Crypto Academy Season 4 | Advanced course - Week 5: Onchain Metrics(Part-3) - Homework for @sapwood

.png)

𝙌𝙪𝙚𝙨𝙩𝙞𝙤𝙣 1: 𝙃𝙤𝙬 𝙙𝙤 𝙮𝙤𝙪 𝙘𝙖𝙡𝙘𝙪𝙡𝙖𝙩𝙚 𝙍𝙚𝙡𝙖𝙩𝙞𝙫𝙚 𝙐𝙣𝙧𝙚𝙖𝙡𝙞𝙯𝙚𝙙 𝙋𝙧𝙤𝙛𝙞𝙩/𝙇𝙤𝙨𝙨 & 𝙎𝙊𝙋𝙍? 𝙀𝙭𝙖𝙢𝙥𝙡𝙚𝙨? 𝙃𝙤𝙬 𝙖𝙧𝙚 𝙩𝙝𝙚𝙮 𝙙𝙞𝙛𝙛𝙚𝙧𝙚𝙣𝙩 𝙛𝙧𝙤𝙢 𝙈𝙑𝙍𝙑 𝙍𝙖𝙩𝙞𝙤?

RUPL is the ratio of the difference of realized cap and market cap to simply the market cap. In previous lectures we studies that realized cap is calculated by summing the last moved prices of all the UTXO of an asset and the market cap is just the product of the current price and the circulating supply of an asset. The Unrealized profit loss helps us understand one thing if the UTXO is spent on the current date how much profit or loss will be generated if the difference is positive then it means the trader will earn profit but of the difference of the current value and the price at which the UTXO was last moved is negative then the trader will be in loss.

On the basis of the market cap and realized cap the UPL is calculated as (Market cap- Realized cap)

𝙏𝙝𝙚 𝙍𝙐𝙋𝙇 𝙞𝙨 𝙩𝙝𝙚𝙧𝙚𝙛𝙤𝙧𝙚 𝙘𝙖𝙡𝙘𝙪𝙡𝙖𝙩𝙚𝙙 𝙖𝙨 :

(Market cap- Realized cap)/ Market cap

Let us take an example, for example, the realized cap of an asset is 69,000,000$ and the market cap is 87,000,000$ then the

RUPL= (87,000,000-69,000,000)/ 87,000,000= 18,000,000/87,000,000 from here one thing is clear that the difference is positive and hence it is a profitable trade finally

RUPL= 0.206 or 20.6%

- A reading 0.75 and above indicates a top and an approaching taking-profit zone

- A reading between 0.00 - 0.75 (0% - 75%) indicates a cycle (bullish or bearish)

- A reading below 0.25% indicates a bottom predicting an accumulation zone.

𝐒𝐎𝐏𝐑

It is the ratio at which a UTXO was bought to the current price. It is used to determine. It indicates the degree of profit or loss of a spent UTXO at the current moment. This metric is used to describe lows and highs inside a cycle.

It is calculated as

SOPR= Current price or sold price/ initial price or the price at which it was bought

- The reading above1 indicate the UTXO holder is in profit

- A reading below 1 indicates that the holder of the UTXO is at a loss

For example, there are 10 LTC UTXO with an initial value of $210 and the sold price of $520 the SOPR will be calculated as

Price bought/created = 10 x $290 = $2900

Price sold = 10 x $520 = $5200

SOPR = $5200/$2900 = 1.79 as the value is above it indicates that the holder is in profit.

𝙃𝙤𝙬 𝙖𝙧𝙚 𝙩𝙝𝙚𝙮 𝙙𝙞𝙛𝙛𝙚𝙧𝙚𝙣𝙩 𝙛𝙧𝙤𝙢 𝙈𝙑𝙍𝙑 𝙍𝙖𝙩𝙞𝙤?

MVRV ratio is the ratio of market cap over-realized cap. It indicates that the market is entering an overbought situation when it peaks to or above 300% or is entering an accumulation zone below 100%. The RUPL on the other hand indicates the unrealized profit or loss situation in terms of the relation between the realized and market cap with respect to the current supply of the tokens. It helps us identify cycle tops and bottoms. It tells the degree of profit or loss the trader will make if he sells the UTXO at the current market rate.

The SOPR depicts a profit loss situation based on the initial current price of a UTXO and predicts local tops and bottoms. It indicates the actual profit or loss in comparison to selling the UTXO at the current price based on the price it was bought initially.

𝙌𝙪𝙚𝙨𝙩𝙞𝙤𝙣 2: 𝘾𝙤𝙣𝙨𝙞𝙙𝙚𝙧 𝙩𝙝𝙚 𝙤𝙣-𝙘𝙝𝙖𝙞𝙣 𝙢𝙚𝙩𝙧𝙞𝙘𝙨-- 𝙍𝙚𝙡𝙖𝙩𝙞𝙫𝙚 𝙐𝙣𝙧𝙚𝙖𝙡𝙞𝙯𝙚𝙙 𝙋𝙧𝙤𝙛𝙞𝙩/𝙇𝙤𝙨𝙨 & 𝙎𝙊𝙋𝙍, 𝙛𝙧𝙤𝙢 𝙖𝙣𝙮 𝙧𝙚𝙡𝙞𝙖𝙗𝙡𝙚 𝙨𝙤𝙪𝙧𝙘𝙚(𝙎𝙖𝙣𝙩𝙞𝙢𝙚𝙣𝙩, 𝙂𝙡𝙖𝙨𝙨𝙣𝙤𝙙𝙚, 𝙇𝙤𝙤𝙠𝙞𝙣𝙩𝙤𝘽𝙞𝙩𝙘𝙤𝙞𝙣, 𝘾𝙤𝙞𝙣𝙢𝙚𝙩𝙧𝙞𝙘𝙨, 𝙚𝙩𝙘), 𝙖𝙣𝙙 𝙘𝙧𝙚𝙖𝙩𝙚 𝙖 𝙛𝙪𝙣𝙙𝙖𝙢𝙚𝙣𝙩𝙖𝙡 𝙖𝙣𝙖𝙡𝙮𝙨𝙞𝙨 𝙢𝙤𝙙𝙚𝙡 𝙛𝙤𝙧 𝙖𝙣𝙮 𝙐𝙏𝙓𝙊 𝙗𝙖𝙨𝙚𝙙 𝙘𝙧𝙮𝙥𝙩𝙤, 𝙚.𝙜. 𝘽𝙏𝘾, 𝙇𝙏𝘾 [𝙘𝙧𝙚𝙖𝙩𝙚 𝙖 𝙢𝙤𝙙𝙚𝙡 𝙩𝙤 𝙞𝙙𝙚𝙣𝙩𝙞𝙛𝙮 𝙩𝙝𝙚 𝙘𝙮𝙘𝙡𝙚 𝙩𝙤𝙥 & 𝙗𝙤𝙩𝙩𝙤𝙢 𝙖𝙣𝙙/𝙤𝙧 𝙡𝙤𝙘𝙖𝙡 𝙩𝙤𝙥 & 𝙗𝙤𝙩𝙩𝙤𝙢] 𝙖𝙣𝙙 𝙙𝙚𝙩𝙚𝙧𝙢𝙞𝙣𝙚 𝙩𝙝𝙚 𝙥𝙧𝙞𝙘𝙚 𝙩𝙧𝙚𝙣𝙙/𝙥𝙧𝙚𝙙𝙞𝙘𝙩 𝙩𝙝𝙚 𝙢𝙖𝙧𝙠𝙚𝙩 (𝙤𝙧 𝙘𝙤𝙧𝙧𝙚𝙡𝙖𝙩𝙚 𝙩𝙝𝙚 𝙙𝙖𝙩𝙖 𝙬𝙞𝙩𝙝 𝙩𝙝𝙚 𝙥𝙧𝙞𝙘𝙚 𝙩𝙧𝙚𝙣𝙙)𝙬.𝙧.𝙩. 𝙩𝙝𝙚 𝙤𝙣-𝙘𝙝𝙖𝙞𝙣 𝙢𝙚𝙩𝙧𝙞𝙘𝙨? 𝙀𝙭𝙖𝙢𝙥𝙡𝙚𝙨/𝘼𝙣𝙖𝙡𝙮𝙨𝙞𝙨/𝙎𝙘𝙧𝙚𝙚𝙣𝙨𝙝𝙤𝙩?

I will be looking into BTC from the LookintoBitcoin platform.

𝐑𝐔𝐏𝐋

There are three aspects that need to be understood when studying the RUPL

- A reading 0.75 and above indicates a top and an approaching taking-profit zone

- A reading between 0.00 - 0.75 (0% - 75%) indicates a cycle (bullish or bearish)

- A reading below 0.25% indicates a bottom predicting an accumulation zone.

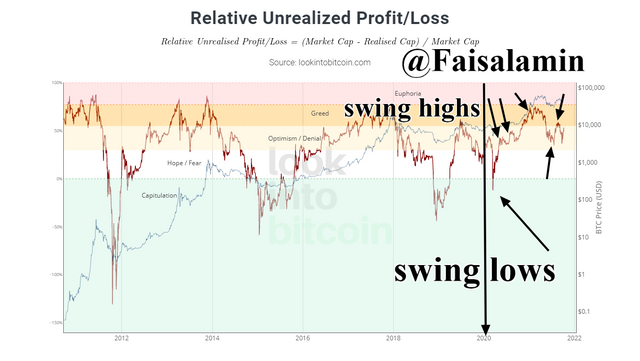

BTC 1 year chart

We are considering the period between 2020 and 2022. The first swing high was below the 78% mark similar to the next 2 swing highs. The third swing however was formed above the 50% and below the 80% any RUPL reading above 0.75 or 75% is considered to be the part of a historical cycle top, as the price touches the bearish resistance it tends to fall back below forming a swing low.

The price line of BTC and the RUPL line can be seen to be moving in direct relationship the swings of the price are a bit shallow in comparison to the RUPL line. The first arrow indicating the swing low is a historical low as the price of BTC was around 5000$ and the RUPL reached below around -12%. The second arrow indicating the swing low is also a historical low as the RYPL dropped below 25% there was the accumulation zone which after the 2nd historical low we saw interim or local Tops forming. The market is currently entering the greed region.

Hence we noticed that whenever the RUPL goes above 75%, it was followed shortly by a corrective bearish reversal. And whenever it went significantly below zero, there was a corrective bullish reversal.

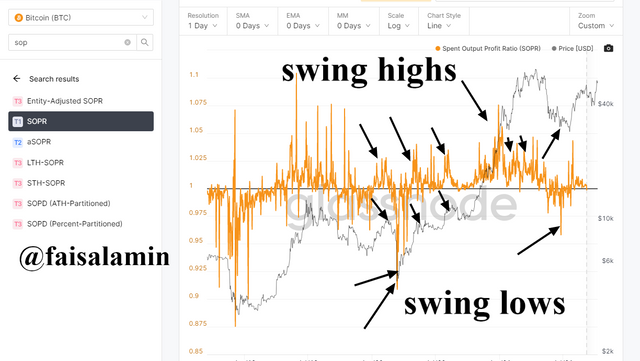

SOPR 2 Years

Here I am using the Glassnode platform

In the chart above we see that a swing high on 7th May 2020 was formed when the SOPR reading was 1.03 the price line was racing around 9.9k$. we already know that when the SOPR reading is above 1 it indicates the formation of high swing which in turn indicates an incoming bearish trend reversal due to increasing selling pressure. It was confirmed when the priced suffered a dip to around 5.8K$ and the SOPR reading reached the 0.9 level.

A higher swing was then observed in February when the price touched around 55K$. Soon after the high the dip took the price to $46k and the SOPR reading to around the 0.9 mark again. Then again a bullish movement was observed the price showed a swing high to reach $52K with the SOPR reach mark around 1.

This indicates when the SOPR dipped below 1 the price followed suit and experienced a swing low and when the SOPR rose above the level 1 the price again followed suit to make swing highs.

𝙌𝙪𝙚𝙨𝙩𝙞𝙤𝙣 3: 𝙒𝙧𝙞𝙩𝙚 𝙙𝙤𝙬𝙣 𝙩𝙝𝙚 𝙨𝙥𝙚𝙘𝙞𝙛𝙞𝙘 𝙪𝙨𝙚 𝙤𝙛 𝙍𝙚𝙡𝙖𝙩𝙞𝙫𝙚 𝙐𝙣𝙧𝙚𝙖𝙡𝙞𝙯𝙚𝙙 𝙋𝙧𝙤𝙛𝙞𝙩/𝙇𝙤𝙨𝙨(𝙍𝙐𝙋𝙇), 𝙎𝙊𝙋𝙍, 𝙖𝙣𝙙 𝙈𝙑𝙍𝙑 𝙞𝙣 𝙩𝙝𝙚 𝙘𝙤𝙣𝙩𝙚𝙭𝙩 𝙤𝙛 𝙞𝙙𝙚𝙣𝙩𝙞𝙛𝙮𝙞𝙣𝙜 𝙩𝙤𝙥 & 𝙗𝙤𝙩𝙩𝙤𝙢?

The specific use cases of the on chain metrics discussed above are:

𝐑𝐔𝐏𝐋

It is used to determine cyclic tops and bottoms based on the ratio of difference between the value of market cap and realized cap to the market cap at a given time. A reading above the 0.78 indicates an incoming profit taking zone where as the reading below the 0.28 indicates and accumulation zone.

𝐒𝐎𝐏𝐑

The SOPR is used to determine swings inside a cycle based on the ratio between the bought and sold price of the UTXOs. A reading above 1 indicates an incoming swing high and the value below 1 indicates an incoming low inside a cycle.

𝐌𝐕𝐑𝐕

MVRV ratio is used to determine oversold and overbought conditions of an asset by dividing the market cap by the realized. The tops and bottoms are formed on the basis of the difference between supply and demand. These underpriced and overpriced regions are then used to locate buying and selling bids or trend reversals.