Yield Farming - Yearn Finance - Crypto Academy S5W3 - Homework Post for @imagen

Yield Farming - Yearn Finance

.png)

Image edited using Canva

Hello everyone, welcome to my post on the third week of the season 5 of the crypto Academy.

Below is my submission to the task given by progessor @imagen , where on this task i will be explaing and giving details on Yield Farming - Yearn Finance.

You can as well join me on the Link to study the course.

Basic Introduction:

Inside the universe of Decentralized fincance known as DeFi , there are two well known items and terms that have gotten a ton of consideration for multiple users, which this two items are Yield Farming and Staking.

These DeFi exchanging techniques expect partners to vow their crypto resources in different ways on the side of a decentralize application.which is where the idea of Yield Farming and Staking comes in , we should bear in mind that these resources the partners are sharing are given back as an interest..

Let's dive deeper into it!!

Yield farming is one the method of investment in the Crypto business, that allow users to earn a return on crypto assets. In a way that, , you can earn income by depositing some amount crypto into a liquidity pool.

You can think of these liquidity pools as the centralized finance meaning like your day-to-day bank account where you store your money, which your bank then uses to offer loans to others and as well rewards you with a portion of the interest earned by Farming.

Yield farming is as well a method in which investors lock their crypto assets into a smart contract-based platform. The locked assets are then made available for other users in the same policy. Users of that particular lending protocol can now borrow these tokens - This idea is now known as margin trading.

One can say Yield farmers are the foundation for some Decentralized finance protocols that offers exchange and lending services. Besides, they as well help to maintain the liquidity of crypto assets .

Crypto staking is another mode of investment in the cryptocurrency business , whereby investors lock up some part of there digital asset for a while as a method of adding security to a blockchain network. In return, stakers can acquire rewards, ordinarily as an extra coins .

Another definition, Staking as well is a term used to crediting a specific number of tokens to the administration model of the blockchain and in this manner , users then keep there digital asset which they stake with for a general use in a predetermined timeframe.

Risk level:

Yield Farming might inclined to misfortunes brought about by an abrupt negative market, or high gas charges

While

Staking is likewise viewed as a more steady choice of investment .

Time of Investment:

Staked investments are locked for a particularperiod of time (meaning they can't be accessed, until there time elapse).

While

Yield farming permits investors to have more command over their assets as these aseset can be moved whenever they wish to.

Fundamentally, Yield Farming is revolved around giving liquidity to a blockchain.

While

Staking is revolves around giving security a blockchain.

Rewards Returns

From the reward perspective, Yield Farming can offers returns on asset somewhere in the range of 2% to 200%, which comes with higer risk.

While

Staking invesetors are checking out returns somewhere in the range of 5% , which comes with lesser risk.

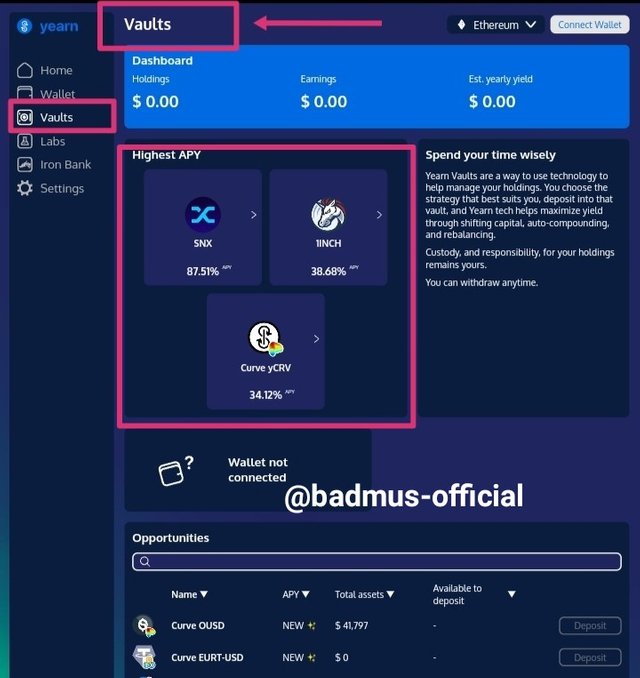

- Log on to the Yearn Platform, which this brought you to the homepage of the website.

Then we get to see the platform features such as Vault , Iron Bank and Lab and as well the settings and the mode where we get to connect wallet.

Vaults

From the vault feautures, we get to see the amount the users posses on the Yearn platform and as well users can choose to invest in DeFi , where we get to see top3 Defi with higher APY such as SNX with a return of 87.5% , and 1 inch with 38.68% and as well Curve yCRv .

Labs

From the Lab features, users can find the freshest and generally unique projects around. And as well lock there token to Yearning on lab projects and must proceed with caution due to higher risk level involve in the Lab Yearning.

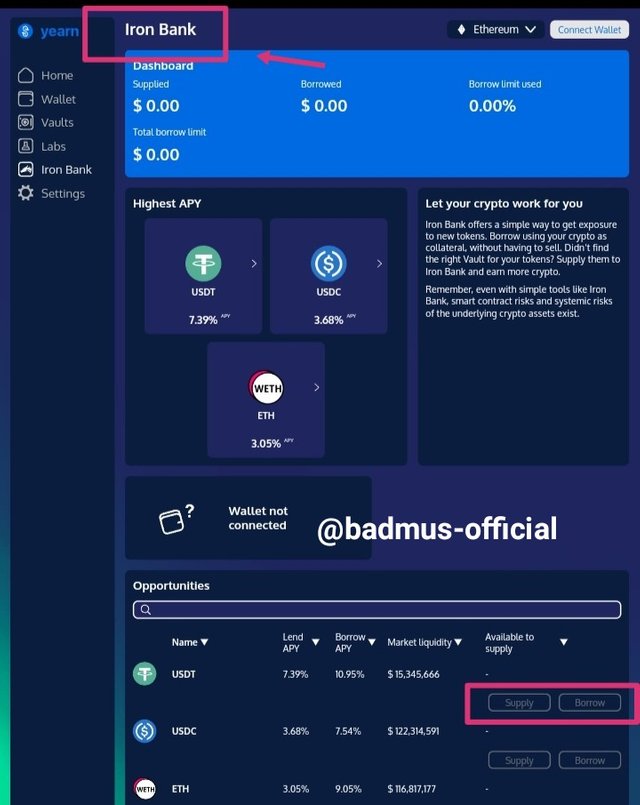

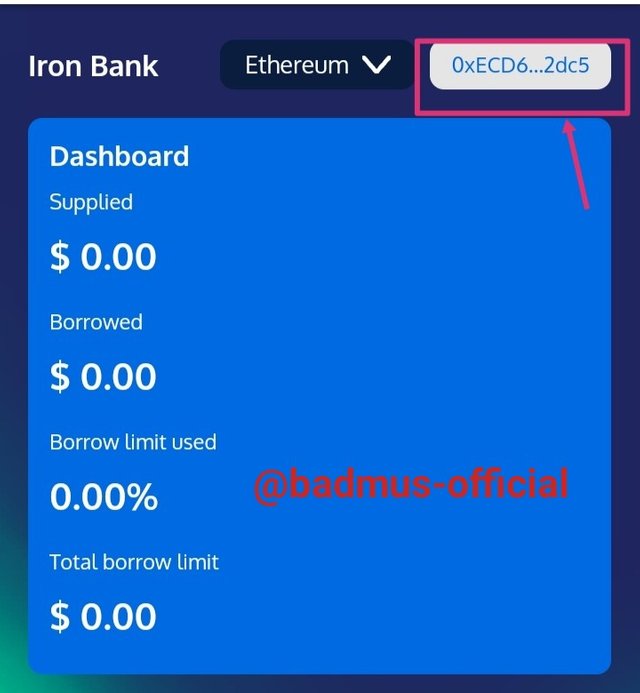

Iron Bank

Then the last features on the Yearn Platform is the Iron Bank which this feauture allow users to supply out there token or borrow tokens to serve as a capital for underlying projects, and as well users should Keep in mind, that even with the straightforward apparatuses like Iron Bank, there might be smart contract hazards to there crypto resources.

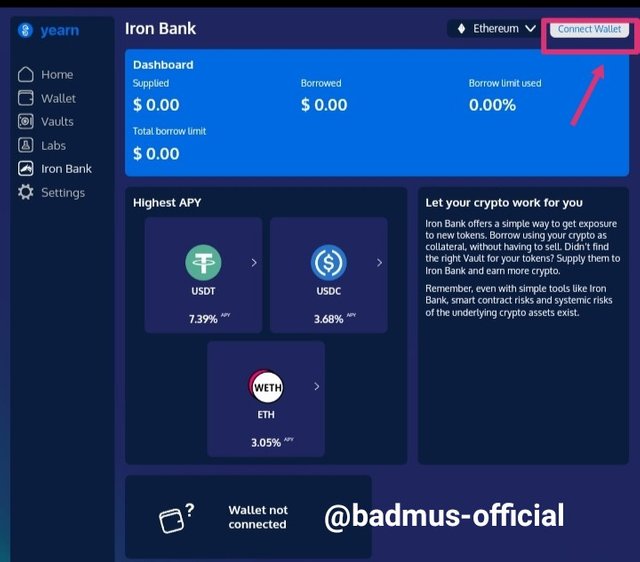

On this task, i will be showing how to trade on the Year Finance Platform and as well How to connect the Yearn Platform wallet to there MetaMask.

Connecting wallet

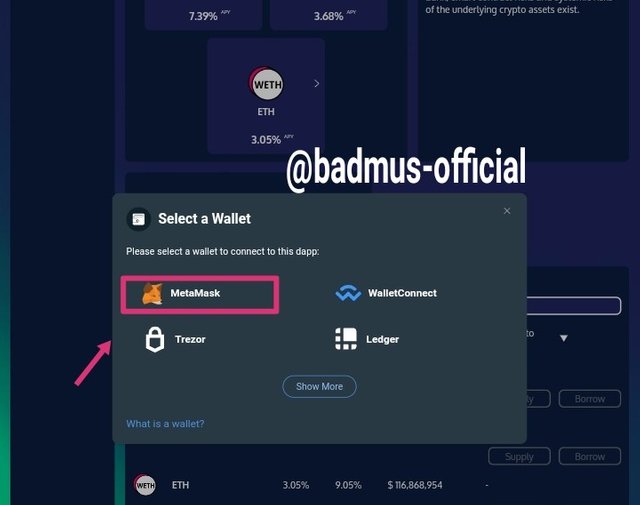

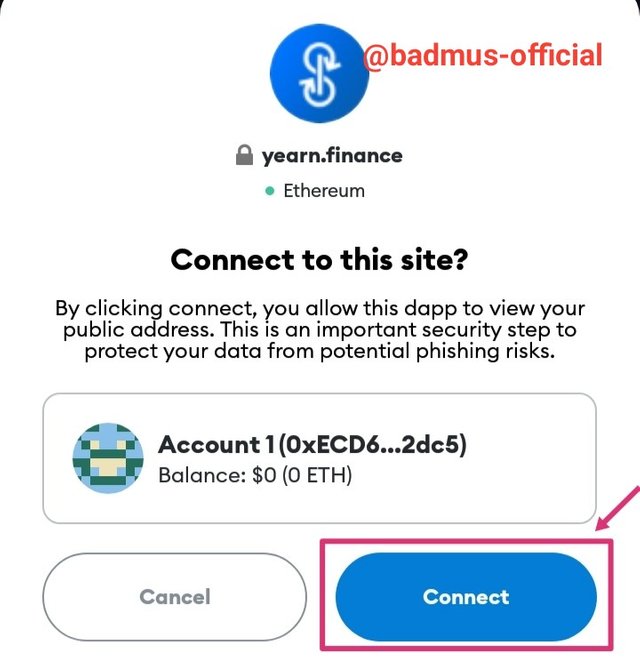

- Step 1 - From the website homepage at the top bar, you click on Connect wallet

- Step 2 - Then you choose your preferable wallet to connect with , in my case , i choose metamask.

- Step 3 - Then i gave approvement to my metamask app , then click connect.

- Step 4 - Wallet successfully connected to the Yearn Platform

Trading:

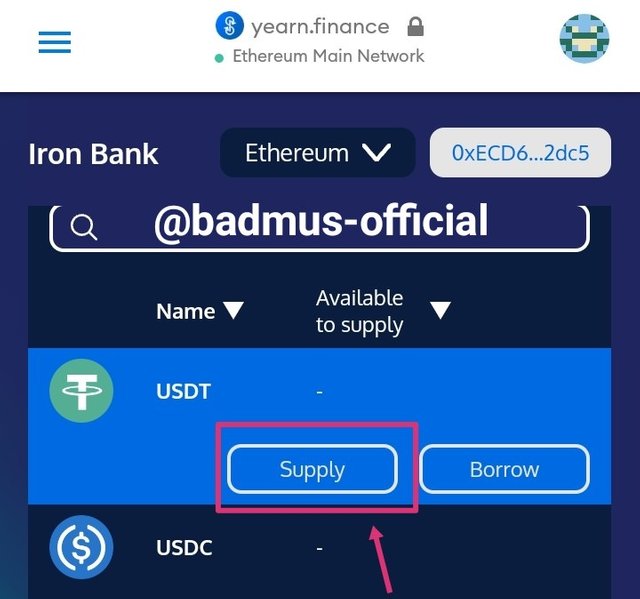

During my trade, i choose the iron bank feauture, where i choose to Supply usdt.

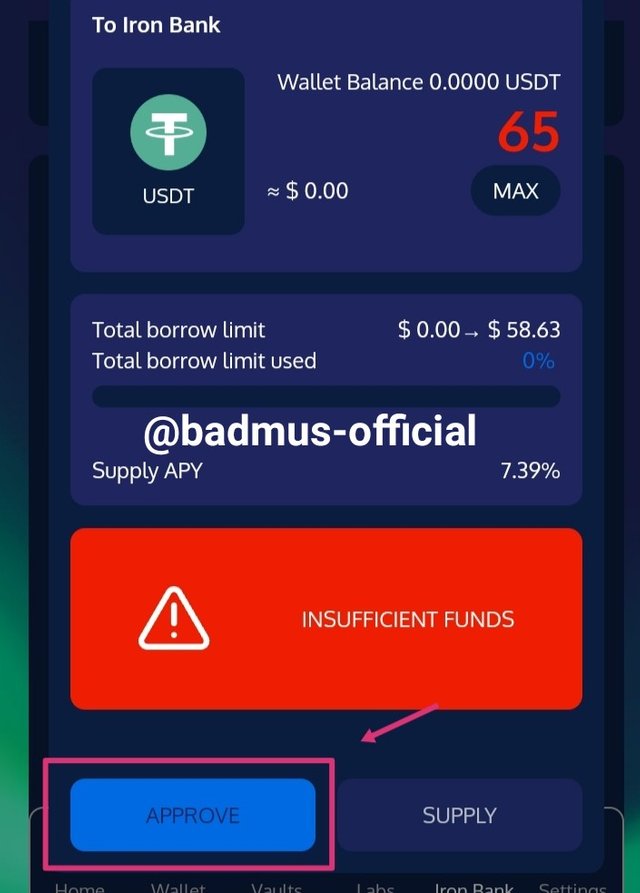

Then from the supply option , i decided to supply 65 worth of Usdt , then you click on Approve next, unfortunately, i don't have sufficient USdt to supply.

Then this would be the confirmation page , where i get to give acces to the yearn finance platform to supply my 65 usdt .

Collateralization in Yield Farming is a situation whereby investors are basically on the off chance that they are borrowing a crypto resources, then they are provided with the option to set up insurance to cover there credit.

This basically goes about as protection for your loan .And this as well relies upon what platform you're providing your assets to, however you might have to watch out for your collateralization proportion , In the event that your guarantee's worth falls underneath the limit needed by the DeFi. For instance some platform might set a proportion of 2:1 or 3:1 ,i.e , if you plan on borrowing 100usdt from a DeFi platform , you should have at least deposit 200usdt or 300usdt before you could qualify as a collateral.

To emphasize, every platform have varied arrangement of rules for collateral i.e., their own necessary collateralization proportion.

Function

The major function of collateral in Yield Farming is so as to decrease the danger of intense market declines , and as well reduce the risk of liquation with lots of insurance in the platform.

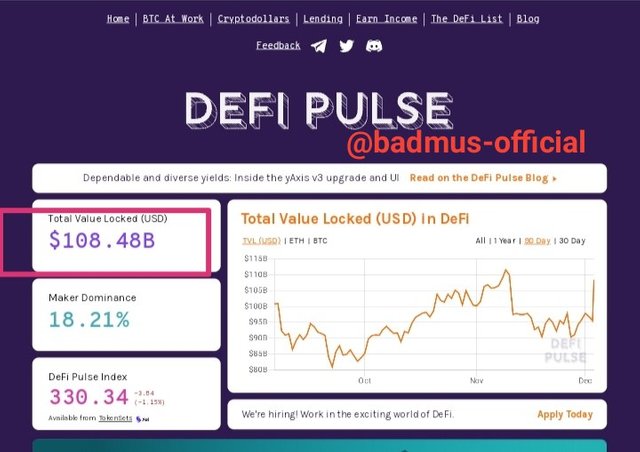

As of today 3rd December 2021 , the total value locked in the DeFi ecosystem is at $108.48B . image screenshot below

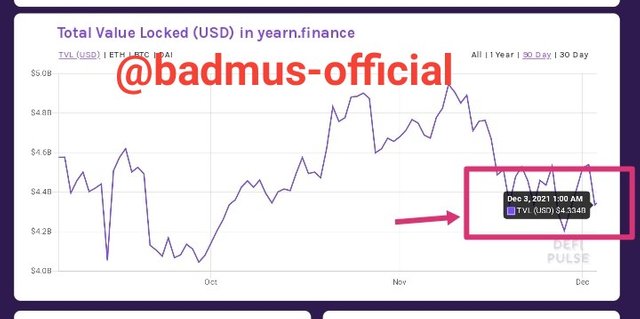

The Total value locked on the Yearn Finance Protocol as at December 3rd is at $4.33B

The diluted market capitalization of the Yearn finance is at $1,067,603,030 while The Market Cap / TVL ratio of the YFI token is 0.182, and as well the The (Total Value Locked) is at $5,861,575,389.

I could really say the YFI token is currently undervalued at the moment.

Why?

Simply because the YFI token is still at project proposal(0) which thus proves these from the market/tvl ratio to be 0.81 and its been known in the crypto business that , before a project could be considered overvalued, the project must at least be in the proposal(3) which this means the TVL/Market ratio at least must have been in the value of 3 and above.

Thou , there are some fact that the YFI token will seek some significant value later in coming days or early next year , which by then we can considered the token to be Overvalued.

For this task , i will be carrying out the investment anology using the price of the bitcoin and YFi token from TradingView.

Bitcoin Investment

From the screenshot below where i added a date range between Aug 1 2021 till Dec 3 2021, we could see that the bitcoin market has had a profit of 41.45%

Now here is the analysis

If i have made an investment of 500usdt in these particular asset and it risen 41.45%

That means 500 x 41.45% = 500 x 0.4145

Then my earn will be = (207.25sdt) + my investment (500usdt)

That is , my total earning will be 707.25usdt , meaning have made profit with the bitcoin investment .

YFI Investment

From the screenshot below where i added a date range between Aug 1 2021 till Dec 3 2021, we could see the YFI/USDT market has had a loss of -11.74%

Now here is the analysis

If i have made an investment of 500usdt in the YFI/USDT asset and it dropped to -11.74%

That means 500 x -11.74% = 500 x -0.1174

Then my loss would be = (-58.7usdt) + my investment (500usdt)

That is , my total earning will be $500 - $58.7,

Which then equals 441.3usdt , meaning have made loss with the YFI investment

Just like have explained earlier, that the rewards that comes with Yield Farming are quite tempting , but users as well should take note when making Yield Investment due to its high level of risk, below are the reason;

- On the off chance that you are utilizing a collateralized loan through a DeFi platform, you should know about the liquidation hazard. And this happens when your assurance is at this point is insufficient to cover the measure of your loan, . Liquidation can then occur if either the worth of your asset drops, or on the other hand in case the worth of your loan increases.

- And as well , too much of loan can cause maximum risk to the Yield Farming and as well its advisable to users to reduce there smart contract when Farming, so as to reduce the level of there risk due to possible hack.

Yield Farming as well is a subset of Staking. Yield Farming is a methods by which investors gives there static crypto-resources something to do, just like in our day to day banking where we give some portion of our asset to others to borrow and so as to make profit with it , Yield Farming targets acquiring the best return conceivable, while Staking centers around aiding a blockchain network stay secure.

Just that , Staking comes with lower risk but the return rate is not as high as that of Yield Farming.

Here comes the end of my assignment, its indeed a great task, as the topic has expose me more to some interesting topic related to DeFi

Thanks you everyone, special regards professor @imagen

Anticipate you on your next class