Spotlight on Huobi - "Margin trading on Huobi"

Welcome to my first entry to the #ilovehuobi contest. The contest has been running for quite some while now and a lot of fantastic posts have rolled out in accordance each highlighting the wonderful features of Huobi exchange from different yet interesting perspective. I would also like to submit my review and highlight another amazing feature of Huobi exchange "Margin Trading"

With respect to the myriad crypto contests hosted by @steemitblog and commendably curated by @steemcurator01 andconsidering many others currently active on the blockchain it would be fair to say everyone in this space is familiar with exchanges also putting into cognizance our very own indigenous Poloniex with which we perform basic transactions and exchanges on the platform. Currently, there are multiple exchanges both centralized and decentralized to which we have the luxury of choice to use to exchange or change tokens from one form to another. With several platforms performing the same functions/service, how can a exchange truly prove to be unique from the rest?

Huobi is a global blockchain asset financial services provider including exchange, trade, wallet and storage founded and established by Jun Du in september of 2013 making it one of the foremost crypto exchanges. huobi boastes to be one of the largest crypto-currency exchanges in the world of crypto.

Huobi offers one of the safest and convenient crypto trading services covering the spot market, OTC, margin trading futures e.tc. To know more about Huobi, check out this guide by @whitestallion

So let's get on with it

Margin Trading with Huobi Pro

What's margin trading you may ask if you're not used to the term

Margin trading is a method of trading assets using funds provided by a third party. When compared to regular trading accounts, margin accounts allow traders to access greater sums of capital, allowing them to leverage their positions.

Source

Margin trading refers to the practice of using borrowed funds to trade a digital asset which forms the collateral for the loan. For example, if you have 100 USDT you can apply for loans which would be repayed later to trade and your gains can be magnified. Essentially, margin trading amplifies trading results so that traders are able to realize larger profits on successful trades.

Margin trading is also often referred to as leverage trading — “leverage” is the amount by which a trader is able to multiply their position. A margin trader that opens a trade with 3X leverage, for example, will multiply their exposure and potential profit by 3 times.

Different crypto exchanges offer differing amounts of leverage. Some exchanges offer up to 200X leverage, which allows traders to open a position 200 times the value of their initial deposit, while others limit leverage to 5X like poloniex and 3X like Huobi. Don't be confused on he term "leverage" Leverage is typically referred to via the former “X” terminology in the crypto trading world. 100X leverage is the same as 100:1 leverage.

Now that we've understood the basic stuffs let's dive in a bit deeper

There are three simple steps involved in margin trading

- Request for loan

- Trade on margin (long/short)

- Repay margin loan and Interest

1) Request for token loan

a) Login to your Huobi global account, for details on creating an account, view this article by @whitestallion. Navigate to the top menu option slightly towards the left. click【Spot trading】at the top menu option and select【Margin】as shown below:

b) Upon entering【Margin】page, switch 【Margin】account type to 【Cross】and select a trading pair. I would be using BTC/USDT for this guide.

c) Now we need to transfer assets from our 【Exchange】account to our 【Margin】account.

We are transferring assets from【Exchange】to 【Margin】account so ensure it's in that order then select asset which you want to transfer and enter amount of assets. Since we chose BTC/USDT trading pair, let's transfer some USDT. Click confirm to execute the transaction.

e. Upon successful transfer of the principal balance to the Margin Account, users can start to borrow token by clicking the【Loan】button option on the Trading Panel as shown below:

f. Click【Loan】to access dialog box below, maximum available loan amount based on the principal balance will be displayed. Input the requisite loan amount in the input box below. The selected token e.g. BTC below, is the token to be borrowed using USDT transferred into the Margin Account.

source

Reduce the loan amount if the original input amount exceeds the maximum available loan amount, For example our minimum loan amount in the image above is 0.02BTC while maximum amount is 0.077, our amount can't exceed this range. The loan will be effected and the borrowed token will be reflected in the margin account if there is sufficient principal balance.

g. Upon successful loan application, loan position will be reflected in the account, and can be verified by accessing【Balances】on the top of the website,【Margin Account】sub-menu option and clicking 【Cross Leverage】tab as below:

source

2) Margin trading (long/short)

Margin trading can be used to open long and short positions. When you open a crypto margin trading position, you have the choice of “going short” or “going long.”

A long position is taken by a trader that thinks the price of a digital asset will rise. If there's expectation of a price rise in assets take the BTC/USDT pair for example. Using the above guide, we transfer assets (USDT)to our margin account, borrow tokens (BTC), purchase target at a lower price, sell at a higher price and earn the remainder after repayment of loans plus Interests.

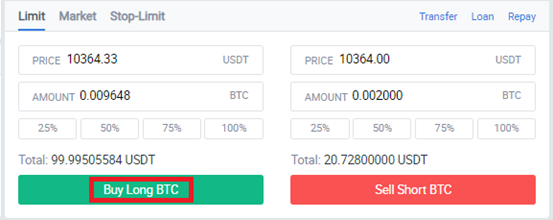

a. At the【Margin】page, there is option to apply limit price, market price and stop-limit buy order

b. When the token price hits the target selling price, input sell order using limit price, market price or stop-limit sell order.

Going short, or “shorting,” is the opposite. A trader will open a short position if they believe a digital asset will fall in value. Shorting is used by traders that seek to profit from falling crypto prices. In the case of Sell Short, borrow the target token (e.g. BTC) to sell token at a high price and purchase at a lower price to earn a profit.

a. Firstly, borrow a fixed quantity of the target token.

b. Upon successfully borrowing the token, sell short on the Margin tab at a high price.

c. Once the price falls to the target level, buy back the token in the Margin tab at a lower price and repay the loan + interest on loan

Repay margin loans and interests

It's very important to repay margin loans and interests and on a timely basis to avoid incur unnecessary charges. Note, interest rates are charged as a percentage of the borrowed tokens and on a hourly basis so the more time by the hour you spend without repayment the more likely it is to pay a higher interest rate.

a. To payback loaned tokens and interest, access【Balances】on the top of the website,【Margin Account】sub-menu option and clicking 【Cross margin account】tab as below to check outstanding applications:

b. Click ‘Repay’ button on the right side to access the Repay dialog box, input the quantity to repay, verify input amount and click ‘Confirm’ button

Note

Margin trading is regarded as a high-risk investment strategy that depends on the short-term market movement. The crypto market is very volatile when compared to traditional securities or forex markets, which makes it more risky.

There are a number of important practices and strategies that you should think about before margin trading Bitcoin or other cryptos:

Progressively increase trade size: If you’re new to margin trading, it’s best to develop a firm understanding of the practice by starting with smaller position sizes and lower leverage.

Try your hand at demo trading: Paper trading, also known as demo trading, allows new traders to “practice” trade in a fake trading environment. Demo trading platforms don’t take real money, but they do reflect real market prices. Demo trading gives newer traders the ability to put their strategies into action without risking capital.

Understand order types: Margin traders often use combinations of order types such as stop loss and take profit in order to lower risk and open complex positions. These order types can assist by setting specific profit or loss targets and automatically closing positions.

Pay attention to fees and interest: When you open a leveraged position you will pay interest on the capital you borrow. Margin trading Bitcoin and other cryptos incurs ongoing fees that can quickly cut into your profits.

Sign up for Huobi

This post is set to 100% power up

Subscribe:::Discord.

:::Whatsapp :::join trail :::Steemalive Website

Tweet-ed