XRP: Is it really on the verge of a breakout?

XRP has been in a consolidation mode recently, while other cryptocurrencies have been volatile. However, there are some technical indicators that suggest a big price move could be coming soon.

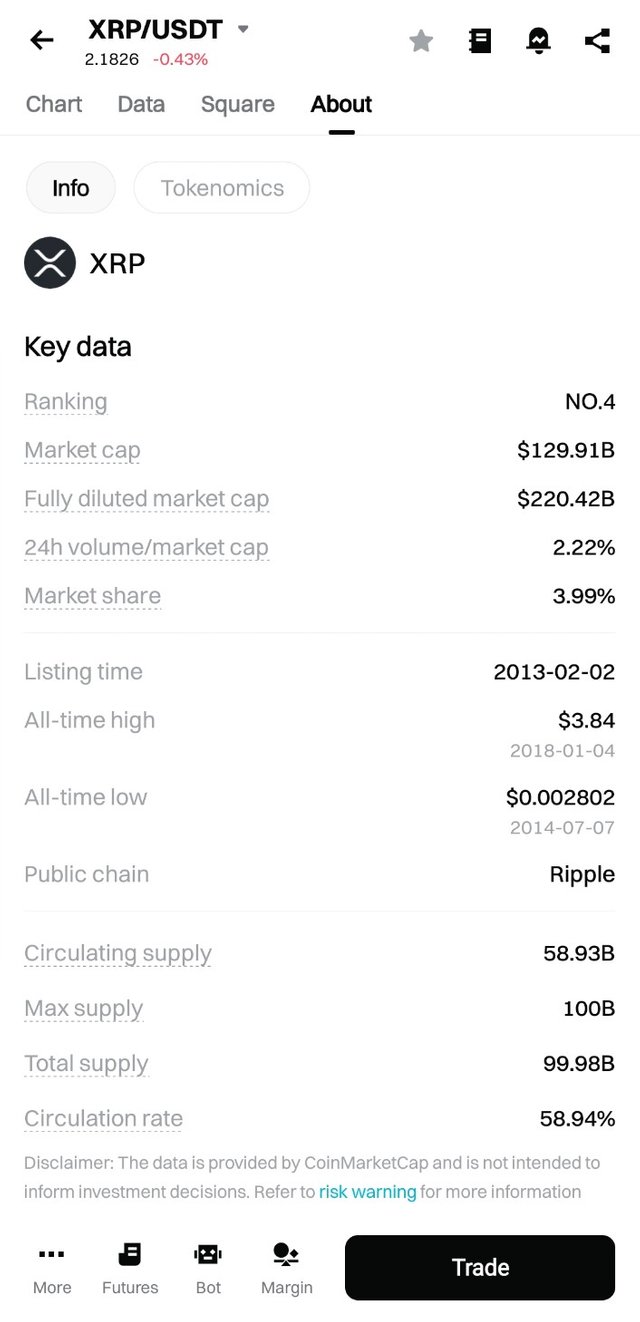

Photo source

XRP/USDT was trading in a descending channel on the daily chart, meaning the price was going down a bit and then up—but now it’s breaking out of it. It recently bounced back after sweeping sell-side liquidity below $2 and is now testing its 100-day moving average (cryptopotato.com).

The RSI is now around 50, which means the market is in a neutral state—no bullish, no bearish. But after a clear break above the 100- and 200-day SMAs, a major price break could be seen between $2.2–$2.4 (cryptopotato.com). And if the daily close is above $3, the real bullish trend could begin.

The same picture is seen for XRP/BTC versus BTC. A steep downward channel has been in place since March. The price is now near the lower limit, which is in a large Fair Value Gap (FVG) position—between 1,600–2,000 SAT, which could act as a new Demand Zone

In addition, the RSI is also down, but is turning slightly upward, indicating that the bearish force is decreasing slightly. If the price breaks above the channel and regains the 2,300 SAT resistance, there could be a positive price move. However, if it is lost, there is a possibility of a decline to the 1,500 SAT level.

USDT pair: Close above 100/200 SMA and Daily Close above $3.

BTC pair: Channel breakout and 2,300 SAT test.

Failure: USDT pair $1.95–$2.00 support break likely to collapse; BTC pair likely to fall below 1,600 SAT.

XRP is in a Danger Zone for the short and medium term, where there is doubt about whether a major price move will come in the middle.

Some analysts believe that the Doji or RSI collapse is an early indication of a sustained uptrend.

However, by not controlling the mobile phone, you can avoid losses most of the time by holding small positions.

XRP is now in a really confusing situation, where “stay silent or strike now” are the two choices.

If it catches fire, it will open the way to profit,

If it fails again, it will bring a recession.

My advice as a small trader—Keep in touch with the stream, RSI, volume, and be careful with support-resistance points.Keep Risk Management—Stop-Loss, with the target set.Because XRP can be the opportunity for a big price swing like the next time.

Will XRP really break its stride, or will it move away again only time will tell. At this moment, we should only watch, prepare, and focus on controlling our positions.

My x link

Upvoted! Thank you for supporting witness @jswit.

Hi @mamun123456,

You should set 10% beneficiaries for @tron-fan-club. It's a mandatory rule of TFC.

Thanks.

Ok brother next time I follow , thank you for informing.