Inside the Market Manipulator’s Game

The market is a living thing, a restless beast shaped not by rigid rules or predictable patterns, but by the hands of those who move it and bend it to their will. For a trader working at home, at any stage of profession and skill, using chart indicators is like using broken compasses in a storm. Profit doesn’t come from following the obvious; it comes from stepping into the shoes of the operator, who actually makes something out of market chaos.

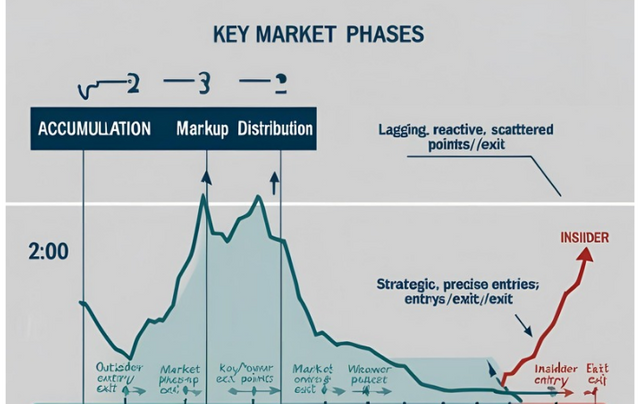

Empathy with Insiders

The only way to thrive as an outside trader is to watch and play the proposition from the standpoint of the insider angle, standing “on the ground floor with the insiders,” who influence prices. Reason out what you would do if you were in their place. Psychologically, they have a timing advantage. Over time, they get a bird’s-eye view, seeing the big picture from as many angles as possible and capable of acting at any stage. Like an artist with no time and no words, they just feel “at one.”

It’s a mistake to think the market is a war between institutional and retail players or that all movements are orchestrated by a single entity. However, it’s important to know whether large operators, inside interests, a pool, or the public dominate the market. Sometimes it’s scientific to go with the crowd; at other times, it’s scientific to go against it. The only way to decide is by analyzing the behavior of the chart to determine which side has the most money and control.

Do not focus on determining the intent of a particular order, but rather identify the most relevant trading zones. Look for the entry of large traders with the intention of taking risks and speculating on imbalances. You must visualize yourself buying low from panic sellers and selling to the laggards.

The “interests” in banking pools and big operators change according to market conditions. The market is continually put to the test by these traders, and therefore, for us too, flexibility is essential.

Also, anyone operating in the market is on the watch for conditions that might lead to a panic. They’re always alert to ferret out a weak spot, for they love the short side. Lack of support, if detected, generally leads to a raid, which produces a reaction or a slump all around. Likewise, if they find a vulnerable short interest, they’re quick to bid up a stock and drive the shorts to cover. In any case, they disclose their anticipation of advances or declines through their purchases or sales, which is the only reliable indicator.

The Operator’s Profit Window

As a rule, the large operator does not go into a campaign unless he sees a movement of 10 to 50 points. The manipulator must work with a large block of assets, or the risk and expense of the deal won’t be worth his time. They have only so much time and capital, and this must be employed where it yields the greatest results.

Companies engage manipulators to make a big market and distribute their shares to the public. The subject of manipulation is the forces that artificially alter the course of prices through various swings—whether to buy or sell without advancing, to mark the price up or down, or to discourage others.

Evidence

Reading the Small Waves

The small waves, which run for mere minutes, are caused largely by the restlessness of active professional traders. As a result of these struggles, the market reaches a position where operators uncover vital weaknesses or strengths. When a campaign period is nearly complete, a study of the small waves will usually disclose the imminence of a trend.

The Volume Tell

Volumes are least liable to mislead when manipulation prevails, for the manipulator is obliged to deal in large blocks. The trained ear can detect the steady “chomp, chomp.” What’s known as the “Yao Ming Bar” is the participation of large traders, identified by an increase in volume. Also, heavy liquidation without any apparent reason indicates that “somebody knows something.” The sudden activity, volume, and advancing tendency give notice to get aboard. This is why tracking smart money wallets in crypto is a powerful tool to understand trading strategies. By the way, to distinguish the genuine from the fictitious move, watch for abnormally large volumes within a small radius. A small price advance on large volume with high volatility is the smart money moving counter to the trend.

Decoding Price Action

Price action usually indicates the character, methods, and ability of those who operate heaviest in it. You must care as much about what they do as what they don’t do at critical points. However, random fluctuations should be ignored, as there’s probably no professional interest behind that market.

Method

Operation

The Manipulator’s Mirror

The whole game appears to be inducing the public to do the opposite of what the manipulators wish to do. Time, patience, and risk-taking are their magic; they play on a higher time frame and leaving small players lost in the dust. They fail in many little games until the table turns, and they start winning the bigger game. The advantage of the operator is their ability to buy low, letting them play their hands against the crowd. They always have money to buy on declines because they sell on the rallies.

Manipulation never fits a simple or obvious structure. Like in a scenario, manipulators strive to confuse the public for an ultimate purpose, influencing them to think the opposite. The operator disguises his operation to look like accumulation when he’s distributing—but only to a certain point. They can sell heavily in a green candle and buy huge amounts in a red candle—climactic buying or selling to deceive the market, then steady buying or selling back to their plan. Or they split a large limit order into smaller portions using programmed algorithms without turning the price. They buy under cover and deliver to another party. Imagine a scenario where two brokers are placed in the crowd—one to depress the stock, the other to accumulate it. They play into each other’s hands, and the tape reports what happens.

They work on the public’s ignorance, encouraging them to think for themselves instead of relying on ready-made opinions. There’s a definite number of rocks and only two pans. The operator knows exactly how much weight everyone has, so by putting more rocks on his favorite side, he bends the trend to his interest.

The Accumulation Trap

In accumulation, they mark down the price, spread bear rumors, and try to shake out or tire the outsiders until they sell. To depress a stock, they sell more than there’s demand for, or they coax or frighten other holders. They shake out their followers because those followers might sell at the wrong time and cause an embarrassing situation. As Jay Gould said, “Your followers often cause you more trouble than your opponents.” Thus, to avoid a disastrous break, they’ll provide support if weakness breaks out anywhere. Like a good general, he’s always endeavoring to hold his lines against attack and advance his front lines as far as he can.

In a maneuver, they close their position and short to cover at lower prices, then take a long position. They squeeze the public out by dragging the market into a dull, weak slog for weeks, bleeding hope dry, so nobody can make money, and discouraging people finally closing their positions. In other words, he first shakes them out, then tires them out.

They accumulate an asset without advancing its price; then, when market conditions are favorable, they bid it up. If the operator has bought all the stock he wants, it will go up. If not, he’ll back it down again. Vice versa. When insiders shake other people out, it means they want the stock themselves—usually a good time for us to get in.

The Unload Play

The big fellows prefer to let outsiders in when it serves their purpose best—namely, in marking up and distributing. They unload holdings when the danger is past and conditions are more favorable. The public comes in after the move has started and forces prices high enough to permit them to unload.

When they intend to unload a line at 80, they push it to 120 and then sell it back to par. Selling at 70 with a ten-point rise wouldn’t attract much of a following, while a 50-point rise attracts an enormous one. People think themselves shrewd because at 80 or par, the stock looks cheap compared to 120.

It’s a famous phrase on Wall Street: “If you want to get them to buy, all you have to do is advance the market, and they’ll come in on the bulges.” Large volume, transactions, and great activity make the ordinary trader intensely bullish, and they bite off a lot of assets at the top of the market.

News vs. Action

Insiders tend to buy on bad news and sell on good news. If the operator knows of a favorable announcement coming in the next few days, his operations will be timed so the rise culminates around that time, letting the stock sell at its highest price. When they wish to distribute, prices are artificially stimulated, and glowing reports are spread broadcast. He’ll run the price up on that day and close it at the highest point it’s touched in the whole campaign, with great activity and large trading volume. This isn’t mere accident—the whole move is manufactured. They stimulate the public through the news until the laggard buyers or sellers exhaust the trend.

Orientation

Insiders may pull out all their orders to see what the stock does if left to itself, or initiate an action to test whether it triggers the public’s emotions of greed and fear. Manipulators constantly test the market to see whether it’s most responsive on the bull or bear side—to see how easily they can buy it or, by selling a similar quantity, how well the market will absorb it. If they find others trying to buy and the stock is scarce, they regard it as a bullish indication. If the price yields easily to pressure, they see it as bearish and take a short position.

Conclusion

So there it is—the market’s a beast, and the operator’s the one holding the reins. They don’t play by your rules or mine; they write their own, testing the crowd, bending the tape, and pocketing the difference. You can’t outsmart them with a textbook or a lagging signal. You’ve got to feel the pulse—watch the waves, the volume, the silences—and move when they move. Now the question is: when the next raid hits, will you be the one buying the panic or the one selling the bulge?

If this piece hit you—or didn’t—drop a line below. I’m leaning on some old-school Wyckoff ideas here. Curious what you think about how it plays in today’s game.