Crypto Academy Season 4 [Advanced Course] week 2 // Homework for Professor @ kouba01: Crypto Trading with volume indicator by @janettyanez

.png)

Adaptation with Canva. Image Pixabay.com

Introduction:

The volume indicator is undoubtedly an excellent tool that can assist in the identification and interpretation of important signals and data that contribute significantly to the operations of the crypto market.

Among the objectives of this publication are the understanding and mastery of the multiple uses, benefits and information provided by the volume indicator in operations within the cryptocurrency market.

1. Explain the volume indicator in your own words.

In this sense, the volume indicator is a very useful tool that allows identifying the necessary signals to carry out activities in the cryptocurrency market in a timely manner, by identifying the price trend in the market.

It is important to note that this indicator takes into account, in addition to the price of the asset, other relevant data about it, allowing traders to predict through their behavior an emerging price trend or a sudden drop, which may be indicative of the completion of a trend and / or its reversal.

Likewise, there are other indicators based on volume that associated with this indicator can provide vital tools for achieving satisfactory experiences in this market, such as: the Money Flow Index (MFI), OBV, Levels by volume, Money Flow Index, Blai5 Koncorde, Chaikin Money Flow (CMF) and Volume Weighted Average Price (VWAP).

Likewise, through the volume indicator it allows us to know the degree of interest on an asset of investors during a period of time, this behavior often being affected by news or information provided by relevant public figures that directly influence it.

Finally, it is important to point out that graphically this indicator shows us through the size of the vertical green and red bars or columns, the level of investor activity; the green ones, the higher they are, the higher the level of negotiation has occurred in the time studied; as well as the red bars identify a lower level of negotiation of the asset.

Image 1: Screenshot Coingecko.com App

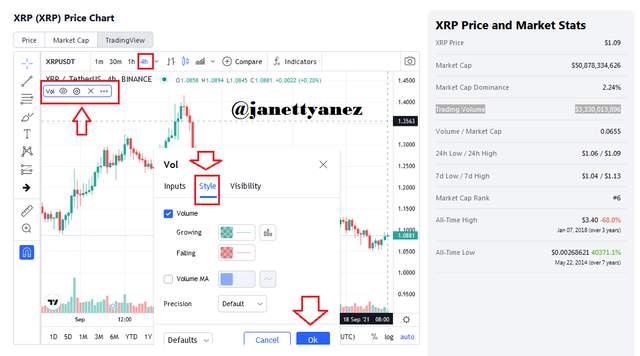

2. Use a platform other than Tradingview to present the volume indicator on a chart and show how to configure its parameters by justifying your choices. (Screenshot required)

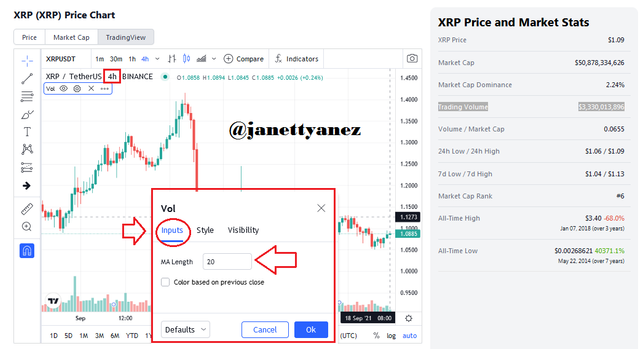

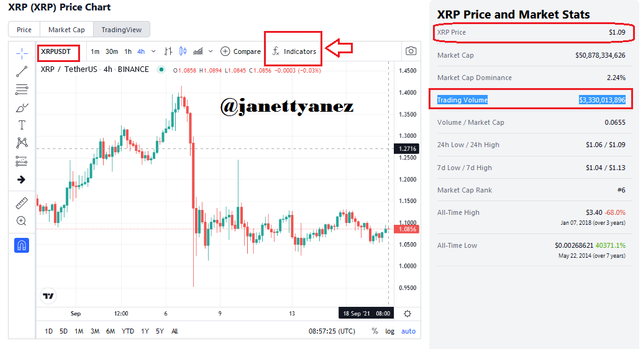

Using the App Coingecko.com/ we proceeded to the configuration of the Volume Indicator with the selected cryptocurrency XRP, whose price is The market for today 09/19/2021 at 8:57 UTC time, was $ 1.09 and with a Raking in the market # 7, with Trading Volume $ 3,330,013,896

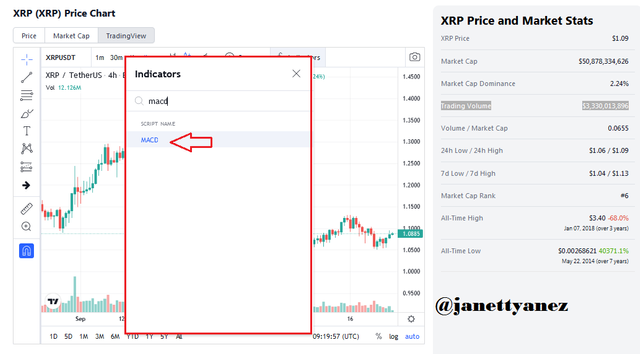

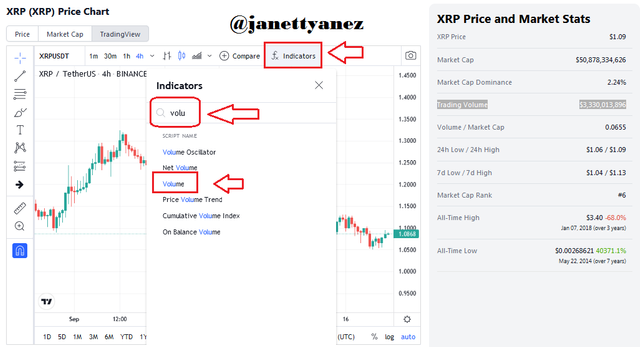

Initially, the tab located in the upper right part with the name of "Indicator" is displayed (Image 2), where it is placed in the search bar "Volume", it appears at the bottom of said tab and is selected (Image 3).

Image 2: Start Settings at coingecko.com. Screenshot

Image 3: Volume Indicator Selection

Next, it is configured in the Imput tab, the corresponding value of the MA of 20 is added, that is, a Moving Average of 20 previous volume bars is established (image 5).

A period of 4 hours was also selected, that is to say that in the graph each volume bar represents the total volume of operations for 4 hours (Image 5).

Image 5:Imput tab configuration to set MA

Image 6: MACD Indicator Settings

3. What is the link between Volume and Trend and How to use volume to predict a trend reversal? (Screenshot required)

It can be stated: that the volume increases in the direction of the price trend.

Based on what has been stated above, it can be said that during a downtrend investors are under greater pressure to sell the asset, resulting in the continuation of the trend.

However, when this pressure decreases, the so-called rebounds appear, it is then in those moments where the observation of the behavior of the volume of the negotiations must be maintained in order to determine the possibility of a potential reversal of the trend.

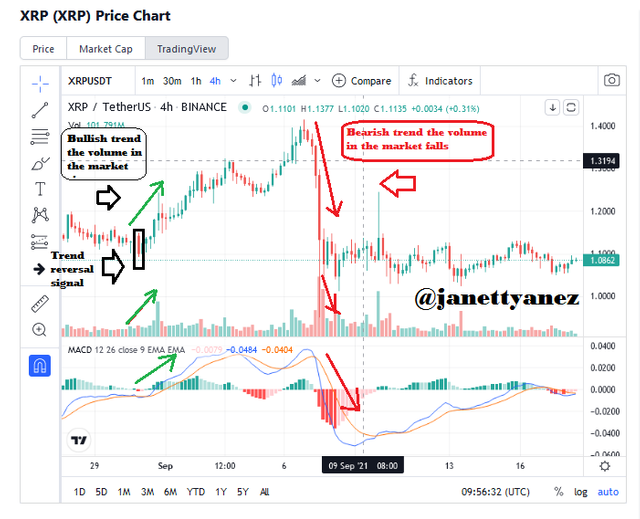

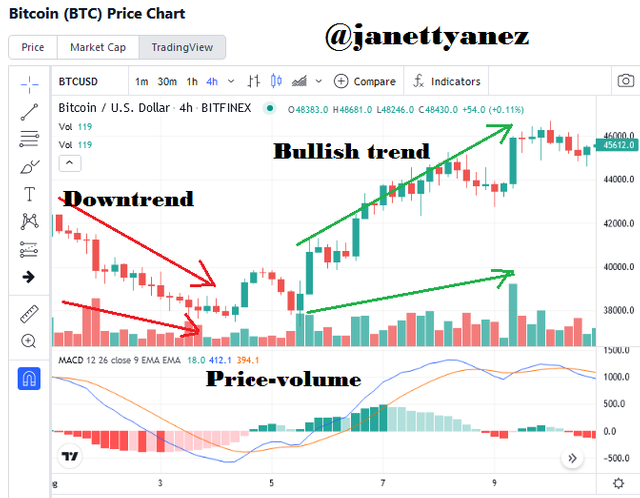

Below in Image 7, the screenshot of the cryptocurrency XPR is shown where the relationship of the volume with the market price of the asset is shown.

Image 7 shows the relationship between the volume and the trend, in the first case the upward trend on 30/08/2021 is clearly displayed with the volume indicator and the MACD, as well as with the price reflected in the green candles.

In the case of the downward trend, it is evidenced in the corresponding period from 06 to 09/07/2021, in the same way evidenced with both indicators and in clear relation to the price reflected in the red candles.

On the other hand, image 7 shows the trend change signal with a candle shown in a black box

Image 7: Volume ratio = trend and trend change

4. How to use the volume to have a signal confirmation? (Screenshot required)

One of the most frequent signals is the divergence of the volume of the asset, this signal consists of the disparity that is evidence in the graph, such is the case that there is a maximum in the price of the asset with an evident descending volume in the market , which may be a consequence of the decrease in the purchase levels of the asset.

However, it may occur that after this divergence there is an increase after a correction ending the upward trend that the asset presented.

Likewise, this indicator provides us with signals related to the breakdown of an asset price pattern in the market:

1.- Strong bullish trend: Increase in price and volume.

2.- Completion or break of the Bullish Trend: Increase in the price of the asset with a low volume.

3.-Strong bearish trend: Decrease in prices and volume.

4.-Completion or breakdown of the Downward Trend: Decrease in price with decrease in market volume.

Another sign that we can identify is the accelerated movements of the market volume together with the price of the asset due to the FOMO of the investors caused by this market behavior and that they fear losing the opportunity to obtain profits.

Signals related to reversals in the price and the volume of the asset can frequently appear after a marked variation in prices up or down, followed by slight movements in the price but with a strong variation in volume.

Signs that confirm an upward trend can also be seen:

1.- The price of the asset falls reaching a minimum and the volume increases

2.-The price of the asset achieves an increase and the volume is lower than in the previous one.

3.-The price reaches another minimum that does not break the previous one.

Finally, the breaking of a support or resistance level can be evidenced due to the absence of enough buyers, substantially decreasing the number of operations in the market, this results in a downtrend in an increase in pressure on the trend. In the case of an uptrend in the absence of enough buyers, this results in a market correction.

For the purpose of this assignment, a screenshot of the divergence of the asset volume in discord with its price is presented, as evidenced in Image 8 below:

Image 8: Price-Volume Divergence

5. How does the volume reflect the evolution of prices in the charts and why does the volume sometimes anticipate the price? (Screenshot required)

However, it is very important to be aware of changes in the behavior of the price-volume relationship in order to act immediately in the search for signs of reversal of these movements to make the corresponding adjustments in the established strategy.

On the other hand, the volume can anticipate the price because by studying the market pressure it can be determined which direction the trend is leading, in the case of an upward trend there is greater pressure to buy the asset than to sell it.

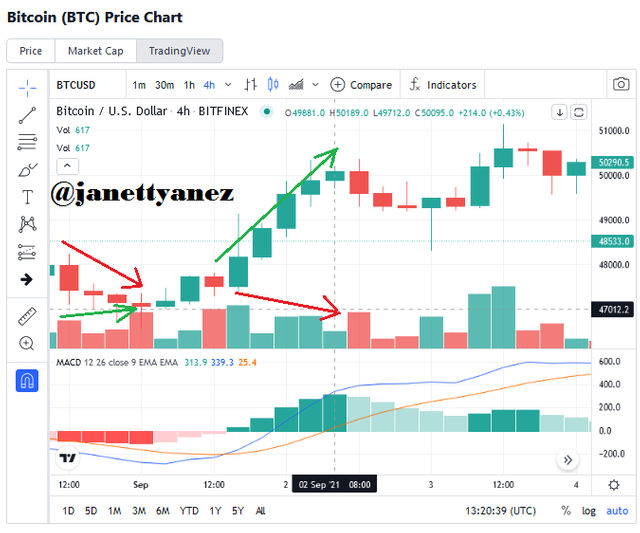

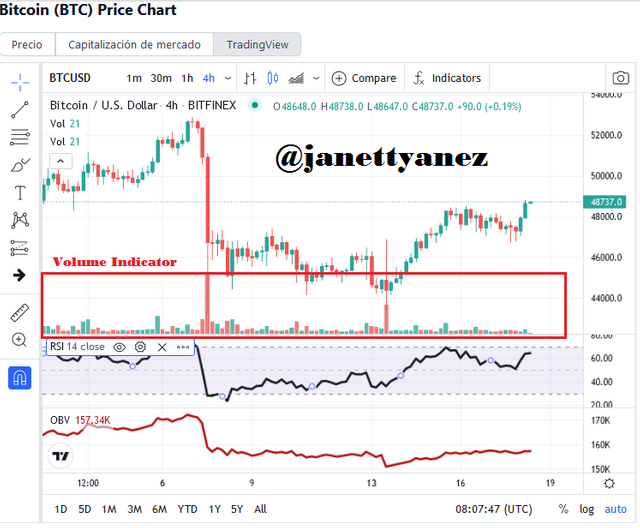

Below is shown in image 9 the BTC graph where the period from 08-01-2021 to 08-04-2021 shows the evolution of prices to an upward trend as well as the price is anticipated with the volume.

Image 9: Evolution of prices to an upward trend- BTC Graph .

6. Is it better to use the volume indicator alone or use it in parallel with another indicator when trading? Justify your answer

However, this indicator, like the rest of the indicators, is not advisable to use in isolation or individually, always recommending the use of two or more technical indicators combined and allowing them to complement each other.

Likewise, it is recommended to use the Volume indicator with another indicator such as moving averages, MACD, RSI and even others that use volume such as: On Balance Volume (OBV), Klinger Volume Oscillator, Price Volumen Trend, Volume oscillator, Levels by volume, Money Flow Index, among others.

7. The volume indicators are multiple, choose one of them to briefly explain its usefulness in crypto trading.

Certainly there are many volume indicators, as some of them have already been mentioned throughout this publication, however, to cover the requirements demanded by Professor @ kouba01, the On-Balance Volume (OBV) Indicator was chosen for analysis.

The OBV was developed by Joseph Granville (1963) and is a technical indicator of commercial impulse, whose purpose is to project the variation of the price of the shares in the market.

Its objective is to project the moment in which significant changes in the price of assets will occur due to changes in the volume of operations.

It also has the purpose of identifying when institutional investors buy and when private investors do, this in order to provide strategic information for the acquisition of shares at a price established and subsequently. This price will increase, which is when large investors sell and small investors buy.

Granville argued that when the volume undergoes a drastic increase without taking into account a variation in the price of the asset's share, the price of the asset will suffer a setback or a downward trend.

For the calculation of this indicator it is required:

• Current candle> previous candle: the volume of the period is added to the OBV of the previous period.

• The current candle closes = previous candle ==> current OBV = previous OBV.

• Current candle <previous candle = current OBV-previous OBV.

Conclusion

It is very important to consider the signals that this indicator offers us and to achieve the learning, mastery and management of it to take advantage of this tool.

Sources consulted

1.-Comprar Acciones De Bolsa: El Volumen en el Trading. Link

2.-Guia de Trading: 8 Mejores indicadores para el trading con Criptomonedas. Link

Hello @janettyanez,

Thank you for participating in the 2nd Week Crypto Course in its 4th season and for your efforts to complete the suggested tasks, you deserve a Total|8/10 rating, according to the following scale:

My review :

Good work in general in which the answers differed in their analysis and interpretation, and these are some notes.

Good explanation of the indicator by clarifying its uses.

Your choice to add the 20 moving average was not supported by arguments.

Determining trend reversals by volume, you did not succeed in explaining them.

The rest of the questions and I was somewhat satisfied with your answers.

Thanks again for your effort, and we look forward to reading your next work.

Sincerely,@kouba01

Hello Professor @kouba01

Thank you very much for the comments, I will continue working to improve.

My best wishes and regards.