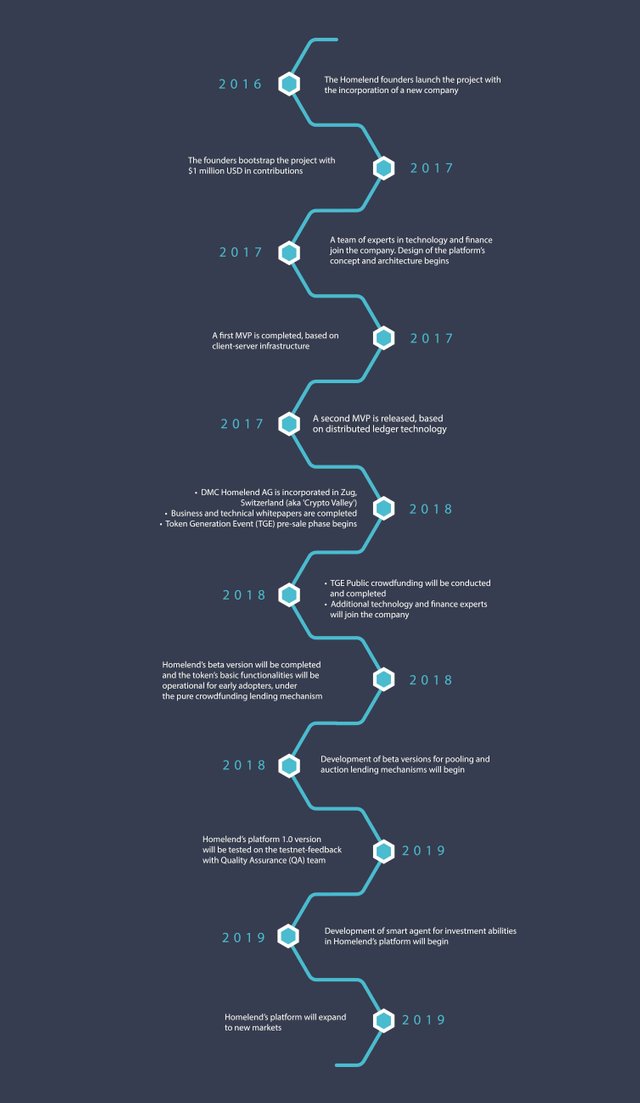

HOMELEND:DECENTRALISED MORTGAGE BLOCKCHAIN PLATFORM

Homelend platform is a decentralized platform allowing the following technology of homebuyer loan financing. Homelend creates an interface for direct interplay among debtors, lenders and other parties worried in the mortgage cost chain. By means of doing so, it permits mortgage crowdfunding the usage of a peer-to-peer version with the security, transparency and automation provided by way of disbursed ledger generation (DLT) and clever contracts.

Homelend connects borrowers and creditors in a unique way, managed with the aid of smart contracts, without concerning middlemen. Borrowers will practice for mortgage loans through homelend’s platform. These programs may be assessed and pre-authorized (or now not) with the assist of synthetic intelligence and gadget mastering technology. Then, character creditors might be capable of fund pre-authorised loans by using shopping for “slices” of them. All methods can be controlled through clever agreement protocols, in place of by way of people.

Homelend will generate sales from origination gas and promoting bargain factors, as is normally executed inside the mortgage industry. All deposits will be completed in homelend tokens (hmd).

Homelend’s community architecture is powered by using blockchain generation and ethereum clever contracts so that it will guarantee that all transactions are obvious, secured and depended on. All information amassed and generated inside the procedure of originating a mortgage loan is saved in a decentralized database maintained via all users. Which means that no person can manipulate the facts or get hold of privilege on any transaction.

Similarly, blockchain technology increases liquidity for the lenders, enabling them to alternate their investments without delay with one another.

The homelend benefit

From guide & period, to efficient & efficient

By means of embedding predefined commercial enterprise logic into clever contracts, digitizing documentation and eliminating needless processes, homelend will robotically provoke cease-to-stop origination, reducing it from 50 days to less than 20.

From ambigu & clunky to transparent & person-pleasant

Homelend goals to create a loan system that isn't always only smart, but also simple and fair. This may allow debtors if you want to effortlessly follow for loans, tune the reputation in their utility at any time and engage without delay with mortgage creditors.

From intermediation price to value-powerful & free-middleman

The firmness, security and transparency supplied with the aid of dlt makes it viable to document transactions, along with loans, without the bank performing as an intermediary. This could reduce fees for borrowers and creditors, whilst minimizing the space between them.

The firmness, security and transparency furnished via DLT makes it feasible to document transactions, consisting of loans, without the financial institution appearing as a middleman. This could lessen prices for debtors and creditors, at the same time as minimizing the distance among them.

From susceptible & unreliable, depended on & safe

Centralized and paper-based totally techniques are the key factors at the back of the insecurity and vulnerability that characterize the conventional loan enterprise. The particular traits of dlt and clever contracts permit homelend to offer a platform for human beings to transact big sums of money in a straightforward, obvious, and comfy way.

The homelend blockchain platform token info

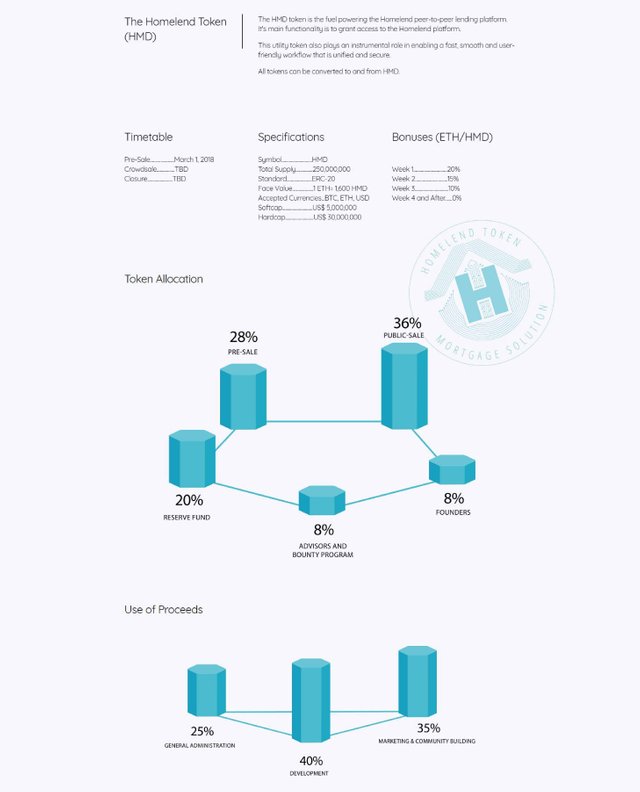

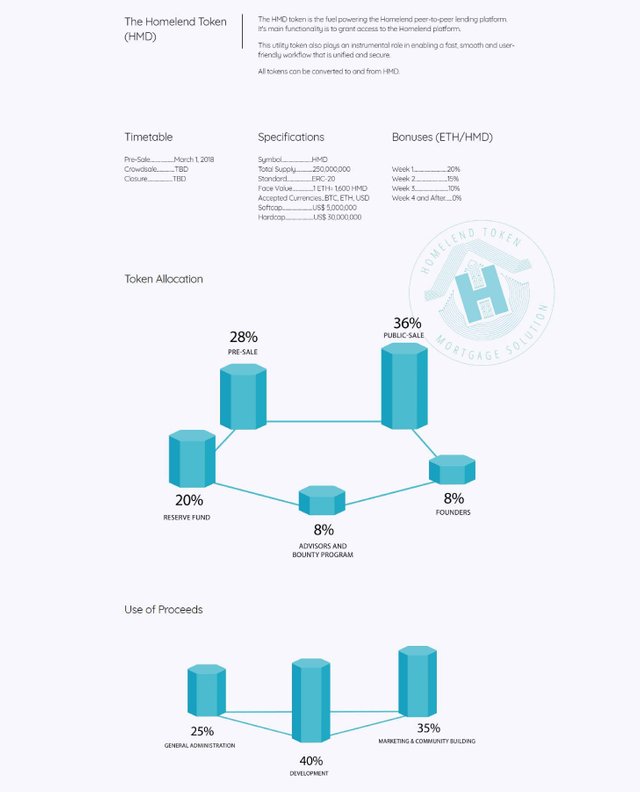

The homelend token is the center piece of each operation inside the homelend platform. The token is used and beneficial for all its person operations such as purchases, lending, paybacks etc. The pre-sale dates starts offevolved at the 1st of March, while crowdsale and closure are to be announced or disclosed (tbd). The symbol at the alternate market is (hmd) with a token overall supply of 250,000,000 hmds. The smart settlement general is the erc-20 coinage paradigm thru a face fee of one(1) eth= 1,600 hmd. Hmds everyday currencies are bitcoin (btc), ethereum (eth), and the united states dollar (USD ). Hmd softcap is estimated at us$ 500,000,000 whilst its hardcap charges for us$ 30,000,000. The bonus ratings are week one ( 1) for 20%, week 2 for 15% ,week 3 for 10% and week 4 and after zero% percentages.

The homelend token distribution and allocation probabilities.

The homelend token distributions are as follows.

-presale (28%), public sale (36%), founders (8%), advisors and bounty programs ( 8%) and reserve fund status at (20%). Using proceeds from tokens are as follows; popular management (25%), development at (40%) and advertising and marketing and community constructing at (35%) in general.

For further information on this project visit the following websites:

Website: https://homelend.io/

Whitepaper: https://homelend.io/files/Whitepaper.pdf

ANN: https://bitcointalk.org/index.php?topic=3407541

Twitter: https://twitter.com/HomelendHMD

Telegram: https://t.me/HomelendPlatform

Facebook : https://www.facebook.com/HMDHomelend/

PROMOTE BY:Yusufuntop

BITCOINTALK PROFILE LINK: https://bitcointalk.org/index.php?action=profile;u=2176682;sa=forumProfile

ETHERUM ADDRESS; 0xc619E93DD1039C5EC66A052ede79fD00c8Ef5D1d