The FANG Stocks Are Still Hissing

It’s no secret that the FANG stocks are an overcrowded trade. Oaktree Capital's Howard Marks is concerned the rise of ETF investing is making FANG stock investing more risky as many of these funds are using the same "momentum" factor.

Marks is known for his prescient investment memos, which warned about the financial crisis and the dot-com bubble implosion. Oaktree Capital had $121 billion of assets under management as of March. The investor has a net worth of $2 billion, according to Forbes. Thus he's earned the right to be listened to.

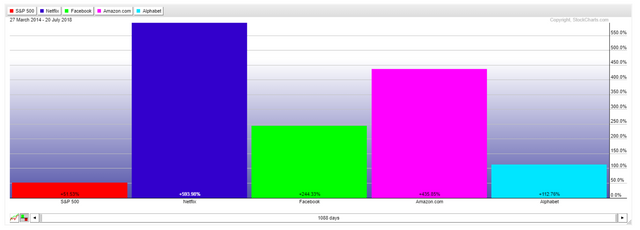

For the last several years and based on the chart below, the trading strategy for the FANG stocks has been “buy high and sell higher.”

However, all great things eventually come to an end, I think there is still a little punch in the punch bowl. There are many ETFs that mimic the FANG stocks like:

First Trust Dow Jones Internet Index Fund (FDN). FANG stocks make up roughly one-third of the 42-company ETF, and have accounted for half of its return during the past five years, according to data compiled by Bloomberg Intelligence. The FANG stocks make up 36% of the holdings by weight.

PNQI tracks the price and yield of the NASDAQ Internet Index, which includes the most liquid U.S. internet companies. The FANG stocks make up 33% of the holdings by weight.

But my go to FANG ETF remains the QQQ. The Invesco QQQ tracks a modified-market-cap-weighted index of 100 NASDAQ-listed stocks. QQQ is one of the best established and most traded ETFs in the world. The FANG stocks make up 36% of the holdings by weight.

So is it time to be worried like Howard Marks, lets go to the charts to find out?

The chart suggests there is still room for price to move to the upside. Price pulled back to the weekly demand at $168 at the end of June before moving higher and reaching new all-time highs. Thus, breaching the weekly demand zone would be a caution sign. The February lows reached a low of $150 and hasn't looked back. Thus, if price approaches and breaches the $150 level, than you have every right to be more worried than Howard Marks.

NOTE: the week ended with a weekly doji candle, which is an indecision candle. This week coming up Facebook, Amazon and Google will announce earnings, so expect volatility the QQQ this week.

This post is my personal opinion. I’m not a financial advisor, this isn't financial advise. Do your own research before making investment decisions.

Published on

by rollandthomas

I think that Amazon will continue to grow and Netflix will continue to grow fast as it gains popularity as a cheaper alternative in emerging markets. Facebook need to die the horrible death that it deserves. Google is anyone's guess. It's a behemoth that may still grow in unpredictable ways e.g. we may all be driving Google cars 10 years from now. But I worry about the censorship and agendas being pushed on Google - it's certainly not neutral!

Well said, as the 4 Titans get bigger, I get more fearful of my entertainment and consumable goods options.

True. But nothing lasts forever!

Your posts are well written!

I've followed Marks through one of my paid financial newsletters and owned his OAK fund for a while. He's been raising many billions for new distressed bond funds in preparation for the oncoming bond slaughter. Their is $4.4T in corporate bonds coming due by 2022. He's going to make a lot of money buying these bonds when everyone panic sells and he can buy the safe ones for $0.40 on the dollar.

Thanks @Morseke1. I don't really know Mark but I have to respect what he has accomplished. I think he has a great pending strategy as I agree, corporate debt is also out of control.

I could not hold back anymore so I bought XLK puts... Let’s. see where this goes!

What made you buy puts and how far out are your puts?

Most of the markets look weak except Tech so I thought a hedge and bought October $70 strikes...

OK, so you gave yourself about 90+ days...which is good.