More about Thoth economics

Today, I wanted to understand Thoth's rewards distribution a little better, so (no surprise), I pulled out another spreadsheet. The goal was to understand what amount of rewards the blockchain would direct to Thoth's delegators in comparison to their potential returns by self-voting under a variety of scenarios.

So let's start with the theory. My basic idea is that a mechanism like Thoth can outperform the current generation of delegation bots because it can attract organic votes in addition to proxied self-votes. If right, this has several benefits for the ecosystem:

- SPAM reduction: Delegators don't need to post daily vacuous posts in order to optimize rewards;

- #passive-rewards: This is the flip-side of number 1. Investors optimize rewards by delegating to the delegation service that does the best job of drawing organic votes.

- #lifetime-rewards: The Steem blockchain has produced more than 98,463,384 blocks. Of those, 98,261,784 (99.8%) happened before the current payout window. The mechanism behind Thoth can bring new rewards to posts in that 99.8% of all blocks.

- The flip side of rewards for authors, is that Thoth also helps authors by bringing eyeballs to their previously buried content.

- Finally, if Thoth is doing its job well, it benefits visitors by replacing SPAM with interesting content that visitors might actually enjoy reading.

All of this fundamentally depends on Thoth actually being able to deliver better rewards for delegators than the current generation of voting services. Can it do that? Let's take a look.

Basically, there are 3 factors that effect the returns:

- The ratio of ownership vs. delegation in the Thoth account. i.e. if I am running a Thoth account with a 3 million SP ownership stake, and I have 1 million SP delegated to me, that's a ratio of 3. If I'm running it with 100,000 SP owned and 1 million delegated, that's a ratio of 0.1.

- The beneficiary percentage that's being assigned to posts. Obviously, this can range from 0 to 100%.

- The impact from organic voting. I'm calling this "vote amplification". If nobody else votes for the post, the vote amplification is 1. If external votes double the post's value, the vote amplification is 2. And so on.

Combine it all, and I come up with this equation: expected_rewards = vote_amplification * beneficiary_percentage * (1 + ownership_ratio)

This equation comes entirely from intuition and from observing the behavior of numbers in a spreadsheet. I believe, but have not proved or verified, that this equation describes the expected returns for a Thoth delegator.

The way Thoth is constructed, the number of delegators shouldn't matter (beyond some minimum that I'm ignoring for now). This is because the beneficiary algorithm is constructed to distribute rewards in proportion to the delegation amount. When delegators get selected as beneficiaries, they get a return from all delegations - not just their own. This is balanced by the times when they don't get selected. The more they delegate, the more likely they are to be selected. In the end, if I'm not mistaken, the expected returns should be identical for 20 delegators or 100.

So, on to the numbers, what can we expect?

Ownership vs. Delegation and beneficiary percentage

Be forewarned. This is unverified, and it could easily be mistaken. |

|---|

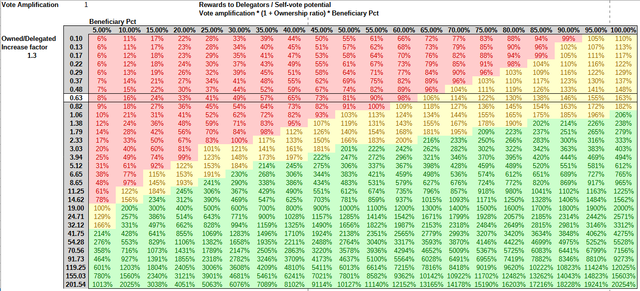

I started off by creating a table where I could see the potential values with the ownership ratio on the left-hand side and the beneficiary percentage across the top. The ownership ratio is multiplied by 1.3 in each row in order to fit an interesting amount of rows into the viewing area. I then added a parameter so I can check the same numbers at different vote amplification rates.

The row at 0.63 has its border outlined because that is the one below what we currently see in the Thoth testing account (@thoth.test, and I'm counting the delegations from penny4thoughts as "owned" because that account is now excluded from the beneficiary selection).

Red cells score less than author rewards from proxied self-voting (100%), yellow cells perform less than proxied self-voting + curation rewards (200%), and green cells outperform proxied self-voting with curation rewards.

Vote amplification 1 (no organic voting)

Here are the expected returns to delegators if Thoth is the only one voting.

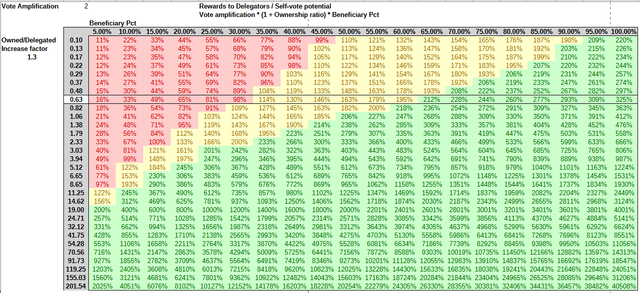

Vote amplification 2 (organic votes double the post value)

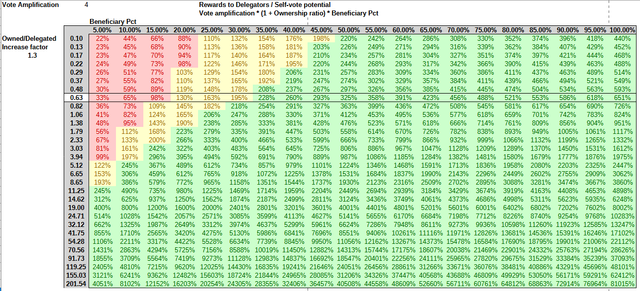

Vote amplification 4 (organic votes are 3 times as high as Thoth's voting)

So, the unsurprising observation is that when vote amplification goes up, the Thoth operator can produce better results with lower ownership/delegation ratios and also with lower beneficiary percentages.

I picked the 2 and 4 as the amplification factors because my current testing has the beneficiary setting at 37.5% for delegators. In the 63% row and the 40% column, we can see that vote amplification of 2 is when delegators will be expected to outperform proxied self-voting and a vote amplification of 4 is when they'd be expected to outperform proxied self-voting with curation rewards.

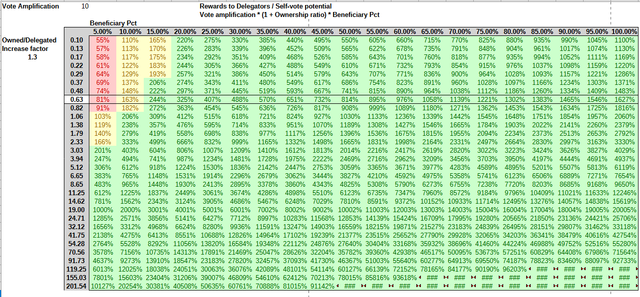

Just for fun, let's look at 10, too. Suppose Thoth's $0.10 vote gets amplified to $1.00.

Vote amplification 10

As you can see, expected rewards to delegators get pretty big, pretty fast.

Discussion

To me, the interesting thing here is that the Thoth operator, the included authors, and the included delegators all have a clear incentive to encourage organic voting on Thoth's post. Also, voters can still collect curation rewards. it's a "win, win, win, win" scenario.

The effect of vote amplification

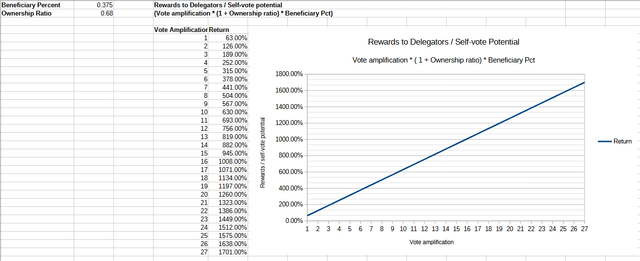

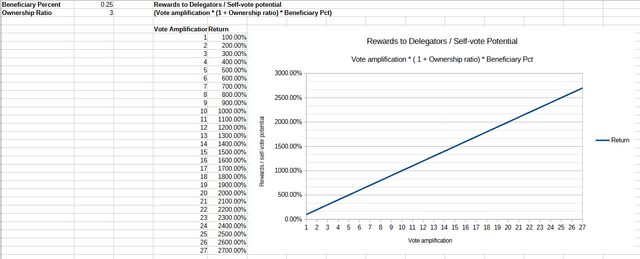

In the previous section, we saw the effect of vote amplification on a range of ownership ratios and beneficiary percentages. What happens, instead, if we hold the ownership ratio and beneficiary constant and look at vote amplification in a graph.

Unsurprisingly, it's a simple straight line, but let's take a look at a couple examples, anyway. The main focus is the lower-left corner of the graph.

Example 1: Values from @thoth.test (0.68 ownership ratio, 37.5% beneficiary percentage

This confirms what we saw before. In order to outperform proxied self-voting with curation rewards, the Thoth account needs vote amplification to be somewhere between 3 and 4.

Example 2 (ownership ratio: 3, beneficiary percentage 25%)

At an ownership ratio of 3 and beneficiary percentage of 25%, expected rewards would immediately outperform proxied self-voting, and it only needs vote amplification of 2 to match proxied self-voting with curation rewards.

Discussion

So, in principle, this seems to support my intuition. With enough ownership stake, and enough incoming organic votes, a Thoth account should be able to help an investor receive more rewards from the blockchain the current generation of voting service. This is because, by and large, the content going into the current generation of voting service has no appeal to organic voters. OTOH, Thoth's goal is to produce content that will actually hold appeal for readers and organic voters.

Conclusion

After looking at Thoth's expected reward mechanism with an eye towards evaluation of the owner ratio, the beneficiary percentages, and the vote amplification, I continue to believe that the gen-5 voting service framework holds promise for the ecosystem.

It can improve the experience for the reader and curator by reducing SPAM and serving up interesting content; it can improve the experience for the author by providing rewards and audience over an extended time period - long beyond 7 days; and it can improve the experience for the delegator with fully passive rewards and higher returns. By operating a gen-5 voting service that actually surfaces interesting articles, it seems that the operator creates a win-win-win-win scenario for all involved stakeholders.

Finally, all of these positive changes could (conceivably) lead to an influx of attention economy value in the Steem ecosystem, which stands to make it a win for other STEEM investors, too.

Just remember this one caution. None of this information has been proved or verified, and it could be filled with errors. Sorry, but that's the way it goes when first-of-breed technology is a hobby project. 😉 Please let me know if you discover any errors here.

Please visit the @thoth.test account to see what it looks like, in action.

Thank you for your attention!

You can see my active projects, here.

A complicating factor for your strategy is that there's not an infinite pool of organic voting to capture, so treating it as an independent linear variable is probably not realistic. I don't know if there's an easy way to measure the size of the organic voting pool, but you could at least put a ceiling on it by subtracting off the known delegation bots, known self-voters, and the steemit curator accounts.

I'm not sure if it's necessary to track different account types like that. Voting behaviors can always change and delegations can always be shifted. But I think what you're getting at is that it's a lot easier to amplify a small post than a large one.

For example, it's easier to double a $1 post than it is to double a $100 post - and it's basically impossible to 10x a $1000 post (at today's prices). At some point, the account just becomes too large to get much benefit from organic voting.

I also thought of this, but left it out of the analysis because I haven't really thought it through yet. My first impression is that it's an argument for decentralization and competition. For example, there could be moderate sized Thoth accounts posting in English, Spanish, German, Ukrainian, etc... there could also be Thoth accounts that specialize in topic areas: science, history, current events, etc... (one of my favorite features of the test account has turned out to be the English language summary of non-English articles)

So the fundamental thing is probably that there would be diminishing returns as the account grows. And I agree that this mechanism needs to be better understood. This is on the to-do list. ;-)