RE: Here's why Steem's witnesses should start paying SBD interest - today

You should establish some parameters for what you would consider enough of an experiment to conclude that this idea doesn't have the effects you hypothesize

I would argue that each witness should define the parameters of the experiment for their own project, and yes, stopping conditions should be included.

I'd say they should focus on three things: (i) SBD conversions, since that's the primary variable that we're trying to minimize; (ii) STEEM price; and (iii) Unintended/unanticipated consequences. A hoped-for secondary effect would also be the reduction of delegation-driven low-value content, so they might want to also do some monitoring of delegations, powerdowns, and post volume & quality.

Thus, I guess the main stopping condition would be if the SBD to STEEM conversions increase by some amount for a sustained period of time. (how much and how long need to be defined, but it should take the powerdown cycle into account.).

Also, the STEEM price, as you allude to here:

if you're imagining lots of SP getting powered down and sold to buy SBDs, are you factoring the price effects of that into your projections?

We can potentially expect some short term effect on price (STEEM down, SBDs up). The goal should be finding an interest rate that encourages an orderly conversion, not a shock. By harnessing this uncertainty effect:

Returns from SBD interest depend on witness choices which could potentially change arbitrarily with no predictable timing,

Long term, I think migration of investor value from SP to SBD is a positive for the STEEM price, but the transition will apply short-term downward pressure, so the rate needs to be managed.

If the STEEM price falls too much, too fast, then interest rates should be reduced.

Finally, there may be other effects that are unintended or unanticipated, so it's important to observe carefully and update the terms as the experiment moves forward. In January, we had no idea that conversions would effect inflation the way that they do. There may be similar unanticipated effects from activating SBD interest.

Ironically, I noticed that the SBD supply has already stopped shrinking for the last few days. Is that because we finally soaked up the excess liquidity, or is it because people paused their conversions when I posted this article?

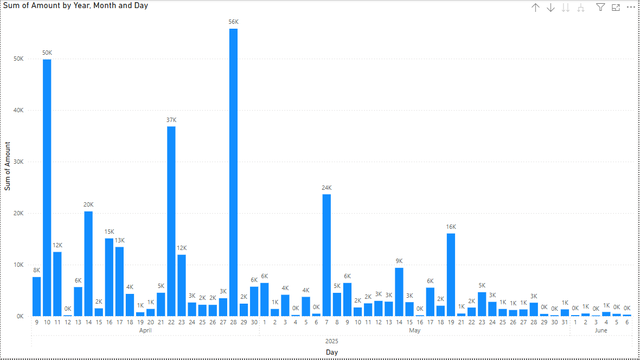

To be fair, I tried a different way of looking at the data today, and it suggests the inflation problem has finally solved itself without intervention. Here are SBD conversions in the last month:

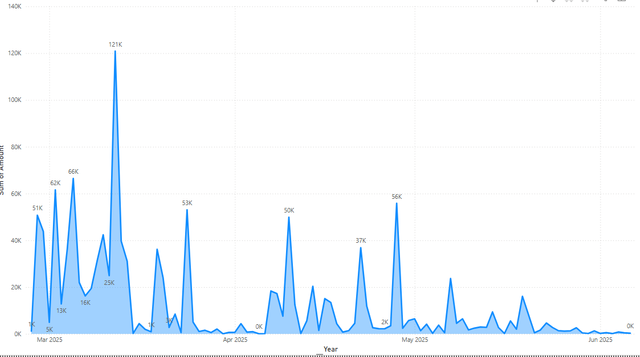

And here they are longer term:

I still think it's worth trying an experiment with interest to see what sort of effect SBD interest payments would have on investors' junk-posting behavior, but it's probably not quite as urgent as I thought it was when I posted this article.

I do not understand why you are opposed to SBD conversions. SBD conversions are the correct and proper mechanism for getting excess SBDs out of the ecosystem.

It's not clear to me what counts as "excess" liquidity, but I believe the internal market was drying up for at least several days before your post. I doubt the people who have the ability to have a big impact on what SBDs are in which markets pay much attention to the social media aspect of the chain.

In general, I'm not opposed to SBD conversions. Reducing debt is generally a good thing. I am only opposed to them when they're doubling (or more) the blockchain's inflation rate, which devalues the STEEM token. That's what they were doing from February until June. As the graphs above show, that seems to have ended within the last week, but I hadn't realized it when I posted the top-level article.

I agree that the timing was probably coincidental. It looks like the SBD supply minimum occurred on June 1, two days before I posted. When I posted on June 3, data was only available through June 2, and it wasn't obvious that it might have turned a corner.