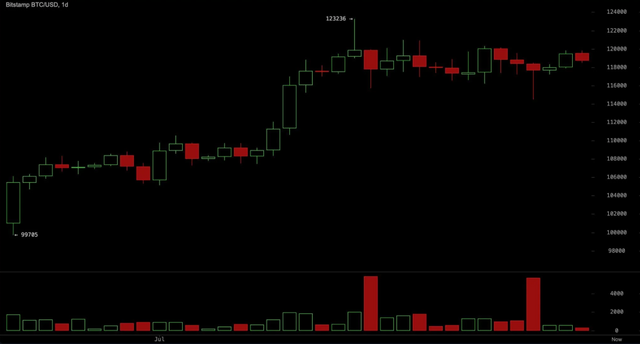

Bitcoin Price Watch: Uptrend Intact, but Volume Drop Raises Caution

Bitcoin Price Watch:

Bitcoin’s price stood at $118,629 to $118,823 over the past hour on July 28, 2025, with a market capitalization of $2.35 trillion & a 24-hour trading volume of $38.23 billion. The digital asset traded within An intraday range of $117,953 to $119,754, reflecting a consolidative pattern amid reduced volatility.

Bitcoin:

On the daily chart, bitcoin remains in an uptrend from its base around $99,700, though recent candles indicate plateauing around the $119,000 to $120,000 zone. A volume spike leading up to a peak at $123,236, followed by declining volume, suggests buyer exhaustion. Long upper wicks on recent candles also imply rejection at higher levels, reinforcing the possibility of a distribution phase. Traders are advised to watch for a pullback to the $114,000–$116,000 support area, with entry signals hinging on bullish reversal patterns.

On the 4-hour chart, Bitcoin experienced a sharp sell-off from $120,297 to $114,518, followed by a swift V-shaped recovery. However, the rally stalled around $119,500–$120,000, & subsequent candles show a series of lower highs, indicating weakening upward momentum. A potential entry exists if the price rebounds from the $116,500–$117,000 zone with volume confirmation. Aggressive traders may consider entering above $119,800 if strong buying volume returns. If the price breaks below $114,000, this would invalidate bullish setups, prompting exits.

The 1-hour bitcoin chart reveals a range-bound structure between $117,900 and $119,800, with increasing bearish pressure and a sequence of lower highs. Traders should seek long positions only if the price holds above $118,000, supported by green candle volume. Short-term scalping may be viable between $117,800 & $118,000. Target exits are set around $119,800, with a stop-loss below $117,500 to guard against trend reversals.

Bull Verdict:

Bitcoin continues to demonstrate underlying strength with all major moving averages signaling a buy, suggesting that the broader uptrend remains intact. If volume returns and price breaks convincingly above $120,000, bulls may regain control, pushing bitcoin toward a retest of the $123,000–$124,000 resistance zone.

Bear Verdict:

Despite the prevailing uptrend, declining momentum and multiple rejections near $120,000 point to potential exhaustion. If bitcoin fails to hold above key support at $117,500 and breaks below $114,000, bearish pressure could intensify, triggering a deeper retracement toward lower support zones.