Steemit Crypto Academy S2 W3 | JustLend by @theopportunist

JustLend

Brief overview

The normal way of finance is not all encompassing, that is, it does not cater to millions of people who are left out of the traditional financial system. Another important thing is that it is based on the centralised system of protocol, where users lack control over their finances, terms are dictated to them, payment of high fees, lack of transarency as users don't know what going on behind the scene, and it is prone to server and thus banking failure.

Some banking products and services come onboard and was regarded as Decentralised Finance (DeFi), and it had a meteoric rise in mid 2020. Yet, even them had some areas that needs to be looked upon and inovations brought about.

One of the most popular DeFi products are the Lending and Supply protocols. And most of these DeFi products run on the Ethereum blockchain where you have to pay high gas fees.

Imagine a DeFi product that cannot facilitate small loans due to high network fees on the Ethereum blockchain.

This is where JustLend comes in handy. JustLend is a money market which runs on a Tron network, powered by a smart contract, the brings about two pools: Supply pool and Borrow pool, where the dynamic interest rate is defined. The user who borrows pay a floating interest rate, while the user who supplies the pool earns a dynamic interest rate.

There are 9 different pool markets found in JustLend, they include:

Tron

Tether USD

Bitcoin

Ethereum

SUN

JUST

JUST Stablecoin

Wrapped BTT

WINK

Market with the best Supply APY

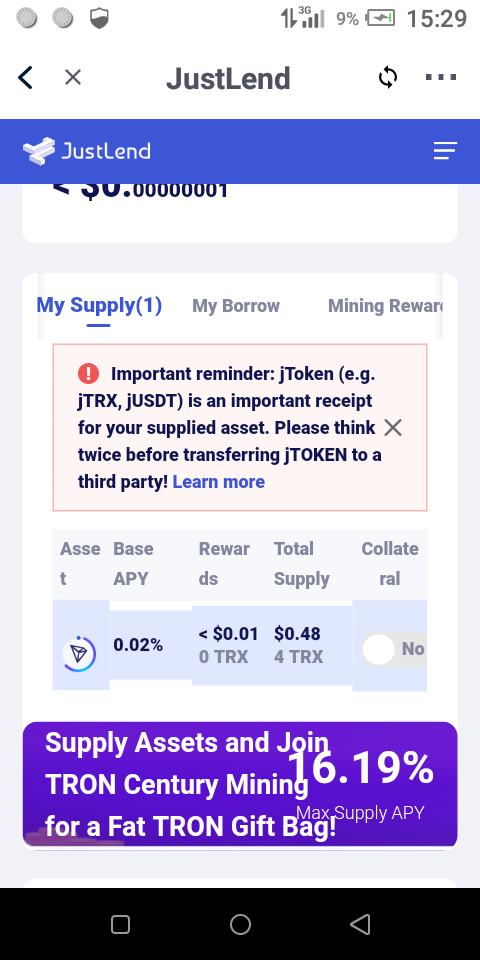

As at the time of writing, the best supply APY is both the SUN and WINK market with 16.19% each.

Market with the lowest Borrow APY

If the demand for a specific market is higher, then the Borrow APY is Higher.

Therefore the market with the lowest Borrow APY at the time of writing is the JUST market.

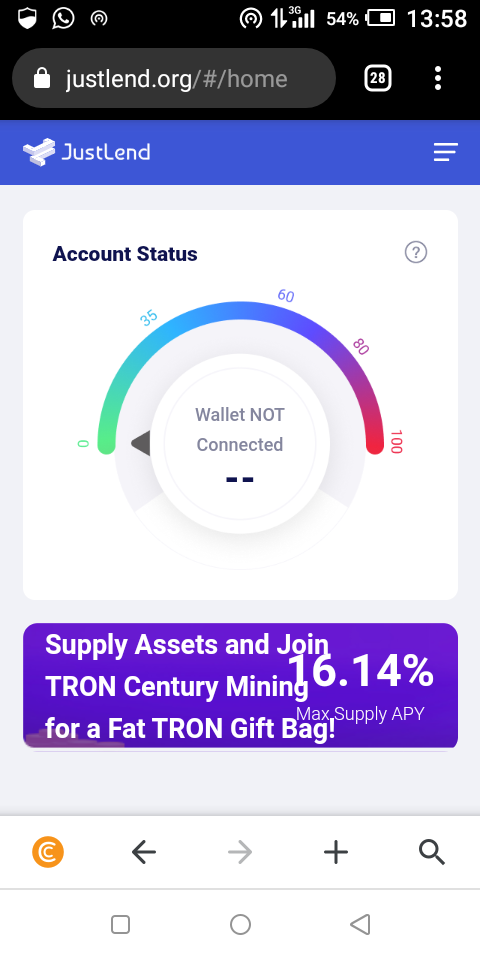

I tried to use my laptop system to connect my Tronlink Wallet to JustLend, but it kept on showing this display. When I read it, I saw I had to go to my Tronlink Wallet app to confirm the request, I couldn't find my way around it.

I also used my phone with the Tronlink Wallet app and the JustLend site on my browser. I still got the same result. I couldn't find any way to confirm the request.

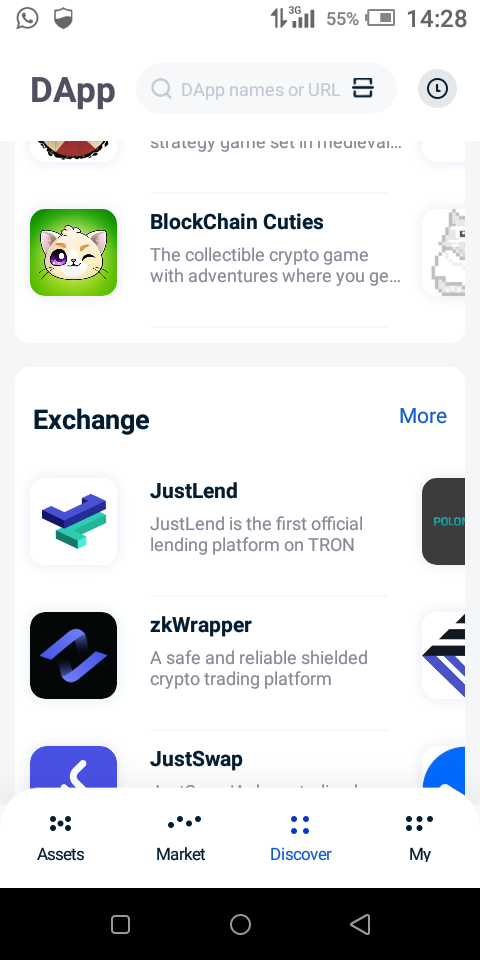

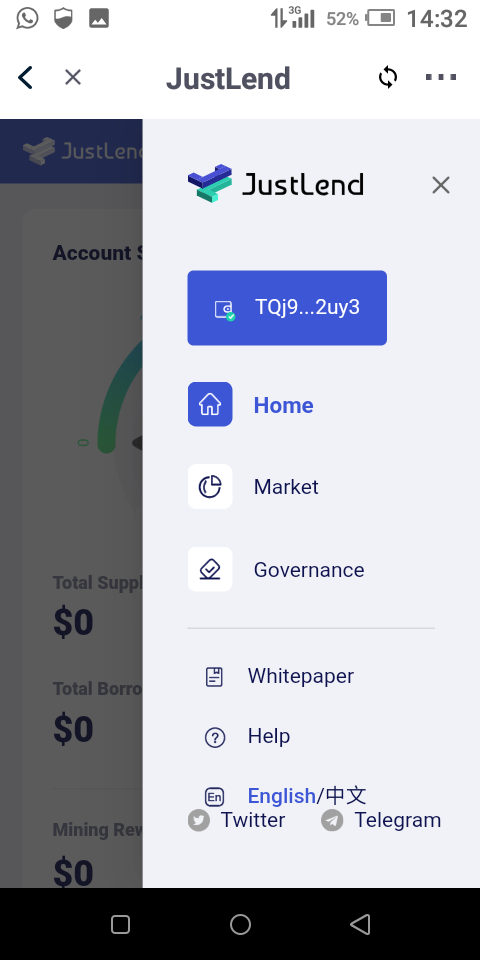

Then I navigated through the Tronlink Wallet app to see if I could get a clue. Luckily I stumbled on the discover label, at the bottom of the app. Then I clicked on it and it took me directly to JustLend with my Tronlink Wallet connected.

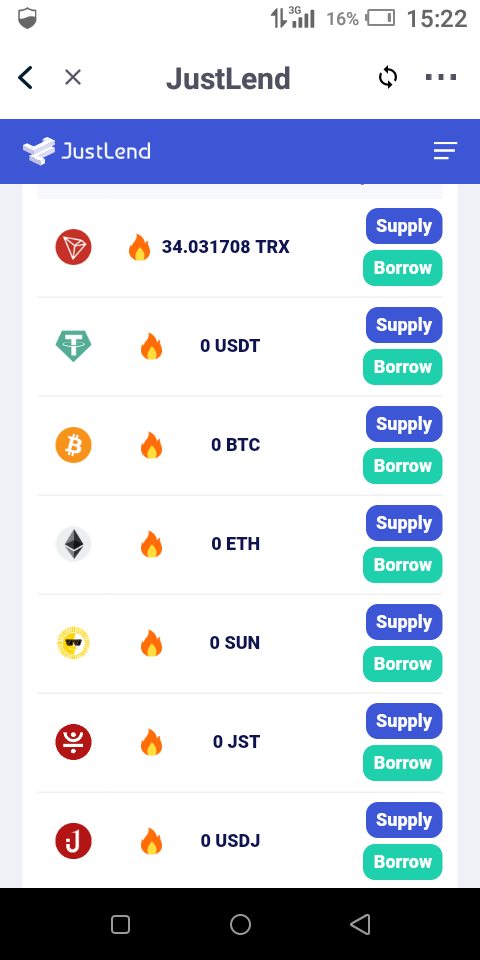

On the home page, you would see all the markets with supply and borrow besides it. Also you would see the amount you have in your wallet depending on how you connect your wallet to JustLend. I connect my Tronlink Wallet to JustLend which had some TRX in it.

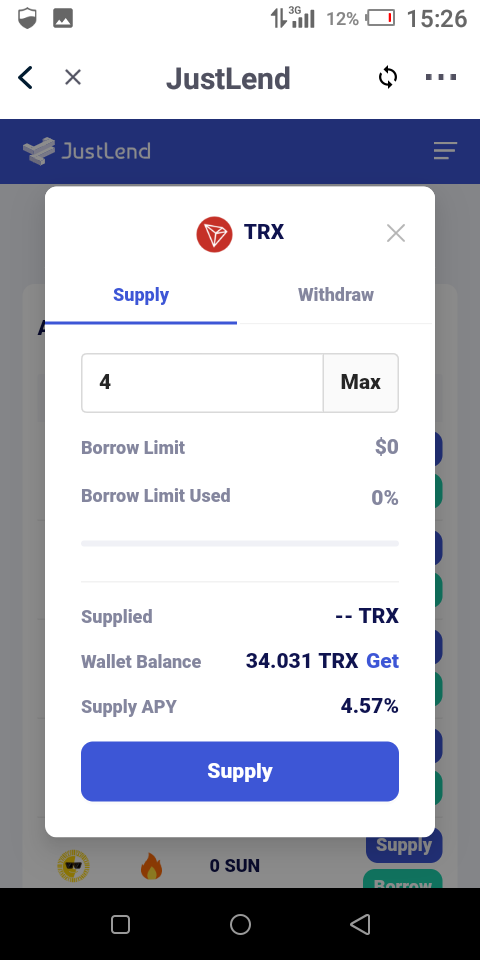

Click on supply and a page showing details of how much you want to supply will pop up. Other details necessary for the deal are included too.

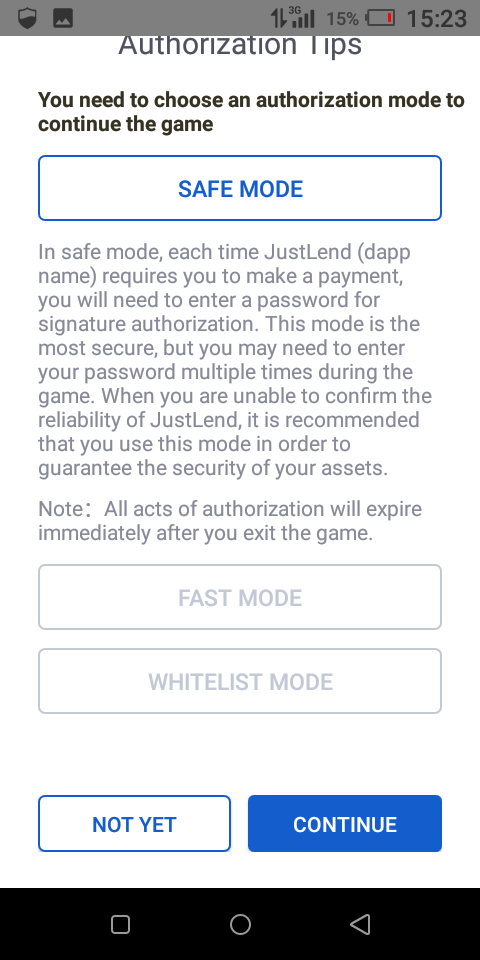

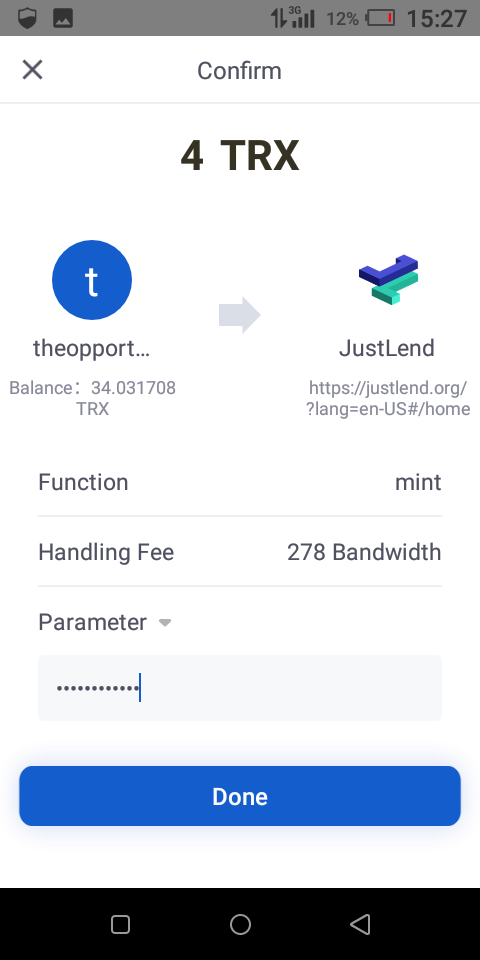

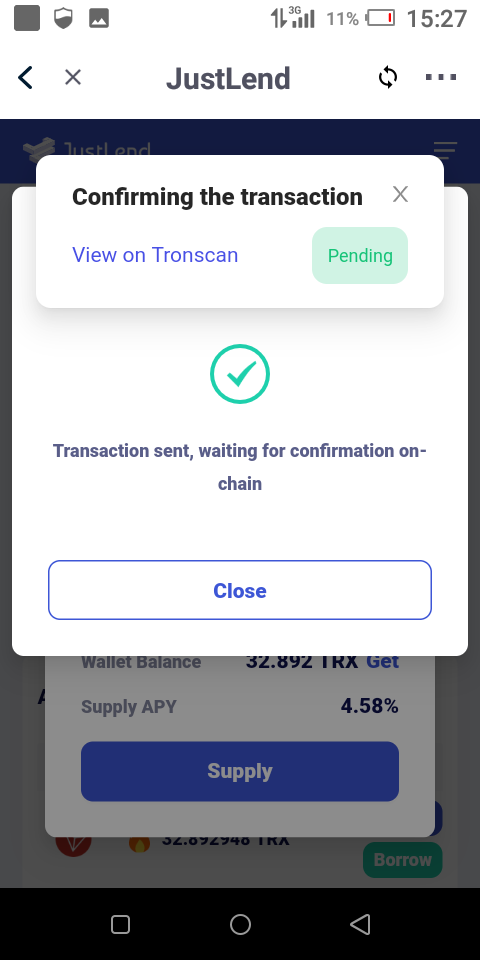

When you are done imputing the necessary details click on the supply button below. First It would take you to this page where you have to indicate what mode you are operating your account from, then to the page where you have to confirm transaction and then fill in your wallet password. After that you click done.

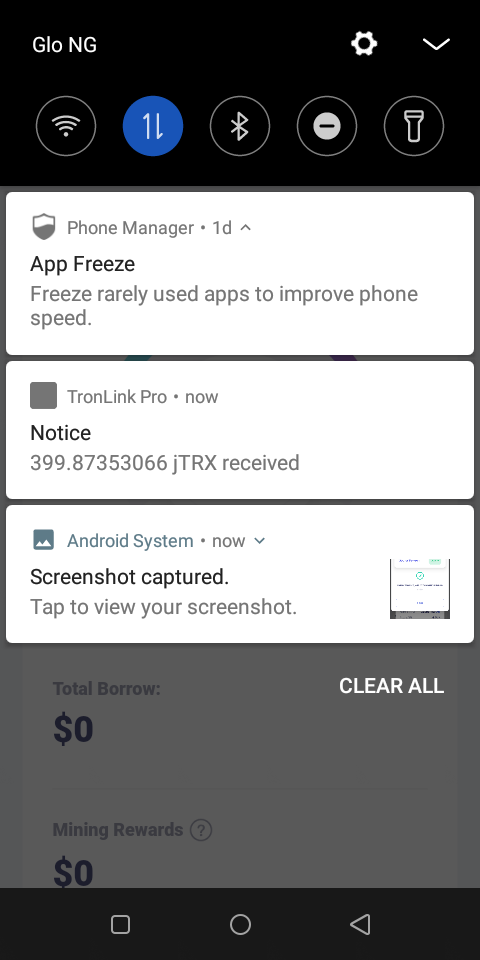

I received this notification which confirms that the supply transaction was successful. And my jTRX tokens received.

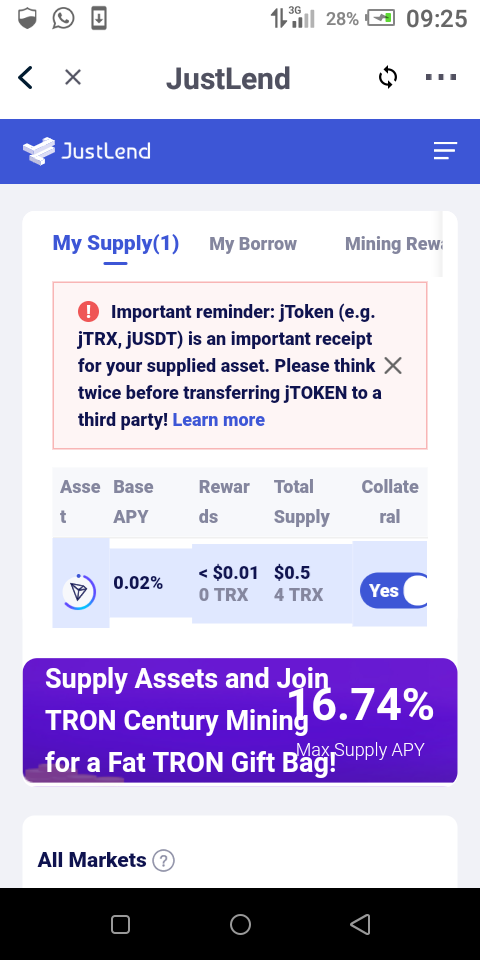

On the home page on the in the JustLend site, this display show that i have supplied to the TRX market pool and received jTRX as tokens.

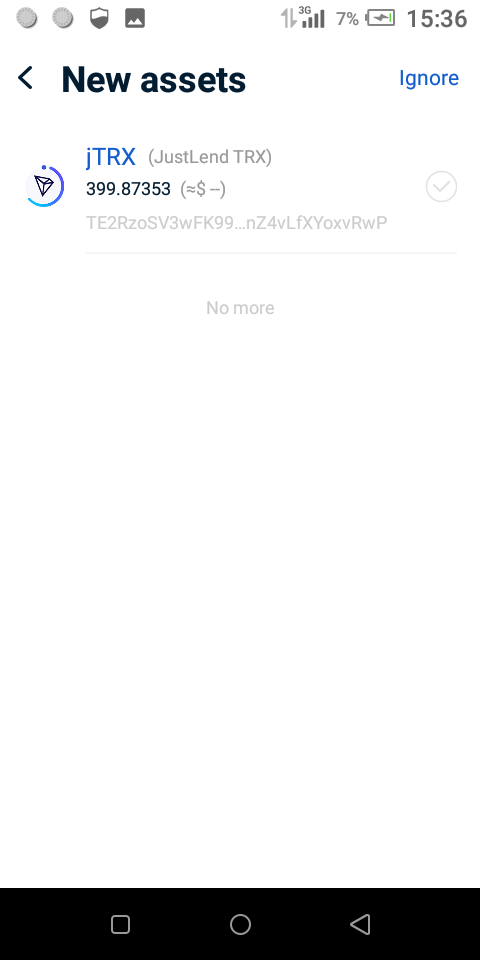

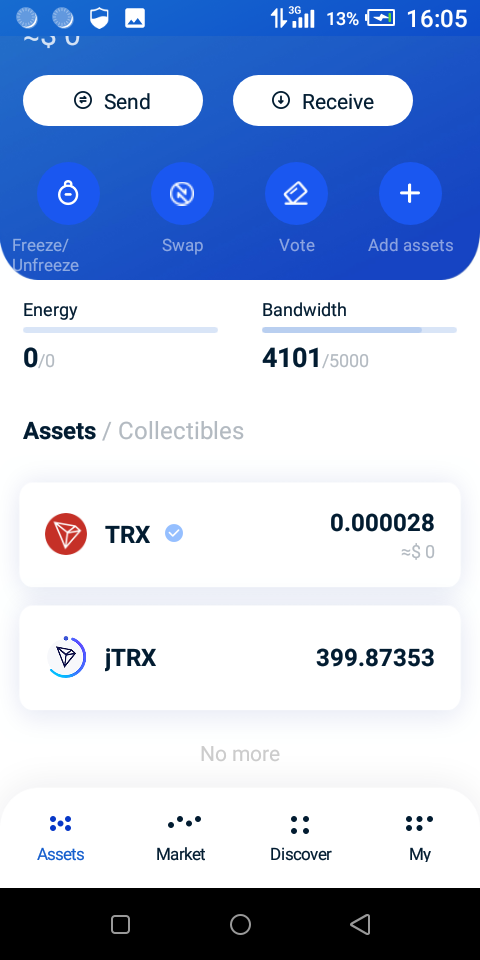

Then I received a notification in my Tronlink Wallet app that a new asset awaits me. So I clicked on it and added the new asset which is the jTRX token.

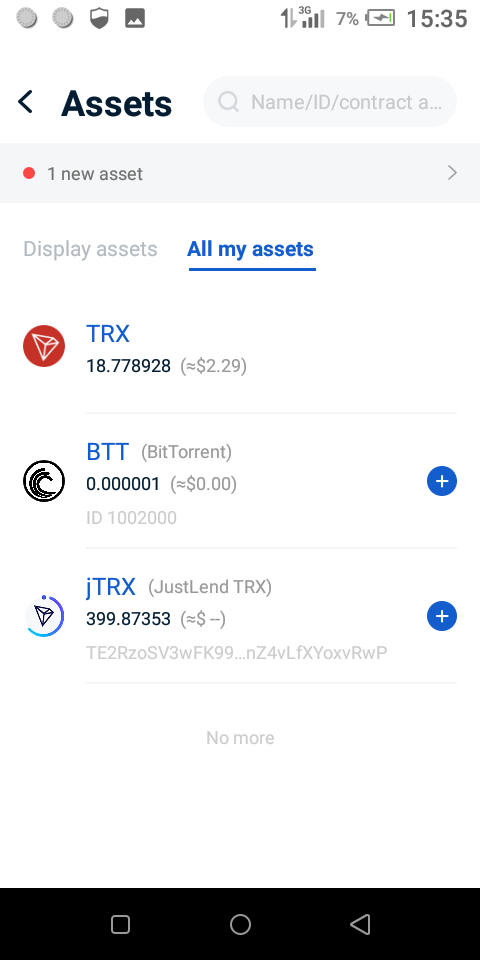

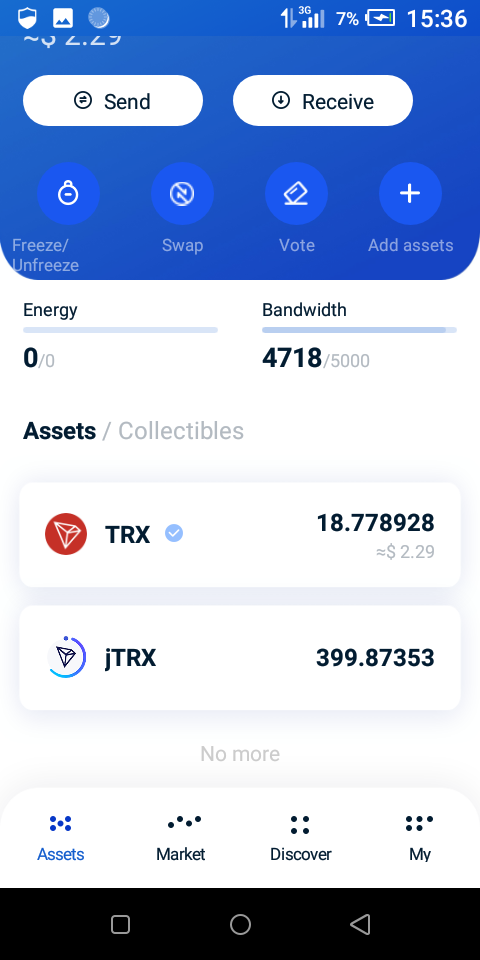

As I clicked on the add button the jTRX token became a part of my assets.

From the image above I was able to get jTRX tokens amounting to 399.87353

After you have supplied to the supply market and have been rewarded with jTokens. You would see a display of the transaction that has occurred. At the far right is a switch button which helps you to collateralize your jTokens, click on it.

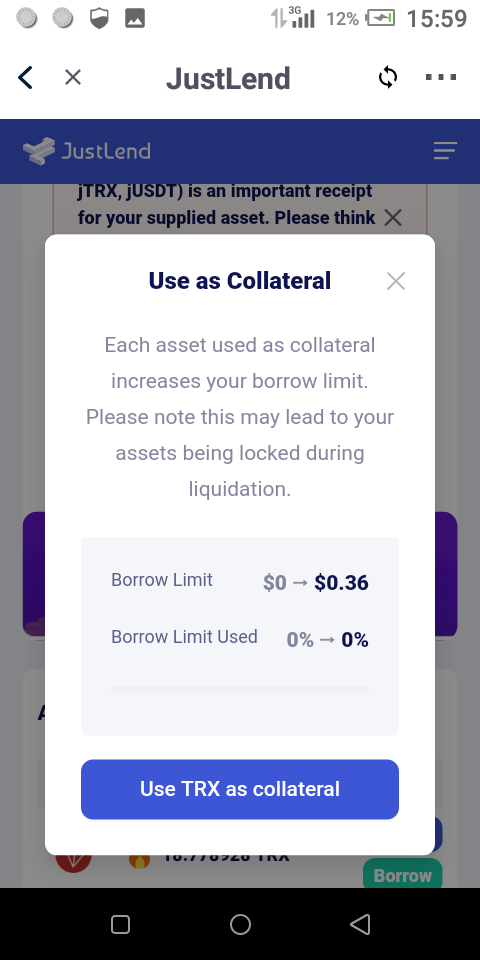

When you have done that a pop up display would come out, showing you your borrow limits and the borrow limits already used. At the time of writing mine was zero.

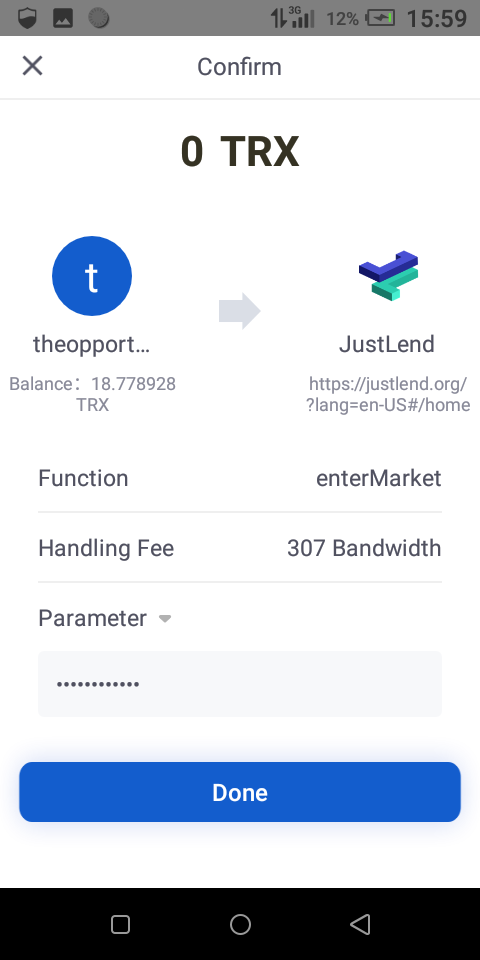

Click on use TRX as collateral, then it would take you to this page where you have to confirm the initiation, as well as input you password to go on with it.

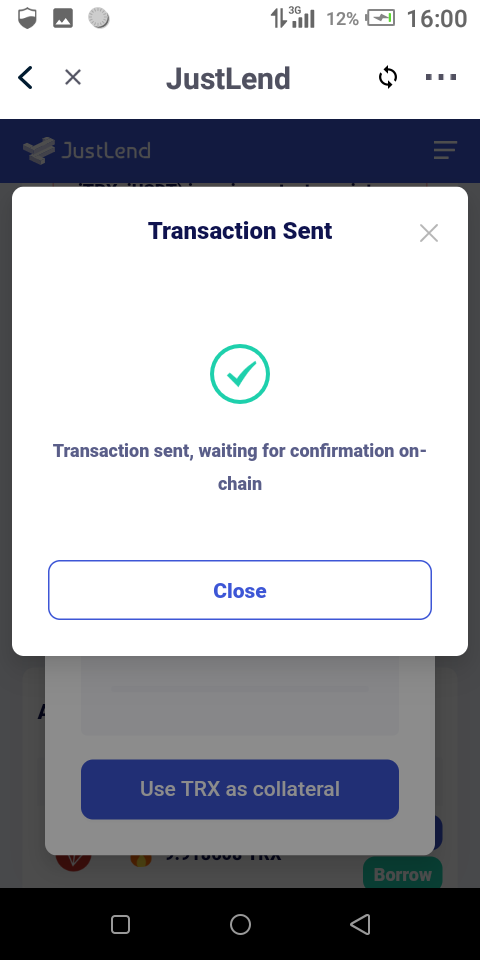

It would then show you the transaction processing.

Borrowing of funds

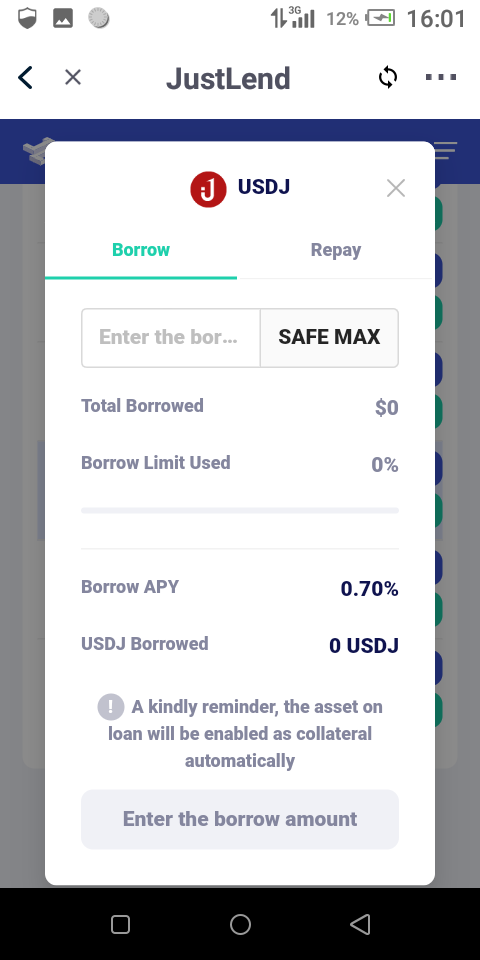

I tried to borrow from the USDJ pool market. I clicked on the borrow button on the USDJ market pool. Then it brought me to this display showing details such as borrow APY and USDJ borrowed.

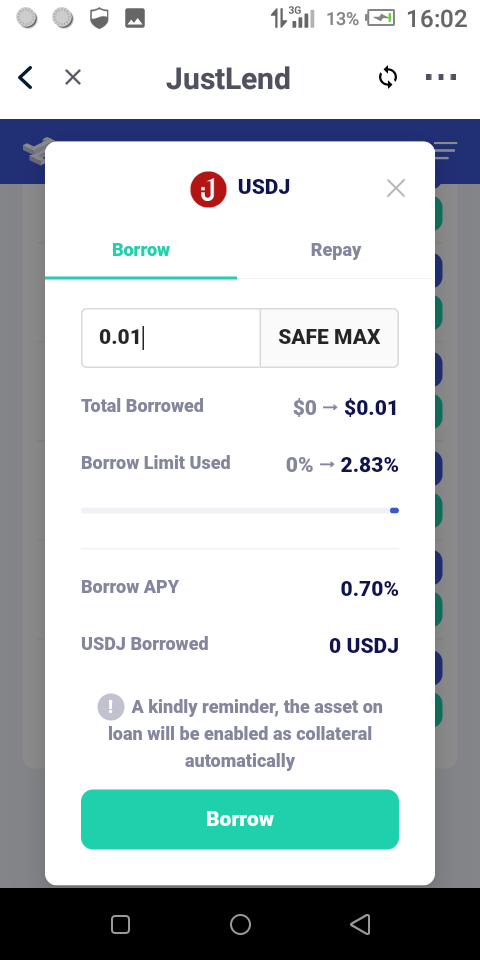

Then I inputted the amount I wanted to borrow from the USDJ pool market.

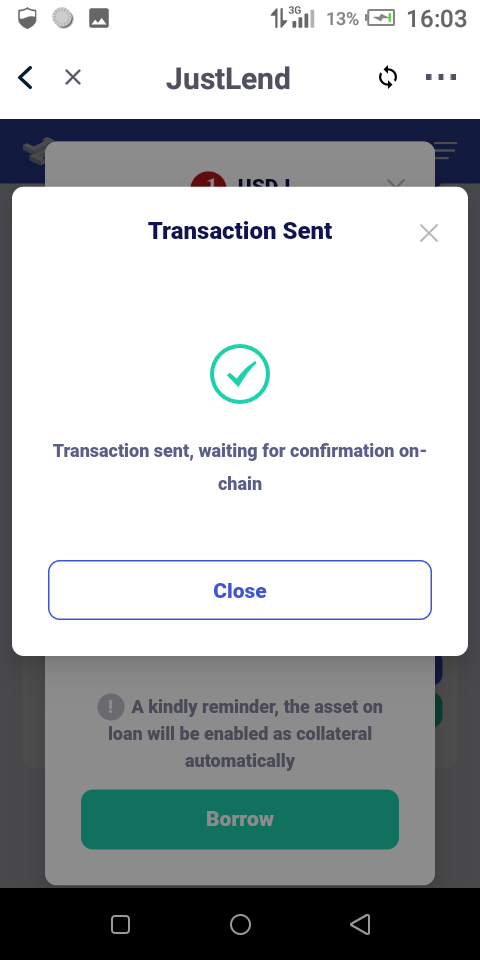

A confirmation of the transaction process went on.

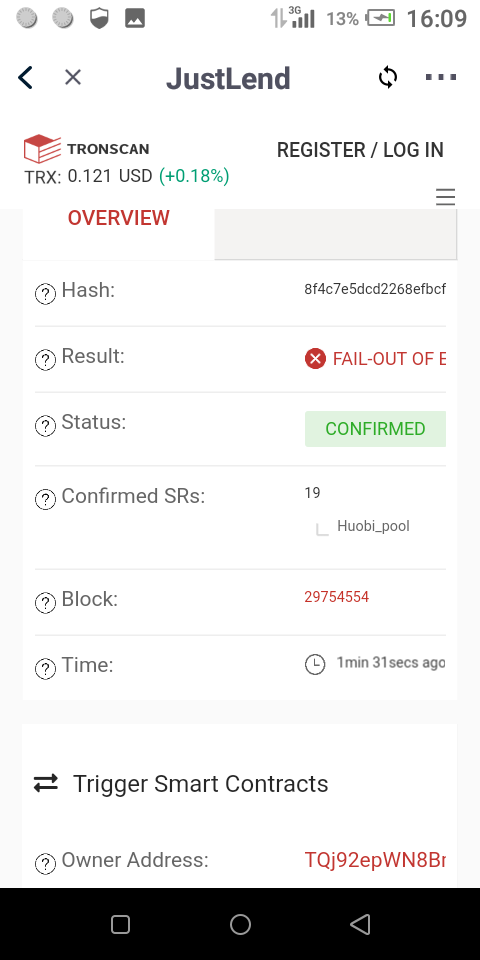

But unfortunately the borrowing transaction failed and the amount in my TRX balance got wiped out. I don't know what happened but still trying to figure it out.

Using the USDJ market pool when borrowing. Based on the Borrow APY, the interest I was going to pay is 0.70%.

This is the message I got due to the failure of the process of borrowing. Look at the part that part that said Result: Failed-out-Energy.

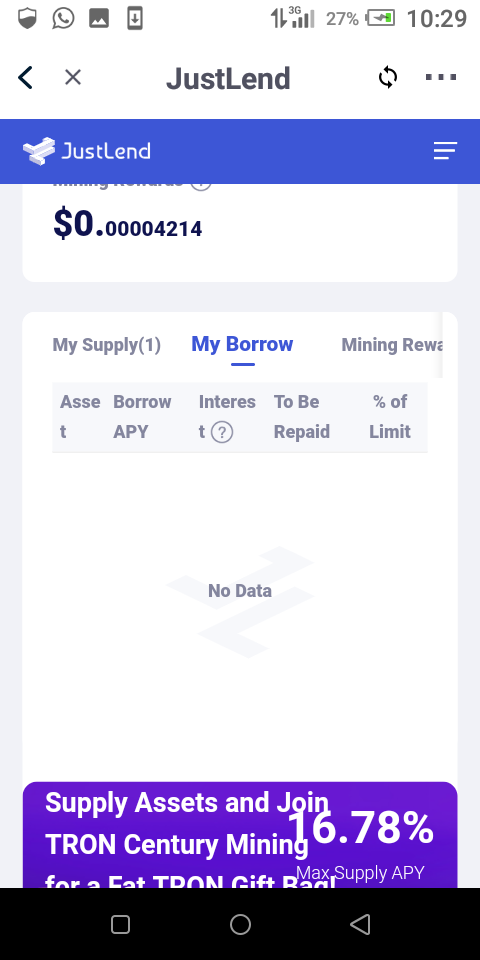

However to check how much you have to pay as interest and conditions for Liquidation, you have to click on the Borrow segment in the list below.

Net APY

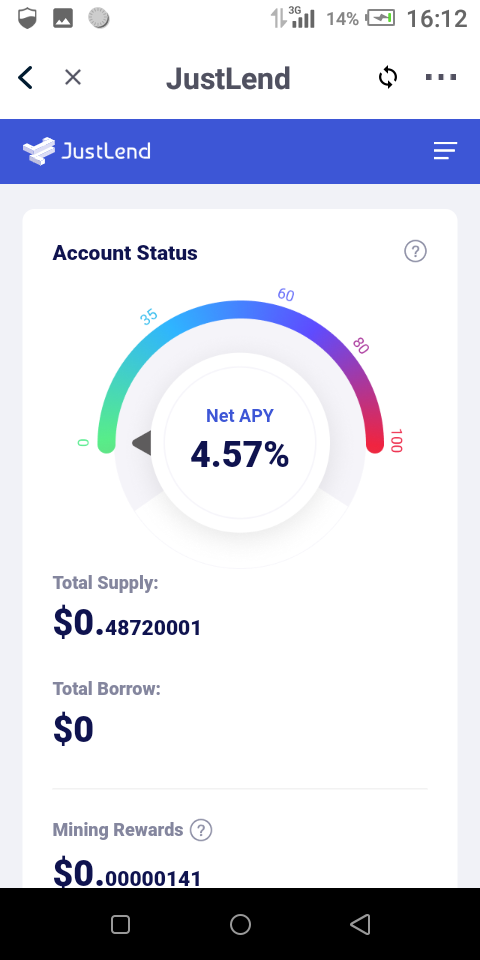

In my case net APY is 4.57%

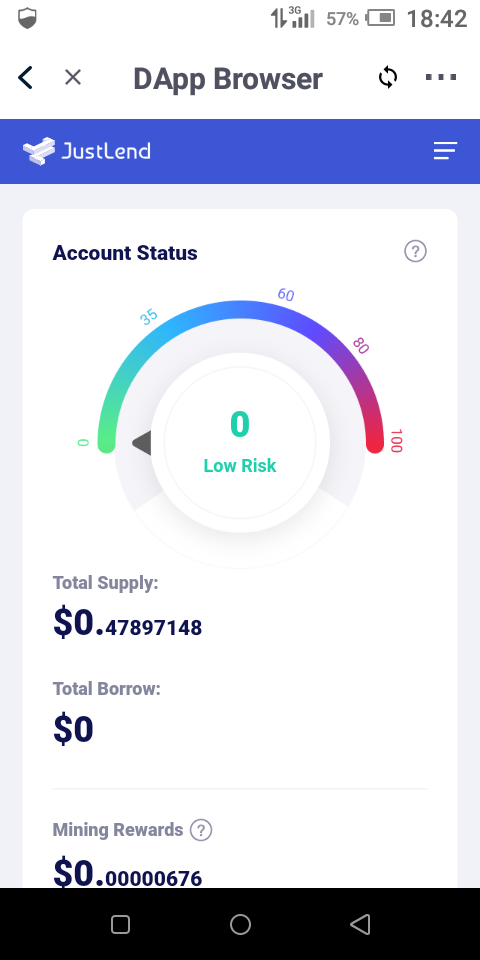

Status/Risk value

The status/risk value in my case is Zero, which serves as low risk.

Note:

- Couldn't do exercise six because of the failure results I get each time I try to borrow.

- All images are derived from JustLend.org unless otherwise stated.

Thank you @sapwood for this wonderful opportunity in doing this exercise

</div

Great Post my dear!

Participating in steemcryptoacademy isn't an easy task which I can do this 😔