Altcoin Mania Overtakes Bitcoin

The key index reveals the abrupt end of "Bitcoin Season," as altcoins soar on trade optimism and Trump suggests a drastic tariff cut on China. Is this the prelude to an explosion of gains in alternative cryptocurrencies?

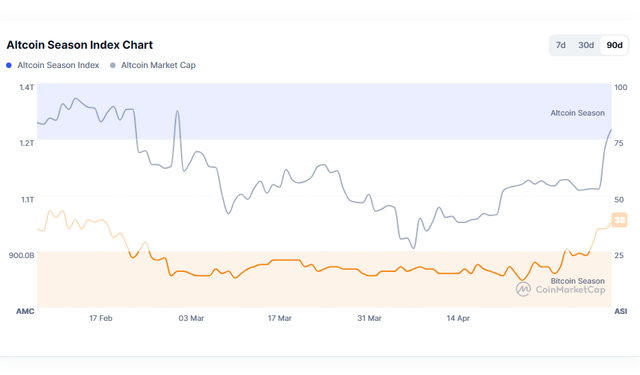

The recent euphoria in the cryptocurrency market took an unexpected turn. This week, the CMC Altcoin Season Index abruptly fell to 40 points out of 100, marking the end of "Bitcoin Season," which had been in effect from February 26 to May 6. This change comes amid a strong rally in altcoins, driven by demand for risky assets amid rumors of trade negotiations between the United States and the United Kingdom, expectations of meetings between US and Chinese officials in Switzerland, and President Trump's announcement of a possible reduction of tariffs on China to 80% from the current 145%.

The abrupt end of "Bitcoin Season" and the resurgence of altcoins mark a pivotal moment in the cryptocurrency market / Coinmarketcap

What was "Bitcoin Season" and why did it end?

Bitcoin Season is defined as a period in which Bitcoin outperforms most major altcoins over a 90-day period. According to the CMC Altcoin Season Index, "Altcoin Season" is considered when 75% of the top 100 cryptocurrencies (excluding stablecoins and asset-backed tokens) outperform Bitcoin over that period. The index's recent drop to 40 points signals a shift in momentum, with altcoins taking the lead in terms of performance. During the recent "Bitcoin Season," the leading cryptocurrency managed to break through the $100,000 barrier and approach overbought areas, while many altcoins are just beginning to emerge from a downtrend that has spanned the past three months.

Altcoins Lead the Charge with Exceptional Gains

Over the past 90 days, a select group of alternative cryptocurrencies have demonstrated significantly better performance than Bitcoin, marking the beginning of this potential seasonal shift. Among the most notable are:

FORM: 500.14%

FARTCOIN: 154.44%

MKR: 87.87%

BRETT: 69.82%

CORE: 58.16%

In contrast, Bitcoin remains in positive territory with a gain of 6.80% over the same period, although considerably lower compared to the aforementioned altcoins.

Is an "Altcoin Season" on the horizon?

This change in performance suggests the possibility of a sharp increase in the value of alternative cryptocurrencies, while Bitcoin could enter a consolidation phase in the $100,000 range. Many investors believe that altcoins are still relatively low in price after the recent downtrend, which could attract increased demand and generate significant profits. The expectation of a more favorable macroeconomic environment, driven by potential trade agreements, could also be fueling this appetite for risky assets, particularly benefiting altcoins with lower market capitalization and greater growth (and volatility) potential.

The abrupt end of "Bitcoin Season" and the resurgence of altcoins mark a pivotal moment in the cryptocurrency market. Optimism surrounding trade negotiations and the potential easing of tariffs have injected a new dose of enthusiasm into investors, who appear to be betting on the growth potential of alternative cryptocurrencies. While Bitcoin is consolidating at historically high levels, attention is now turning to whether this altcoin rally will turn into a sustained season of massive gains, offering new opportunities for investors willing to take on greater risk.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Cryptocurrency trading is highly volatile and carries significant risks, including the total loss of all invested capital. 1 Consult a financial advisor before making any investment decisions.

Upvoted! Thank you for supporting witness @jswit.