Steemit Crypto Academy Contest / S23W5 [SUMMARY] : Steem/USDT Order Book Trading – Mastering Market Liquidity Strategies

Introduction

Dear Steemians,

Welcome to the fifth week of Season 23 of the Steemit Learning Challenge, where participants explored Steem/USDT Order Book Trading – Mastering Market Liquidity Strategies from March 17, 2025, to March 23, 2025. This competition challenged participants to analyze order book data, understand market depth, and build strategies based on real-time supply and demand for Steem/USDT.

This report presents participation statistics, highlights top contributors, and provides insights from this week’s submissions.

Participation Statistics

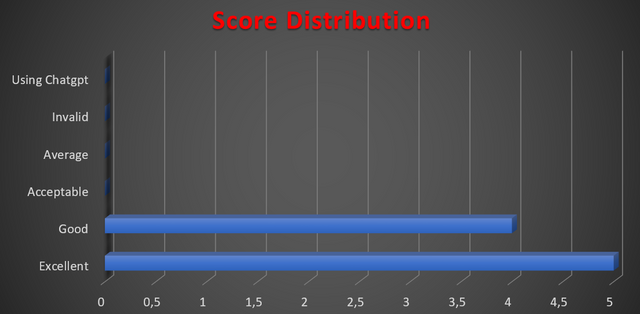

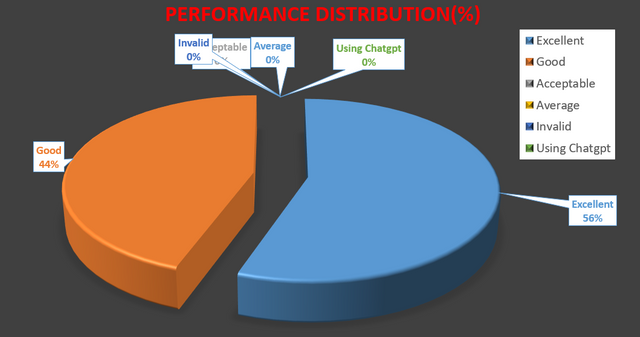

We are pleased to report a strong engagement this week, with 9 valid entries submitted. Below is the breakdown of this week’s entries:

| Total Entries | Valid | Excellent | Good |

|---|---|---|---|

| 9 | 9 | 5 | 4 |

- 5 entries were rated Excellent, offering outstanding insights and comprehensive trading strategies.

- 4 entries were rated Good, demonstrating solid understanding with well-presented concepts.

This reflects a strong grasp of order book mechanics, liquidity zones, and institutional activity patterns among the participants.

Performance Evaluation

Participants addressed a wide range of order book trading concepts, including:

Understanding the Order Book

- Submissions clearly explained how the order book functions, how bids/asks are structured, and its use in short-term decision-making.

Market Depth & Order Flow Analysis

- Several entries analyzed liquidity zones and how traders can detect accumulation/distribution areas using market depth.

Whale Order Detection & Institutional Activity

- Participants explored how to identify and respond to large orders and spoofing behaviors in the order book.

Order Book Strategy Development

- Detailed step-by-step strategies with visual support were presented, outlining risk control, entry/exit planning, and execution precision.

Case Studies & Real-Time Simulations

- Some authors incorporated historical examples or hypothetical simulations to illustrate the dynamics of real-time liquidity trading.

Top 4 Winners

Among the impressive submissions, the following participants stood out:

| Ranking | Username | Article | Score |

|---|---|---|---|

| 1 | @mohammadfaisal | Link | 9.48/10 |

| 2 | @luxalok | Link | 9.12/10 |

| 3 | @shabbir86 | Link | 9.12/10 |

| 4 | @faran-nabeel | Link | 8.96/10 |

@mohammadfaisal claimed the top spot with a deep dive into order flow mechanics and market structure tactics. @luxalok and @shabbir86 tied in second place, both delivering highly detailed strategies with great visual clarity. @faran-nabeel rounded out the winners with a polished and practical breakdown of order book tactics.

Conclusion

The fifth week of Season 23 showcased the power of order book analysis in cryptocurrency trading. Participants skillfully interpreted market liquidity, whale behavior, and depth structure to develop precise, data-driven strategies for Steem/USDT.

Congratulations to all participants for elevating the discussion around real-time trading analytics. Your detailed and thoughtful contributions continue to enrich the Steemit Crypto Academy and empower traders globally.

Stay tuned for the next challenge, where we continue to explore the evolving world of crypto trading and blockchain innovation!

Congratulations to all the winners.

This is great, I'll be on the lookout to enter the next contest.