assets.

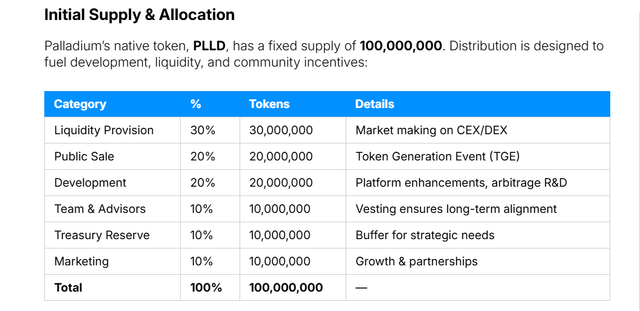

Tokenomics

Palladium’s native token, PLLD, has a fixed supply of 100,000,000. Distribution is designed to fuel development, liquidity, and community incentives:

- Liquidity Provision- 30%- 30,000,000- Market making on CEX/DEX

- Public Sale- 20%- 20,000,000- Token Generation Event (TGE)

- Development- 20%- 20,000,000- Platform enhancements, arbitrage R&D

- Team & Advisors- 10%- 10,000,000- Vesting ensures long-term alignment

- Treasury Reserve- 10%- 10,000,000- Buffer for strategic needs

- Marketing- 10%- 10,000,000- Growth & partnerships

Vesting Schedules

Development (20%)

- Lockup: 6 months post-TGE

- Vesting: Gradual release from Month 7 onward, aligning with platform milestones (e.g., Swap launch, real estate tokenization).

Team & Advisors (10%)

- Lockup: 6 months post-TGE

- Vesting: Linear over 25 months to maintain focus on long-term success.

Treasury Reserve (10%)

- Lockup: 12 months post-TGE

- Vesting: Linear release, offering flexibility for unforeseen requirements and strategic expansion.

Marketing (10%)

- Lockup: None

- Vesting: 25% released at TGE, remaining 75% over the next 12 months to support sustained growth and user acquisition.

These schedules prevent sudden token floods, safeguarding market stability and incentivizing ongoing project development.

Buyback Mechanism

Central to Palladium’s sustainability is a profit-sharing buyback system, where a portion of arbitrage returns fund PLLD repurchases:

- Arbitrage Earnings: Profits generated from market inefficiencies are channeled into the buyback pool.

- Periodic Token Buys: At randomized intervals, Palladium buys PLLD on the open market to thwart predictable front-running and speculation.

- Supply Reduction: Tokens are transferred to the treasury or retired, effectively shrinking circulating supply and potentially supporting the token’s market value.

Transparent Reporting" Quarterly disclosures detail total tokens repurchased, expenditure, and transaction references for on-chain or exchange verification.

PLLD Token Utility: More Than Just a Crypto

The PLLD token is central to Palladium’s ecosystem, serving multiple purposes:

- Arbitrage-driven buybacks → A portion of profits is used to buy PLLD on open markets, reducing circulating supply.

- Liquidity enhancement → Supporting smoother trading and stability.

- Staking rewards → Holders can lock PLLD for passive income.

- Governance rights → Active community participation in ecosystem decisions.

- Loyalty incentives → Long-term holders benefit from periodic airdrops and bonus rewards.

This dual-stream model—real estate NFTs for property income and PLLD tokens for arbitrage-driven rewards—ensures clarity, transparency, and diversified opportunities.

Roadmap

Phase 1 (0–6 Months)

- Expand arbitrage coverage to multiple exchanges

- Conduct buybacks from initial trading profits

- Complete preliminary audits

Phase 2 (6–12 Months)

- Launch PLLD Swap

- Roll out first fractional real estate NFTs

- Integrate advanced arbitrage (options, futures)

Phase 3 (12+ Months)

- Diversify global property portfolio

- Implement AI-based arbitrage modules

- Maintain ongoing buybacks and periodic vesting updates

Conclusion: A Balanced Future for Digital Assets

The future of blockchain is not about speculation—it’s about utility, sustainability, and integration with real-world assets. Palladium Network (PLLD) embodies this shift by converging tangible real estate with high-frequency arbitrage, creating a more stable, transparent, and rewarding ecosystem. For investors seeking real-world backing, consistent rewards, and exposure to premium properties, Palladium is more than just a project—it’s a gateway to the next evolution of decentralized finance.

Whether you’re a crypto investor, real estate enthusiast, or DeFi explorer, Palladium Network offers a unique opportunity to be part of a balanced, democratized digital economy.

Stay connected with us:

- Website: https://plld.net/

- Twitter: https://x.com/DDTechGroup

- Telegram: https://t.me/Palladium_PLLD

- Whitepaper: https://plld.net/whitepaper

- View PLLD on CoinGecko: https://www.coingecko.com/en/coins/palladium-network

AUTHOR

Bitcointalk name : ElbaOslo

Bitcointalk profile link: https://bitcointalk.org/index.php?action=profile;u=3629485

BEP20 Address: 0xAE0A8F375d14d03b6725dC0Fa92D25005b598e35