The Pattern for Handling Market volatility

Market volatility cannot be ignored, it's always right after our investments, our businesses, money and every other aspect. Market volatility is the level of price variation of a financial asset like bonds, stocks, and even goods.

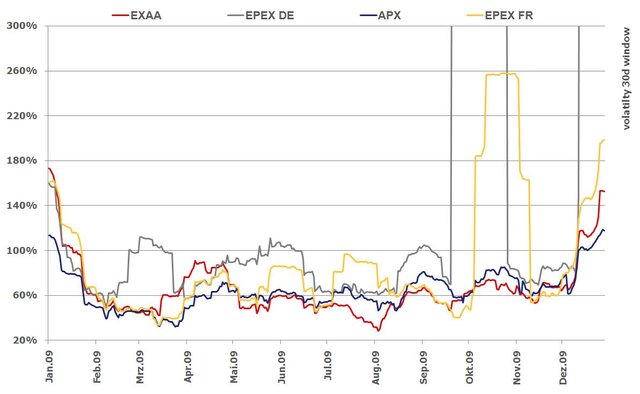

Image source

It is only natural for entrepreneurs to wait for the perfect time to sell their products, and investors also wait for the perfect time to sell their stock, market volatility is a perfect way to disrupt even the most well-laid-out plan, and when entrepreneurs and investors wait for too long to make a decision, the volatility of the market may completely ruin the investment plan.

Business valuations are affected by market volatility in several ways;

The confidence of buyers is limited as uncertainties set in from time to time. Market prices are consistently imbalanced, making it possible for the overall business evaluation to drop significantly.

With a volatile market, buyers would try to negotiate even harder, which could frustrate a business owner. Regardless of how volatile the market is, trying to wait for the right time to sell may be tempting but also comes with its downsides.

While you patiently wait for the perfect time to sell, you may lose out on opportunities for buyers who may be willing to invest, and the level of great buyers can also be significantly reduced. Different things trigger market variation, when there is an announcement made about unemployment, inflation, or GDP growth, it can trigger market volatility.

Political instability, driving volatility, war or trade disputes bring about uncertainties with market prices as well. Adjustments made by central banks can also trigger the value of market prices and create significance there.

Rather than waiting for the perfect time you assume to sell, investors and entrepreneurs should understand the right way to monitor the volatility of the market. A smart investor will adjust strategies that will align with risk tolerance, protect the portfolio when uncertainties are heightened, and then identify possible opportunities for entry and exit in the market.

As we consider market volatility to come with risk and annoying burden, it can also come with great opportunities but that is if we learn to look at things closely and take out the opportunities that lie within. Active traders know how to look for short-term price movement and utilize it for their good. However, this is a risky move, And it is best to approach it with a properly calculated strategy, conduct research, work with data-driven analysis, and stay away from impulsive decisions that are sponsored by greed or fear.

Market volatility can be handled in different ways, some techniques have proven to work over and over by those who have grown to become experts in the space. When investment is spread across different sectors, fields, and industries, then it is possible to save your capital from the volatility of the market.

Hedging strategy is another method that works for investors, where they can employ options, futures, or other forms of derivatives that will help protect against market movements.