🔥What to Expect for Bitcoin, Ethereum, and BNB in August?

🔥Monthly Crypto Report : July Volatility Nears the Close – What to Expect for Bitcoin, Ethereum, and BNB in August?

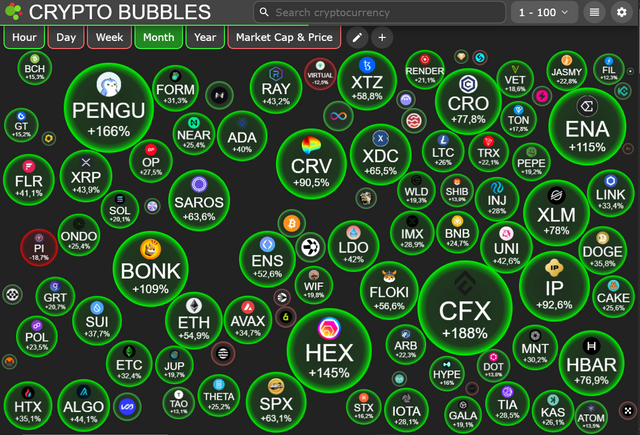

📉 Market Performance Snapshot – July 2025 (As of July 29)

🧭 Introduction

The crypto market in July 2025 was nothing short of turbulent. As we approach the monthly close, digital assets are showing signs of institutional recalibration, with volatility painting a clearer picture for professionals watching closely.

This report dives deep into the technical structure and fundamental drivers behind the price action of Bitcoin (BTC ), Ethereum (ETH ), and Binance Coin (BNB) — with bold predictions for August.

📉 Market Performance Snapshot – July 2025 (As of July 29)

🔶 Bitcoin (BTC)

$BTC

Open: $107,146.51

High: $123,218.00

Low: $105,100.19

Current Price: $117,778

🔷 Ethereum (ETH )

$ETH

Open: $2,485.47

High: $3,941.00

Low: $2,373.00

Current Price: $3,357

🔸 Binance Coin (BNB )

$BNB

Open: $656.90

High: $861.10

Low: $643.71

Current Price: $812.19

🔬 Professional Technical Analysis – July 2025

✅ Bitcoin (BTC )

$BTC

🔍 Technical Outlook:

Currently up nearly +9.9% for the month.

Strong recovery from the 105K demand zone signaled large institutional interest.

Trading above the 20-Month and 50-Week EMAs – indicating structural bullishness.

RSI (Monthly): Around 67 – bullish momentum, close to overbought.

MACD: Still positive on weekly charts, histogram expanding bullishly.

📈 Key Levels for August:

Support: $111,000 – $113,000

Resistance: $124,000 – $128,500

If BTC closes July above $118K → Targets for August extend to $130K – $135K.

✅ Ethereum (ETH )

$ETH

🔍 Technical Outlook:

An impressive +35% rally from monthly open.

Key breakout above descending channel on weekly chart.

Retested and confirmed the 50-day EMA as new support.

RSI: Sits at 63 on monthly – bullish but sustainable.

Volume confirms the strength behind buying pressure.

📈 Key Levels for August:

Support: $3,000 – $3,200

Resistance: $3,900 – $4,200

A monthly close above $3,400 would position ETH for a strong August breakout.

✅ Binance Coin (BNB )

$BNB

🔍 Technical Outlook:

Trading +23.6% above the monthly open.

Hit a new All-Time High at $861.10, facing psychological resistance.

Above both 20 & 50 EMAs on all major timeframes.

MACD: Showing early signs of deceleration – suggests possible correction in early August.

📈 Key Levels for August:

Support: $770 – $790

Resistance: $880 – $920

Sustaining above $800 could fuel a leg up towards $900+.

🧨 Why Did July Become So Volatile?

Macroeconomic Uncertainty:

Mixed U.S. inflation data (CPI) created short-term confusion in institutional flows.

Federal Reserve speeches hinted at delayed rate cuts, fueling defensive trades.

Monthly Close Pressure:

Institutional players are actively pushing prices to close the monthly candles above key technical zones.

This is typical in the last 72 hours of monthly trading sessions.

Whale Activity:

Aggressive accumulation below 110K in mid-July, followed by structured profit-taking, amplified market swings.

📅 August 2025 Outlook – Are We Poised for a Breakout?

🔮 Bitcoin (BTC):$BTC

A monthly close above $118K → Probable target of $130K – $135K.

A breakdown below $112K in early August may trigger a retest of $105K.

General bias remains bullish if macro remains stable.

🔮 Ethereum (ETH):$ETH

A monthly close above $3,400 signals strength → August may push ETH to $4,200+.

Key level to hold : $3,000

Watch for strong L2 scaling news to boost sentiment.

🔮 BNB:$BNB

BNB looks ready to retest $900 once again if it maintains $800+ into the August open.

First support around $770 – a clean dip may offer re-entry for trend followers.

🧠 Expert Conclusion:

What we’re seeing in late July is not weakness, but a strategic accumulation phase driven by institutional logic.

Smart money wants monthly candles to reflect strength heading into Q3, and this week’s price action confirms that.

Do not chase pumps. Wait for retracements to key support zones and enter with precision.

"In trading, precision isn’t a luxury – it’s a requirement."

✍️ Written by a MasterSignalsPro – July 29, 2025 #crypto #signals #money #bitcoin