DISTRIBUTED CREDIT CHAIN - CHANGING BANKING STANDARDS IN THE ERA OF BLOCKCHAIN.

Distributed Credit Chain (DCC) is the world's initially conveyed managing an account open tie with an objective to build up a decentralized biological system for money related specialist co-ops around the globe has arrived. The conventional money related industry is exceedingly concentrated. With considerable exchange charges paid out to huge budgetary establishments, monetary exchanges depend vigorously on the underwriting and support of these organizations. Indeed, loaning rates for borrowers are raised while diminishing the intrigue wage for banks by the monopolistic monetary organization. Now and again making it outlandish for banks to precisely recognize the hazard, the middle people have even contorted the FICO score of borrowers for their own particular advantage.

Since computerized innovations overwhelm relatively every mechanical division in the 21st century, the keeping money and monetary segment is no exemption. In any case, the inquiry emerges: how quick can the managing an account segment get up to speed with the most recent advances in innovation? Contrasted with different enterprises, the managing an account and monetary division is digitized just at a moderate speed, since regardless it works on a customary concentrated framework that is controlled by just a couple of players.

PROBLEMS

The traditional financial industry is profoundly unified. Money related exchanges depend intensely on the underwriting and support of vast budgetary organizations, with considerable exchange expenses paid out to these foundations. Monopolistic money related foundations have in reality raised loaning rates for borrowers and lessened the premium pay for moneylenders.

COST: The center model of a credit office is to share the expenses of non-enthusiasm gaining components and terrible obligations by charging the "great folks" who can pay back the cash. For borrowers, it brings an extra cost.

EFFICIENCY: From the credit office's point of view, a considerable measure of time and endeavors are squandered in checking the credit of borrowers who don't meet the offices' hazard criteria, which prompts squandering assets and diminishing proficiency.

PROFITEERING: An incorporated credit demonstrate allures numerous money related organizations to veer off from their main role—serving clients. Going for productivity, they deduct loan specialists while pressing borrowers, and grow their benefits by broadening their client base.

SOLUTIONS

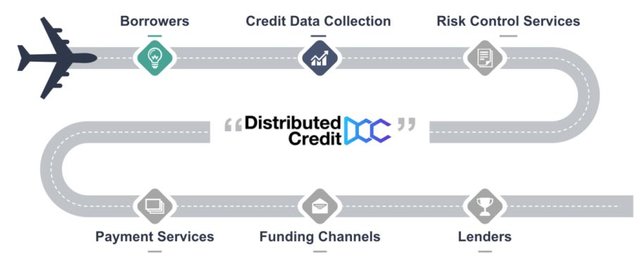

BORROWERS: Individuals with particular acquiring request build up blockchain record to approve information specialist organization and Initiate getting demand

DATA SERVICE PROVIDER: Integrate singular information and store them on the chain, clean messy information, and give information benchmarks

ALGORITHM and COMPUTATION SERVICE PROVIDERS: Extract qualities from information, make judgments in light of approaches and measure judgment in light of attributes

CREDIT HISTORY FEEDBACK: The endorsed financial record reports produced on blockchains counteract issues, for example, long haul obtaining and rehashed test acquiring.

FUNDING PROVIDERS: Not straightforwardly associated with loaning however give financing, (for example, ABS-obtaining organizations).

RISK ASSUMING INSTITUTIONS: Operate a credit business by gaining pay from bearing particular dangers, oversee advances in advance and gather after an advance

ADVANTAGES OF DCC

It breaks the restraining infrastructure: DCC plans to break the imposing business model of conventional monetary organizations and to return income from money related administrations to all suppliers and clients associated with the utilization of worldwide conveyed managing an account biological community. Advanced Banking will at last be a strategy to accomplish a comprehensive arrangement of back.

Decentralized reasoning: Digital Banking will have the capacity to change the collaboration display in conventional money related administrations through decentralized reasoning. This manufactures another shared and all-correspondences model of participation over all districts, divisions, subjects, and records.

Change business structure: Digital Banking will thoroughly change customary managing an account's obligation, resource, and middle person business structure. The tree-like administration structure of the customary bank will along these lines develop into the level structure of a decentralized bank, building up dispersed principles for different organizations and enhancing general business effectiveness.

Government control: in accordance with a run, the way that all records enrolled in the blockchain can't be altered will empower controllers to enter the hidden resources continuously. In view of blockchain information examination, huge information investigation associations will likewise have the capacity to help the administrative bodies perceive and react to industry hazards all the more rapidly.

APPLICATION OF DISTRIBUTED CREDIT CHAIN NETWORK:

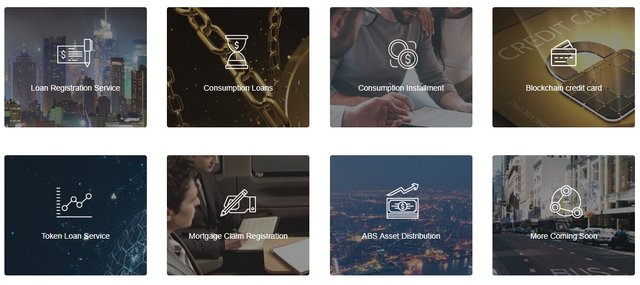

• Loan registration

• Loan consumptions

• Blockchain credit cards

• Token loan service

• Mortgage claim service

• Assets distribution

• And many more

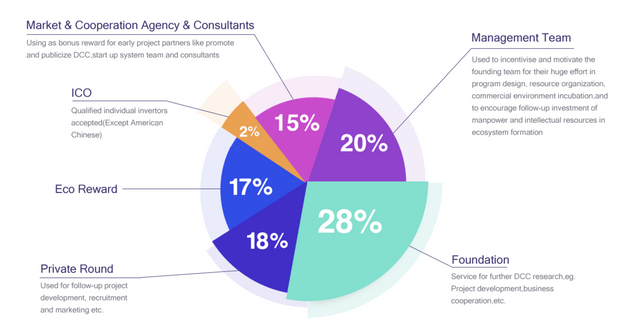

TOKEN DISTRIBUTION

TOKEN AND ICO DETAILS

• Ticker: DCC

• Token type: ERC20

• ICO Token Price: 1 DCC = 0.0388 USD (0.00007299 ETH)

• Fundraising Goal: 49,000,000 USD

• Sold on pre-sale: 26,400,000 USD (BONUS ~80-100% IN USD)

• Total Tokens: 10,000,000,000

• Available for Token Sale: 22%

• Accepts: ETH

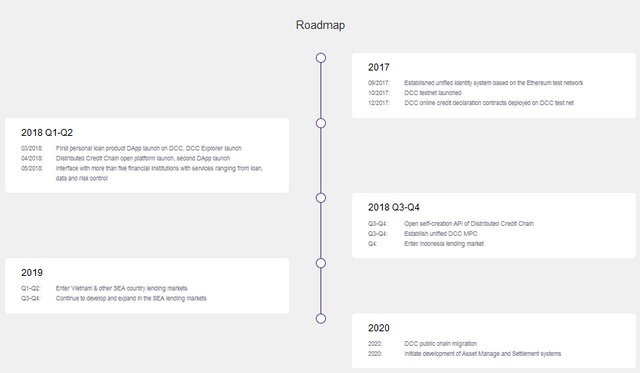

ROADMAP

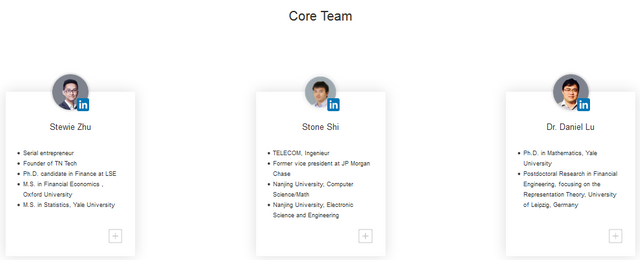

CORE TEAM consist of:

The CEO and founder of DCC Stewie Zhu , who has received many academic degrees, including master's degrees in statistics and finance at Yale and Oxford universities, respectively, is a consistent entrepreneur;

Stone Shi , a graduate of Nanjing University in China, a quantitative research expert, derivative pricing and risk analyst, a great talent in coding and a specialist in Python programming;

Dr. Daniel Lu , a graduate of Yale University, is a specialist in mathematics and finance with a wealth of academic luggage and experience in commercial banking, retail and asset management.

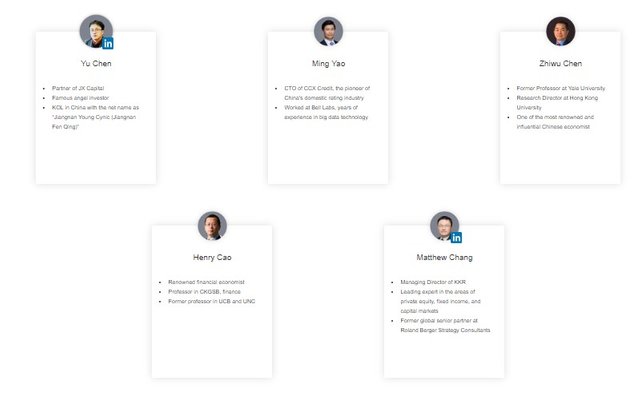

ADVISORS

CONCLUSION

Distributed Credit Chain (DCC) is the world's initially circulated managing an account open blockchain with an objective to set up a decentralized environment for budgetary specialist co-ops around the globe. By enabling credit with blockchain innovation and returning responsibility for to people, DCC's main goal is to change distinctive budgetary situations and acknowledge genuine comprehensive fund.

FOR MORE INFORMATION, KINDLY SEE BELOW LINKS:

WEBSITE: http://dcc.finance

TELEGRAM: https://t.me/DccOfficial

WHITEPAPER: http://dcc.finance/file/DCCwhitepaper.pdf

FACEBOOK: https://www.facebook.com/DccOfficial2018/

MEDIUM: https://medium.com/@dcc.finance2018

TWITTER: https://twitter.com/DccOfficial2018/

ANN THREAD: https://bitcointalk.org/index.php?topic=3209215.0

AUTHOR

JULIET SMITH

Bitcointalk URL: https://bitcointalk.org/index.php?action=profile;u=1776102;sa=summary