Weekly Performance Review 13/03/2018: Cryptocurrency and Equity Markets

A week ago, the generally low unpredictability in the digital currency showcase reached an end. Pretty much all digital forms of money dumped together with sharp decreases, activating recharged fear among brokers and financial specialists. As usual, a base - in any event briefly - was in the long run discovered, prompting ricochets in all cases.

Then again, worldwide value markets were moderately steady and for the most part holding over the help, following sharp drops in earlier weeks. Much of the time, significant securities exchanges keep on evolving a potential base other than India, which starting a week ago has fallen through key help levels.

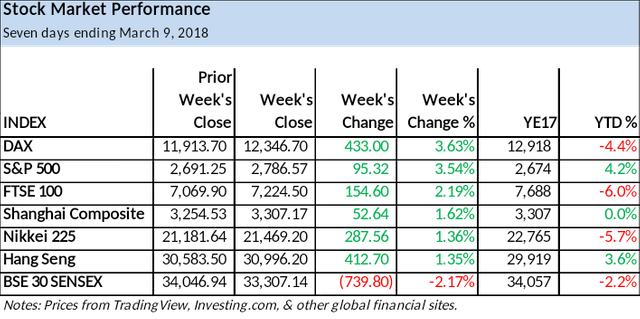

Worldwide value markets: holding unfaltering

The German DAX Index and S&P 500 drove the path with additions of 3.63 percent and 3.54 percent separately. Toward the beginning of the week, the DAX tumbled to another pattern low of 11,831.0 preceding seeing help, around the long haul uptrend line and earlier swing low from August. It immediately switched intraday to close at the high of the day. By the by, it stays in a downtrend following a breakdown from a bear hail drift continuation flag two weeks back.

The UK FTSE Index and Shanghai Composite saw unobtrusive increases of 2.19 percent to 7,224.50 and 1.62 percent to 3,307.17, individually. The trendline protection stays over the FTSE, and it has been tried a few times as of late and halted a progress. This puts the file in danger of falling beneath a week ago's low of 7,062.10. In the meantime, a potential bullish twofold base has shaped. In any case, it isn't affirmed unless there is a rally over the two-week high at 7,326.

Hang Seng: pointing higher

Since tumbling from the January pinnacle of 33,484.1 Hong Kong's Hang Seng Index has discovered help twice around the long haul uptrend line and it keeps on holding. A weeks ago low of 29,852.40 was the second time that the list ricocheted off the help region around the line. This instructs us to watch out for the line going ahead for indications of an adjustment in the connection between the cost and the line. Also, see that the dark colored 100-day moving normal (MA) bolster line on the encased outline has been parallel to the pattern line for a year. The 100-day MA is right now at 30,081.39.

The Hang Seng's undoubtedly next upside target seems to be around 32,522.1/32,552.1. That is the place an ABCD design finishes, and the 78.6 percent Fibonacci retracement is hit, individually.

In the event that a dip under a week ago's low happens rather then the record first heads towards the latest swing low of 29,129.30 at A, trailed by a value zone around 28,588.50 to 28.495.77, which recognized from the earlier protection top in May 2015, and the 200-day MA (purple line).

BSE 30 Sensex: falls through help

India's BSE 30 Sensex Index scarcely got a ricochet following the decrease to help of the 100-day MA (darker line) and 78.6 percent Fibonacci retracement region in February. When discovering support the Sensex framed a generally limit go rectangle solidification design around help of the MA and both above and underneath the long haul uptrend line, until a week ago. That is the point at which the list separated from the rectangle design and underneath the 100-day MA. A week ago the Sensex was the most noticeably bad entertainer of the seven value lists took after, falling by 739.80 or 2.17 percent to close at 33,307.14.

Just beneath a week ago's low of 32,991.14 is the following key help zone around 32,737 to 32,360, comprising of the 200-day MA and earlier help and protection levels, separately. Note that a break underneath the 32,565 swing low from December will damage the uptrend value structure and in this way likely prompts a considerably more profound redress.

A week ago's low finished a 88.6 percent Fibonacci retracement of the earlier uptrend. On the off chance that the most recent week's high of 34,060.13 can be surpassed to the upside, at that point the Sensex may have a possibility of ricocheting higher. Until the point that a breakout above a week ago's high descending weight stays overwhelming.

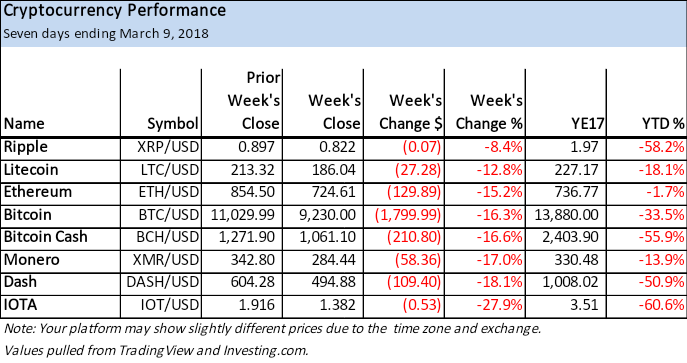

Cryptographic forms of money: shake my reality

Digital currency devotees had their reality shook by and by a week ago with most coins dropping steeply inside a moderately brief timeframe. There was a conjunction of elements that may have added to the influx of offering including:

Hacking - reports have circled that exchanging robot applications associated with Binance, a best digital currency trade were hacked.

Dread of control - the US Securities and Exchange Commission reports an arrangement to manage crypto trades as securities trades, adding a layer of direction to the business working in the US.

Vast supply - the chapter 11 trustee for Mt. Gox sold roughly $400 mln of Bitcoin and Bitcoin Cash since late September and it is accounted for there is an expected $1.8 bln still to be sold. Obviously, this raises fears that an extensive supply has been and will keep on weighing on costs for some obscure timeframe.

In spite of the fact that the news appears to have had some influence in spooking the market, in all cases the graphs were at that point bearish, indicating lower costs. The news may have quite recently quickened the speed toward the path the cost was at that point heading. For those deft and ready to undercut, some decent open doors introduced themselves.

Particle and Dash were the greatest washouts, with IOTA falling $0.53 or 27.9 percent to end at $1.38, and Dash down $109.40 or 18.1 percent to close at $494.88. Dash stays in a reasonable downtrend showed by its pattern line, moving midpoints and value structure (bring down highs and lower lows). The cost got through the help of the 200-day MA and is trying help of the February swing low of $376.05. A week ago's low was $438.80.

Albeit falling $0.07 or 8.4 percent to end at $0.82, Ripple tumbled the minimum out of the eight cryptos. Prior in the week, Coinbase murdered gossipy tidbits that it would add Ripple to its stage. XRP stays in a downtrend yet over its 200-day MA, though various other major cryptos are beneath their 200-day MAs. Following simply behind Ripple is Litecoin with a 12.8 percent decrease. Litecoin fell $27.28 to close at $186.04 and is playing with the protection of its 50-day line. Until the point that last week's decay, it had held above help of the 50-day for the earlier couple of weeks.

Ethereum: bobs off strong help, yet will it keep on holding?

Ethereum finished down $129.89 or 15.2 percent a week ago to close at $724.61. It stays in a reasonable downtrend once a day and is beneath the 50-day line which keeps on falling, yet over the 200-day MA, which is as yet rising. A week ago's low was at $637.73, ideal around the conversion of both the 78.6 percent Fibonacci retracement and the 127.2 percent Fibonacci projection. The projection additionally finished an ABCD design or estimated move where the second leg down off the swing high at point A was around 127.2 percent of the value change in the main leg down.

The key protection from watch is the adjacent downtrend line. The ETH/USD combine would need to close over that line every prior day there some sign that the bob off a week ago's base at D may proceed. In the event that the value falls encourage beneath a week ago's low then next look for help around the intersection of a few Fibonacci value levels around $612.67. From that point onward, there is a value zone from around $587.07 (200-day MA) to the latest swing low of $565.54.

Particle: indicating relative shortcoming

Particle has been falling in an all around characterized downtrend since the top at $5.80 in December. Not just it was the weakest entertainer a week ago however it is likewise the most noticeably bad entertainer so far in 2018, down 60.6 percent. Starting a week ago, it takes a novel position in fact as it is the main crypto out of the eight took after that fell underneath its earlier swing low from February. This is an indication of relative shortcoming when contrasted with the other seven cryptographic forms of money on our rundown. The low from February was at $1.20, and a week ago the IOTA/USD combine dropped to $1.136 before switching higher. Further, the digital money is presently unmistakably back underneath its 200-day MA (purple line) starting a week ago's drop, subsequent to being above it for the greater part of the previous half a month.

Protection at the 200-day MA is currently at 1.71, with the downtrend line not far away. In the event that you take a gander at the dark colored falling 50-day line on the encased graph, you can see it has been following the downtrend line for the recent months. This implies a bullish breakout of the line should likewise rapidly be trailed by a breakout over the MA, which is presently at $1.965. Until then the downtrend proceeds.

For future viewers: price of bitcoin at the moment of posting is 9067.00USD

hey nice post