Apple is encountering its most significant iPhone decline since the onset of Covid-19, amid the ascent of competitors in China.

Apple Inc. saw a steeper-than-expected 10% decline in iPhone shipments during the March quarter, signaling a downturn in sales particularly in China despite a broader rebound in the smartphone industry. Market tracker IDC reported that the company shipped 50.1 million iPhones in the first three months, falling short of the 51.7 million average analyst estimate compiled by Bloomberg. This 9.6% year-on-year drop marks the sharpest decline for Apple since Covid-19 disruptions affected supply chains in 2022, according to researchers.

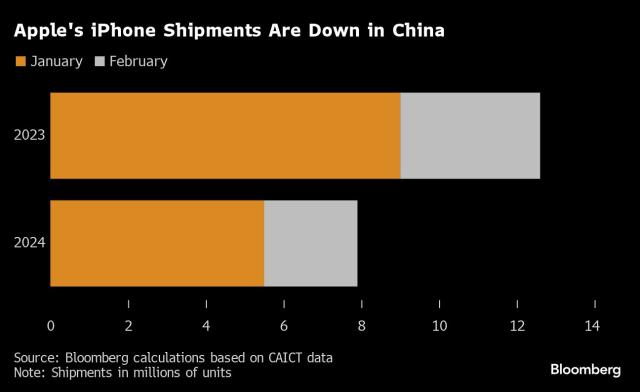

The Cupertino, California-based tech giant has faced challenges in sustaining iPhone sales in China since the release of its latest model in September. Competition from rivals like Huawei Technologies Co. and Xiaomi Corp., alongside Beijing's ban on foreign devices in workplaces, have contributed to the sales slump. IDC's data offers an initial glimpse into the global performance of Apple's flagship product ahead of its earnings report on May 2.

The decline in iPhone shipments is notable considering the overall mobile market experienced its strongest growth in years, with smartphone makers shipping 289.4 million handsets in the period, marking a 7.8% increase from a year ago when manufacturers were dealing with excess inventory. Samsung Electronics Co. reclaimed the top spot in the March quarter, while Transsion, focusing on budget phones, saw an 85% increase in shipments, and Xiaomi narrowed the gap with Apple for second place.

Nabila Popal, research director at IDC, noted, "The smartphone market is emerging from the turbulence of the last two years both stronger and changed." She anticipates Android to grow faster than Apple as the market continues to recover in 2024.

Following the report, key Apple suppliers such as Hon Hai Precision Industry Co., Murata Manufacturing Co., and LG Innotek Co. experienced declines in Asia trading, amid broader market concerns over escalating tensions in the Middle East.

Bloomberg Intelligence observed that Xiaomi's first-quarter handset shipments of 40.8 million units, according to IDC, surged by 33.8% year-over-year, while both Apple and Samsung witnessed declines. This strong performance in handset sales, driven by a recovery in overseas markets, could potentially lead to high double-digit sales growth for Xiaomi in the first quarter.