Lectures Begin: My first Experience As a Lecturer- Taxation (Reliefs and Allowances In Nigeria

Even though I have not been directly assigned a course or courses to handle, I have begun lecturing in Ernest. I was thinking I was going to be nervous at the beginning, but I now understand the real value of advance preparation and understanding the courses to lecture. I am attached to a senior lecturer to put me through as I assist her handle her courses.

She had been fixing lectures for me to handle but the students had been the reason why I am just starting this week. They would not be ready to learn and the lectures will be postponed. However, this week, I have been able to get the opportunity to start my journey as a lecturer.

On Thursday, I was assigned to lecture Public Admin Students who are in their second year, Evening session. The course was Taxation which is a borrowed course to them. It therefore means that I will need to really understand this course because to them, it is foreign. The lecture was to be held by 3.30 pm and I needed to prepare thoroughly. I was given the materials to use as a textbook while I also had to research online for proper understanding. The topic was Reliefs and Allowances in Taxation.

Reliefs and Allowances are those deductions that the law allowance to be deducted from a tax players' income before taxes are charged. These deductions therefore reduces the amount tax payer pays and it becomes a sort of relief to him or her. It reduces the burden such that he or she pays lesser. Take note that a tax is that amount of your contributions to the public or government purse in support or their services or provisions to the general public. The government is responsible in providing good roads, and other social amenities. Paying taxes is a way an individual or an entity contributes to the government to enable them take care of these things. It therefore becomes compulsory that taxes must be deducted from a tax payers income according to the law.

However, there are provisions that try to lessen the burden of the amount of tax to be paid by a tax payer of which part of it is this reliefs and Allowances as a topic in taxation. They are

Personal allowances

Children allowances

Dependent relative allowances

And many more

The law allows a certain amount of percentage of a tax payers income to be deducted depending on the type of allowances as mentioned above. When it comes to children allowances, the law only allows for a maximum of 4 children and the amount is 2500 naira per child while it allows only 2 dependant relatives which must be a tax payers direct parents or the direct parents of the tax payers' spouse.

However, with the passage of time and with the recent law amendments (the Personal Income Amendment Act 2011), we now have what is called consolidated relief allowances whereby these individual allowances are bundled up into one. The amount to be deducted as a relief under this consolidated relief allowance is 200000 Naira or 1% of a tax players' gross income, whichever is higher pulse 20% of a tax players' gross income. The total is what will be deducted from a tax players' income before tax will be deducted. This therefore reduces the amount a tax payer will pay as tax.

There are other sub topics under this, one of which is incomes that are not allowed under law to be taxed. I was able to go through all before the time. The senior lecturer I was attracted to called the course representative and even gave him my number so that he can call me when they are ready for me. The call came in by few minutes to 4 pm and I quickly went in for the class. Yes, the course rep told me the lecture hall were I will meet them. I said a prayer before going and this gave me the needed boldness to walk in without any fear or anxiety.

I was able to meet them, introduced myself , they gave me their writing material which is the marker. Then I wrote the course and the topic on the whiteboard. Then I began. I was able to explain to their understanding, they asked questions where needed and I broke the topic down to their level of understanding. The calculation aspect was a bit of a problem for them but I was able to help them under it. Especially how to get the consolidated relief allowances which is two hundred thousand naira or one percent of a tax players' gross income plus 20% of a tax players' gross income. A little example below:

Q. Assuming a tax players' gross income is five million Naira, calculate the consolidated relief allowance he will pay.

And. I will first of all get 1% of the gross income because I will compare it with the two hundred thousand naira, whichever one of higher.

1% of N5000000 = N50000.

N50000 is lower than N, therefore, I will disregard the N50000 and work with N200000

It is therefore, N200000 plus 20% of gross income

20% of N5000000 is N1000000.

Therefore, consolidated relief allowance is N200000 plus N1000000

= N1200000.

This amount will be deducted from a tax payers income before tax will be deducted. This in effect will reduce the amount of tax a tax payer will pay.

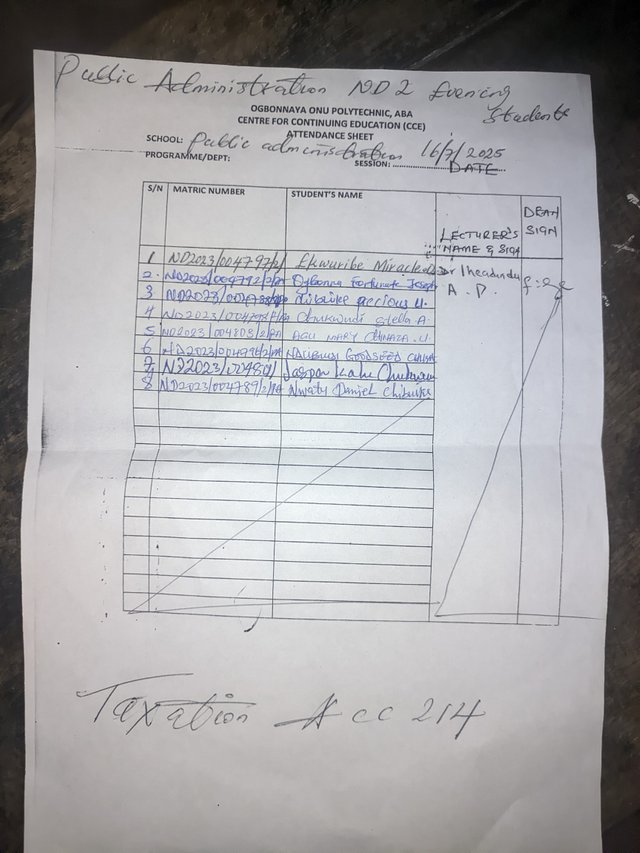

After explaining with examples, they got the point. However, one of them told me that I have tried, though she didn't get it, that it is not my fault but her fault who takes more ti.e to understand calculations or that in fact, calculation is nit her thing. I told her to go home and digest it and in our next class, I will try again and she was happy. They all were so happy with the lecture, they all wrote attendance as it is the custom in the school, I signed on behalf of the lecturer that sent me, there is a column where the dean of the study will sign. They will submit the attendance at the end of the semester. I took a picture of it and it is below

| the attendance list |

|---|---|

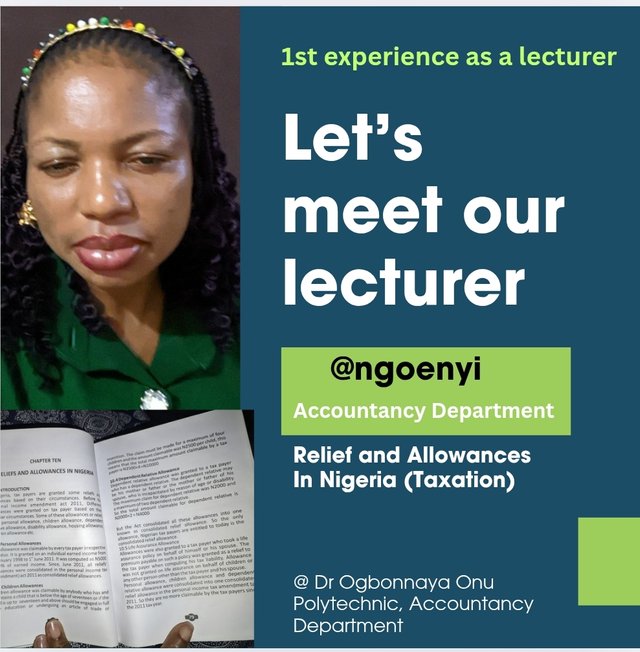

| the face of a new lecturer |  |

| the material I used coupled with my online research |

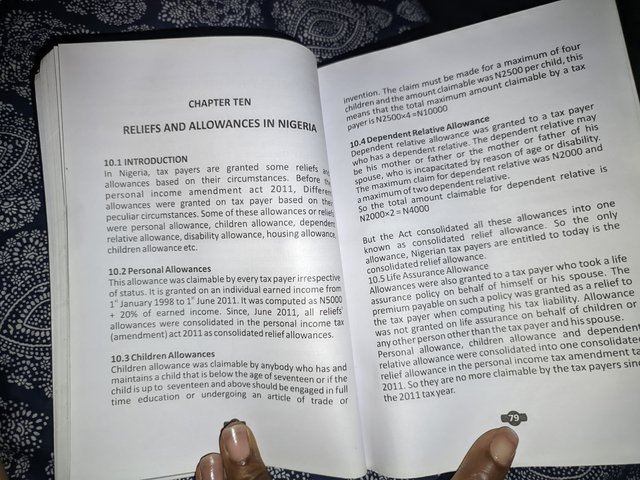

| The topic |  |

The new topic I will lecture them on will be Basis Period. Don't miss this. It will be next week if all things are equal. Be on the look out. However, I have already handled another class. And that is my second experience loading...! Be on the loom out.

This is my introductory post here

This is very interesting, without being in the classroom, I understand the topic with just your publication.

This is great, I know you're doing great and would make us proud as a lecturer, the part of nervousness is totally out.

Best wishes to you in your new placement.

Your post has been supported by the TEAM FORESIGHT. We support quality posts, good comments anywhere, and any tags

Thank you for the support.

https://x.com/NgoziNwank56943/status/1946299931561468353?t=VFS44jaQ_T8RnIL9UQNXiQ&s=19

Congratulations to you sister,I am very much happy for you becoming a lecturer, Accounting is one of course one should run away from because do what ever we are doing on earth we need to give account of everything.

Material things are also accounted for.

I hope you have your first experience and I students are funny when seeing a new lecture introducing to them.i thank God they have giving you attention and i love the way you respond to them.

Using taxation to run your first lecture.

But lecture work is not easy but I pray God to see you through

Thank you so much for your encouraging comment. With God, I will succeed

💦💥2️⃣0️⃣2️⃣5️⃣ This is a manual curation from the @tipu Curation Project

@tipu curate

Upvoted 👌 (Mana: 7/8) Get profit votes with @tipU :)

Job well done 👏

Thank you for publishing an article in the Steem4nigeria community today. We have assessed your entry and we present the result of our assessment below.

MOD Comment/Recommendation:

Mrs lecturer, I'm so proud that you're finally helping people learn what you learnt back then in school. Keep on the ride and may Jehovah continue to strengthen and support you as you multitask. A warm hug

Remember to always share your post on Twitter using these 3 main tags #steem #steemit $steem

Hi, Endeavor to join the #Nigeria-trail for more robust support in the community. Click the link Nigeria-trail

Guide to join