CRYPTO ACADEMY SEASON 3 WEEK 8 /HOMEWORK POST FOR @yohan2on/ RISK MANAGEMENT

1- Define the following Trading terminologies;

• Buy stop

• Sell stop

• Buy limit

• Sell limit

• Trailing stop loss

• Margin call

(I will also expect an illustration for each of the first 4 terminologies listed above in addition to your explanation)

This is an order that is programmed by an investor to purchase an asset once it hits a certain price. The order is placed at a price that is above the current price. Let me explain it practically, a trader performs analysis of a certain asset and speculates that the market will get into an uptrend very soon, he wants to make profit from it. He decides to buy the asset after it breaks a few support levels. Monitoring it might be very difficult so he programs an order and sets a price above that is above the current order, when the assets’ price reaches that point the order is filled automatically without his consent. The order he created is known as a buy stop.

This is also an order that is programmed to sell an asset at a certain price. With this order the price is set below the current price. This order is created with the aim of making profits or reducing loses from a trade. Lets assume a trader purchased an asset at the beginning of an uptrend. After sometime he speculates the market will set in a downtrend so in order to make profit he creates an order to sell the asset the moment the price drops a little. So he sets it below the current price and once the asset reaches that price the order is filled automatically.

This is a programmed order to buy an asset when at a specified price or a lesser price. In this `order the trader gives a maximum price he is willing to pay for an asset so the order will fill whenever the price of the asset reaches that point or goes lower that that price. So he is willing to buy at or less than a given price. This order is created when a decline in price is anticipated.

This is also a programmed order to sell an asset at a certain price or higher. In this type of order the investor gives the minimum price he is willing to take as payment for his asset. The order fills automatically once the price hits his mark or goes above his mark. He is likely to receive more than his stated price if the price goes above his set price. This order is created when an uptrend is anticipated.

This is a market order that has the primary aim of helping the investor to make profit. When opening a trade you create a trailing stop loss at points or you set a percentage at which when the price is declining your trade should close. Lets say you create a trailing stop loss order of 10% when the price is experiencing an uptrend the trailing stop loss order also moves in the direction. The order will be filled only after the prices fall upto 10% from the highest price the asset reached after you bought it. This is very good at reducing loses because of the ability to adjust as the price goes up.

Margin call is always a warning or notice issued to its users who fall below the minimum requirement. They are then notified to load up more funds in order to meet the minimum requirements or their open operations get closed.

Margin call is always a warning or notice issued to its users who fall below the minimum requirement. They are then notified to load up more funds in order to meet the minimum requirements or their open operations get closed.

Practically demonstrate your understanding of Risk management in Trading.

*Briefly talk about Risk management

*Be creative (I will expect some illustrations)

*Use a Moving averages trading strategy on any of the crypto trading charts to demonstrate your understanding of Risk management. (screenshots needed)

RISK MANAGEMENT

Crypto trading just like in order business adventure, investors go into it with the aim of making profits nevertheless you are also at risk of incurring losses because there is no trade that gives a guarantee of making profit unless. Knowing very well that there are risks in trading we need to build up strategies through which these risks can be manage so that in a case where loses are incurred they will be very minimal and the impact wouldn’t be that much on us. For a trader to successful you need to plan very well and in planning you need to clearly bring out your risk management strategies.

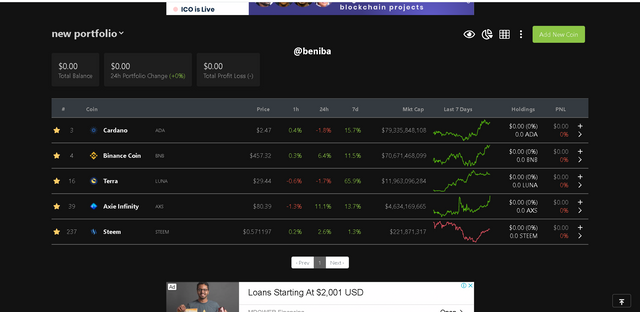

There are a lot of ways to manage risk some of which are: the use of programmed market orders to close and open trades at very good times, the management of a portfolio where a trader invest in very different crypto assets so that in a case where he incurs losses from a certain asset the gains from the other assets will cover up.

The image above is a portfolio I created on coingecko, it can be seen that the first 4 coins were on an uptrend so if I invested earlier I would be making profit but looking at steem its likely that I would have incurred some losses but that would be covered by the profits made from the other coins.

USE A MOVING AVERAGES TRADING STRATEGY ON ANY OF THE CRYPTO TRADING CHARTS TO DEMONSTRATE YOUR UNDERSTANDING OF RISK MANAGEMENT.

I used two moving averages on the steem/usdt chart one was set with a length of 50 and the other with a length of 200. the red one being the short moving average intercepted with the long moving average at point A forming a death cross this means that a downtrend will be experienced so i quickly created a buy limit at point B which will be triggered the moment the price of steem drops to that point.

Trading can be very useful to people to be able to make a living out of it, at the same time it can also lead to people losing lots of money. Being able to get some profit from trading would mean that one understands the risk involved and developing strategies of managing these risks. thanks to professor @yahan2on for giving us this lecture on how to manage risks in crypto trading.

![AddText_08-21-04.02.55[1].jpg](https://steemitimages.com/640x0/https://cdn.steemitimages.com/DQmXRbv4apSHGo4QFVmz9q4NYExJPTgG3EcCTqWoeokvjYw/AddText_08-21-04.02.55[1].jpg)

Hi

Thanks for participating in the Steemit Crypto Academy

Feedback

You missed out on one of the very important aspects involved in Risk management and that is setting the Stop Loss and Take Profit. I expected to see that on the final chart under risk management.