Metric on Coin. Total Supply vs Circulating Supply

These two are commonly used formulas to set the value of a coin. Circulating supply means coins mined or coins are distributed and available for sale.

While the total supply is the maximum supply that refers to the total amount of a coin that has been determined by the coin's code or script. For example, in February 2019 Bitcoin has an outstanding supply of 15.4 million, with a maximum supply of 21 million. By dividing the amount of supply circulating with the total supply, Coinvestors can find out how many coins have been mined or spent.

Bitcoin, for example, means 15.4:21 = 0.73 or 73%. Meaning, the amount of Bitcoin that has not been mined is very limited and the coin that has been circulating will be more valuable along with the reduced new stock of Bitcoin.

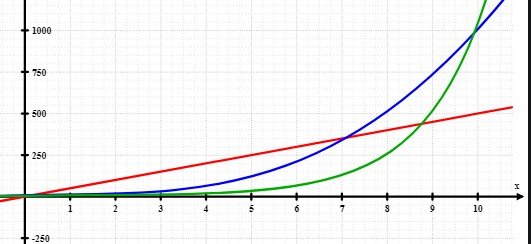

In addition, Bitcoin is also awarded in the Block and the reward is reduced by half in four years, the value of Bitcoin has the potential to increase over the period of time. 2013 and 2017 are the years in which Bitcoin mining rewards are reduced by half, and in that year also the value of Bitcoin has increased significantly.

The year 2021 is the next year where BTC will be deducted half and we will probably see the increase in value as the new BTC making will be increasingly difficult as well as fewer coins entered into the market. But it is speculated that BTC is still the most dominant cryptocurrency and no other cryptocurrency has more demand.

Both of these are also important factors in determining the value of other cryptocurrencies. For the unmined Altcoins for example, based on the supply of coins circulating until the total ratio of the Coinvestor supply can determine how much coin is likely to be dumped on the market by the coin's development team. If the number is too large, the coin-coin has the potential to decrease the price due to excess supply.

Conversely, if it is too low means a coin is growing popular and it is likely that the price will go up with increasing demand but insufficient availability. It is actually a nicer formula to determine the potential of a cryptocurrency than another because it cannot be manipulated.