Tether Update: Is Tether Manipulating the Bitcoin Market?

A few days ago I talked about the USD-backed cryptocurrency Tether and why it's becoming a popular intermediary coin on cryptocurrency exchanges. In case you missed it, you can find my previous post here.

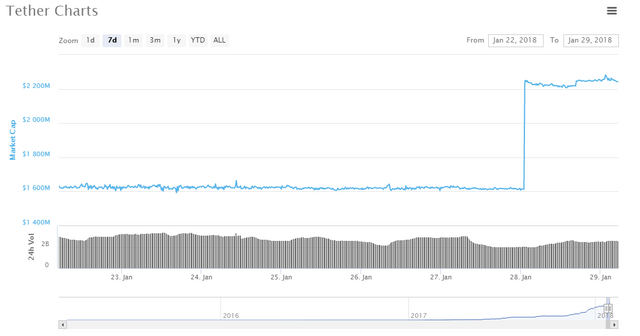

Yesterday there was a significant development for this cryptocurrency - Here's a graph of Tether's market cap from CoinMarketCap.com:

Source: CoinMarketCap.com

Roughly 600 million dollars of new Tether was created on January 28, increasing its market cap by more than 30% overnight.

I like Tether because it's a stable currency in a marketplace that has notoriously unstable currencies. Unfortunately, this latest development puts that into jeopardy.

There's already a lot of speculation about Tether's strange relationship with Bitcoin/Bitfinex, as well as its relationship with its auditors who recently cut ties with the company. Some investors are growing increasingly concerned that Tether is being issued in order to artificially prop up the price of Bitcoin markets, rather than keeping the value of Tether in fiat dollars to back up the value of the Tether coin itself.

Is Tether manipulating the Bitcoin market?

The allegation that Tether is manipulating the markets is a scary one, but at this point it is only speculation by worried crypto investors. We don't have an audit proving, or disproving those facts at this time, and a previous memorandum from Tether's auditor in September 2017 loosely confirmed that they had sufficient fiat to cover the market value of their cryptocurrency at that time.

What might happen

Despite the lack of proof either way, it looks like some investors are losing faith in Tether today.

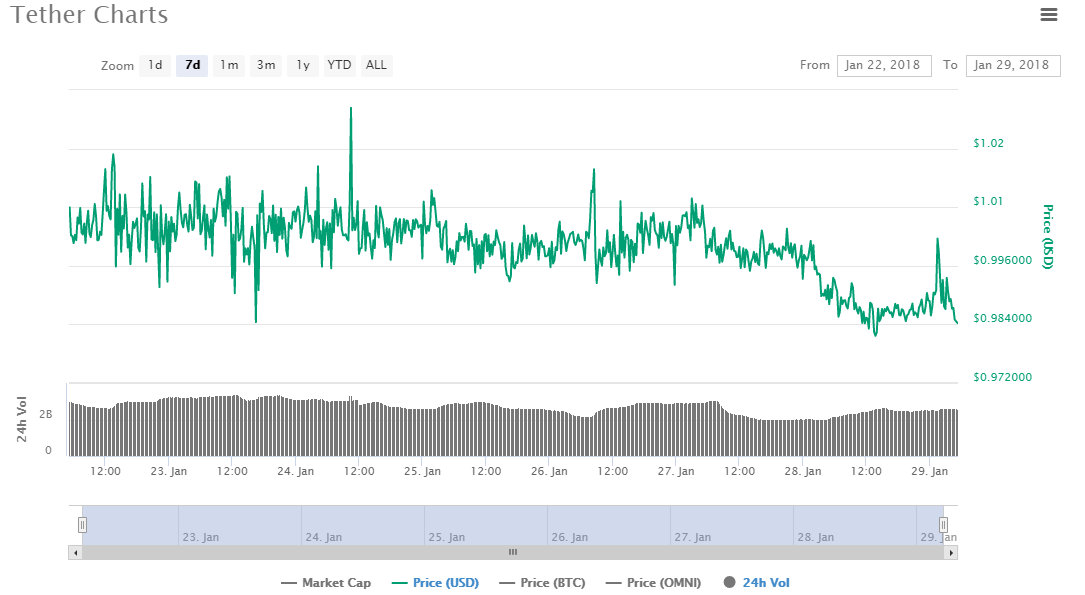

Source: CoinMarketCap.com

Tether is supposed to trade at $1.00, because it is tethered to the US dollar and the fiat holdings of Tether are supposed to back up that value. Presently Tether is trading around $0.986. This seems downright bizarre, as if it's actually possible to redeem Tether for a dollar each, this is a guaranteed 1.4% money-maker for any deep-pocketed investor who wants to scoop it up.

Sadly Tether isn't easily redeemed, and it's not clear if any Tether has ever been redeemed for fiat currency to date. It has largely been used as a trading currency to swap between coins on major exchanges. With uncertainty around Tether's fiat backing, trades through the Tether currency may slow down and it may begin to lose value as investors don't want to get stuck "holding the bag" if it crashes.

What happens in the case of a Tether crash? If it truly is propping up the value of Bitcoin as some investors have speculated, it could be a very dark time for the crypto markets.

Thanks for reading, |

If you enjoy my posts, don't |

Update 1:

Tether has hired Madoff and Associates as their new auditor. I'm not surprised by their quick move to fill the void, as they'll want to reassure their investors as soon as possible.

Update 2:

The Tether Report released January 24 suggests that Bitcoin's price has been fluctuating in time with newly granted Tether.

The Tether Report, a pseudonymously authored analysis examining the speculative assertion that bitcoin price volatility is highly correlated to the issuance of new USDT, has claimed that approximately 48.8% of bullish price movements have occurred within the two-hours immediately following ninety-one individual Tether grants. Source

Of course this is a bit of a chicken-or-the-egg scenario - Is Bitcoin rallying after Tether is issued because Tether is buying Bitcoin? Or are investors doing this themselves by buying Bitcoin based on speculation that the Tether issue will cause a bullish movement?