Use and potential of technology in the financial sector

In your view, how important can blockchain technology be in the future of finance?

Blockchain plays a crucial role in digital life where ledgers are used to store information or data across many computers to ensure data security. Blockchain is the future of digital finance, where many people still continue using it to perform their transactions on a daily basis. The most interesting thing is that it reduces transaction costs when you transfer from one exchange to your wallet or for payment of goods or services to your sellers.

Another thing is that it will prevent fraud from attacking your account; that's why some people make use of two-factor authentication to safeguard their wallet. It promotes trust as well as transparency, where all data and transactions are available for everyone to access the system.

How are mobile financial services (e.g. bKash, Nagad) transforming the economy of rural people?

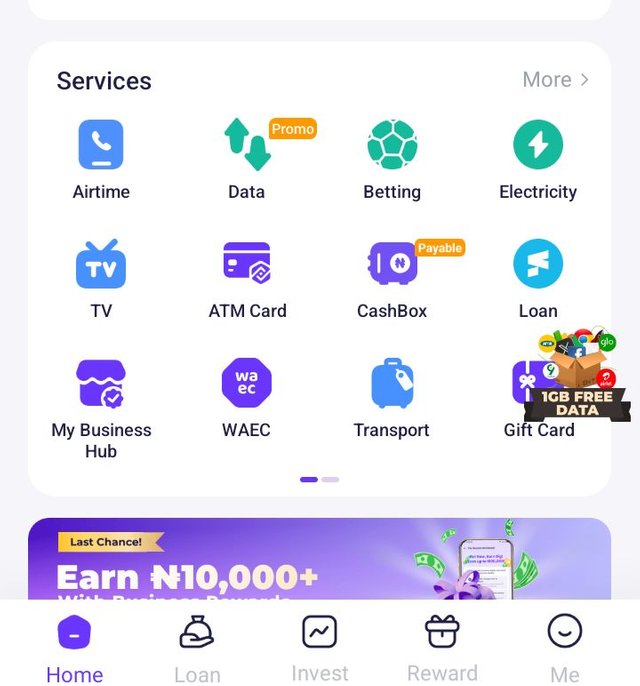

We are in the technology age where mobile banking has changed the financial system of people in rural areas. This system serves as a financial opportunity for people in rural areas to promote their economic growth. Some of the mobile financial services in my country are PalmPay, OPay, Kuda, and Monie Point. These services are breaking down traditional obstacles to our financial access.

Farmers are the major occupation of people in rural areas and some of them also use mobile banking to receive money from their customers instead of going to traditional banks to access their money. Using mobile financial services is very easy and convenient, and some people in rural areas cannot go long distances to perform transactions in a bank.

Once you have a mobile phone and stable internet service, you can perform as many transactions as possible. The charges are low compared to traditional banking, so this will benefit low-income households in rural environments.

Is cryptocurrency challenging conventional currencies? How do you see its future?

Many people believe that cryptocurrency is the next generation of assets where some investors invest huge amounts of money in any cryptocurrency of their choice because they know that the future of cryptocurrency is bright. The performance of cryptocurrency highly favors investors because most of them have full access to their wallets without third-party involvement. Conventional currencies nowadays lose some value as people spend large amounts of money to purchase goods in the market.

Cryptocurrencies increase in value; we can see that Bitcoin rose from $0.10 beyond $95,000. In fact, people's predictions also align with how cryptocurrencies grow. Cryptocurrency is challenging conventional currency because it can be used as an exchange in place of conventional currency.

What are the benefits or challenges of using artificial intelligence (AI) in the finance sector?

Artificial intelligence has a lot of benefits in the financial sector because it will help financial agencies fully understand the market and their customers. Artificial intelligence can make the work easier by creating a mutual relationship between customers and financial organizations. It serves as an opportunity for big companies because it assists them in meeting their organizational goals.

We are in a digital world, and many agencies have adopted technology to help solve some financial issues or challenges they are facing in their workplaces. AI plays an important role when it comes to financial services because it allows an organization to move forward as well as ensures transparency.

Digital banking vs. traditional banking – which will survive in the next decade and why?

Digital banking continues to dominate the banking sector all over the world, where many people embrace digital banking as a means to save money and perform various transactions. Digital banking depends on technology to help the bank and its customers manage their funds.

Screenshot from my palm pay account

Screenshot from my palm pay account

As users, we can operate digital banking with our smartphones in different places we find ourselves. Some traditional banks are not able to pay salaries properly; in fact, they deduct a huge amount of money from customers' savings. Additionally, most of these traditional banks still use old technology to attend to their customers. As a result, many customers will not find it convenient. Thus, digital banking is the future of the banking system worldwide.

Thanks for reading through my post and I would like to invite @manuelhooks, @berda01 and @richy20 to participate in this contest.

Upvoted! Thank you for supporting witness @jswit.

Thank you for publishing a post on the Hot News Community, make sure you :

Verified by : @mainuna