Red Alert in DeFi Project: $6.5 Million “Error” Fixed👏

↘️Big gap in the #Alchemix #protocol!

The #DeFi industry is more active than ever before, and #malicious people also have an impact on this activity. Alchemix, one of the leading DeFi projects, experienced something very interesting on June 16 and the rug pull initiative was seen live.

↘️Another DeFi Project Has Raised An Alarm

Rug pull is known as the withdrawal of all liquidity from a project and the subsequent failure of any user to sell their tokens. Many DeFi projects have either done or taken steps towards doing this in the last spin . In the attack that took place yesterday, those who attempted rug pull were those who wanted to change the project themselves.

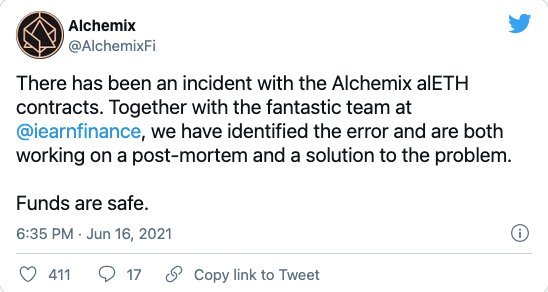

The Alchemix attachment announced that #alETH, one of the #synthetic #assets on the platform, had an “accident”. In a statement on the subject, the team emphasized that the studies on this issue are continuing, the error has been determined, and both the post-error report and the work are done to prevent the error from recurring. The funds were also stated to be safe.

🔥Big Open in alETH Code: Collaterals Can Be Drawn🔥

In a later statement, he emphasized that the incident was actually related to the alETH code software and that this accidentally created additional staking pools and fund safes. Some of these were accidentally used by the protocol, leading to incredible lending debts. In such a case, smart contracts come into play and seize collateral from users to pay off debts that normally shouldn't be that high.

Some people in the community, on the other hand, were able to take advantage of this situation and withdraw their ETH, which was left as collateral thanks to the deficit, although they took ETH-based loans and left their funds as collateral. So this time it was the community that made the rug pull, not the developers, and it saw a $6.5 million fund withdrawal.

🚨First in DeFi History🚨

Although the team later resolved this situation, it is known that many users withdraw ETHs that they left as collateral. This situation, which has never been seen before in the DeFi industry, actually reveals how the industry is growing and developing rapidly. While DeFi may seem quite risky for many investors, events like this actually show that this situation can sometimes benefit users.