Exploring Altseasons and Their Relationship with Bitcoin Halvings

Introduction:

The realm of cryptocurrency is an ever changing arena that continues to captivate both investors and newcomers alike. Among the subjects that grab the attention of traders and enthusiasts the timing of the altseason stands out prominently. Altseason refers to a period when altcoins experience increases, in value compared to Bitcoin, which is eagerly anticipated by many. However an interesting trend has emerged over time – it appears that altseasons are noticeably hard to come by in the period leading up, to halvings.

The phenomenon of Bitcoin Halving

To truly grasp the complexities of altseasons and their relationship, with Bitcoin halvings it is essential to explore the concept of halvings. These occurrences happen every four years. Involve a significant reduction in rewards for miners who successfully mine blocks. The intention behind these halvings is to slow down the rate at which new Bitcoins are created ultimately resulting in a supply of 21 million coins. Throughout history Bitcoin halvings have played a role, in shaping market sentiment and influencing the price trajectory of this pioneering cryptocurrency.

The Evasive Nature of Altseasons Before Halvings

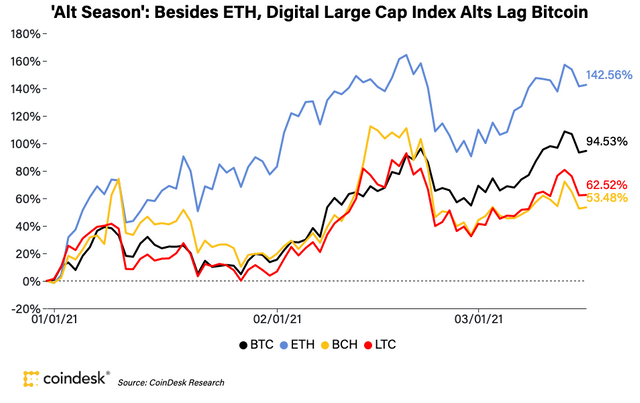

It's quite interesting to note a fascinating pattern when we look at how altseasons relate to Bitcoin halvings. Altseason refers to a phase where cryptocurrencies other than Bitcoin experience significant price surges, often surpassing the growth of Bitcoin itself. While altcoins do increase in value occasionally, a complete altseason, which is marked by a widespread frenzy of value appreciation across the market, seems to be distinctly noticeable.

Behavior in the Market and Investor Psychology

To fully understand this phenomenon, one needs delve into the complexities of investor psychology and market behavior. As the first cryptocurrency, Bitcoin enjoys a distinct and privileged position in the market. Prior to price halvings, it frequently experiences price increases as a consequence of a combination of heightened media attention, the expectation of a decrease in supply, and an ensuing rush of new investors looking to profit from the anticipated bull run. This scenario frequently draws considerable attention and money away from altcoins, which results in a sluggish altseason.

Altcoins' Function Before Halving

While there might not be a full-fledged altseason for altcoins before Bitcoin halvings, it is important to note that this does not mean there aren't any possibilities. A few alternative coins have shown the ability to experience huge price increases prior to these halvings, providing profitable returns for savvy investors. But the overall altcoin market often goes through a phase of consolidation, with modest growth or stagnation being the rule.

Conclusion:

Getting around the Altseason Puzzle The connection between altseasons and Bitcoin halvings poses a fascinating riddle for investors and fans as the cryptocurrency market continues to develop. Due to the gravitational pull of Bitcoin's market dynamics, altseasons might stay quiet before halvings, but savvy traders can still take advantage of the special chances provided by particular altcoins. A tactical approach would involve taking advantage of specific altcoin price increases while maintaining a responsible allocation in preparation of the bigger altseason that frequently occurs in the wake of the next Bitcoin halving, which is scheduled for April 2024. The compass guiding investors through the altseason issue will be patience, research, and a thorough awareness of market patterns, as with any investing activity.