How does Steem's virtual supply behave when STEEM is priced above the haircut threshold?

Background

One of the things that has fascinated me with Steemonomics for a number of years is the counterintuitive way that Steem's virtual_supply behaves when the price of STEEM is above the haircut threshold. Specifically, when the price of STEEM goes up, the virtual_supply shrinks (and vice versa).

This happens because (equation 1):

virtual_supply = steem_supply + ( sbd_supply * steem_per_sbd ).

When the price of STEEM goes up, the number of steem_per_sbd goes down, and that reduces the second term of the equation.

This doesn't happen below the haircut threshold because the number of steem_per_sbd is held constant by the blockchain's haircut rule.

Pixabay license from geralt.

This increase (or decrease) has a downstream effect on the daily number of STEEM that are produced. So, it turns out that the best way to increase scarcity - setting aside "increase demand" - may be to increase the STEEM price, at least under certain conditions.

So, when the STEEM price is above the haircut threshold, even though the blockchain's core inflation rate will be positive, we can still see long periods of deflation. In practice, I think a single quarter is roughly the longest time period of deflation that I remember - or maybe one year.

We recently learned a surprising lesson about the behavior of Steem's virtual_supply when the STEEM price is below the haircut threshold. Specifically, SBD Conversions don't destroy debt. Instead, they lower the haircut price. And the downstream effects of lowering the haircut price are an increase to the virtual_supply and a corresponding increase in daily STEEM production.

So, I thought I'd start looking to see if we're in for any other surprises if/when the STEEM price crosses above the haircut threshold and stays there (currently about $0.156).

TL;DR - No big surprises so far. It looks like there might be a rule of thumb that 80% of virtual_supply reduction can be achieved when the price of STEEM is about 6 times the haircut threshold. |

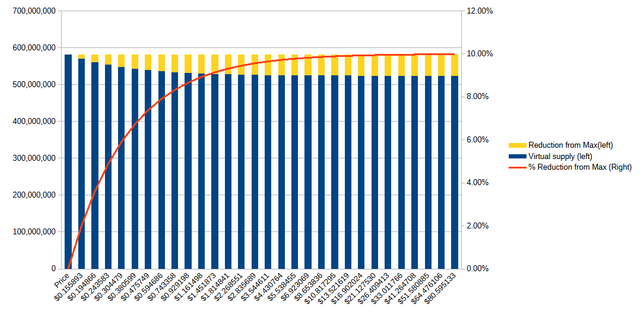

STEEM and SBD Supplies at current values

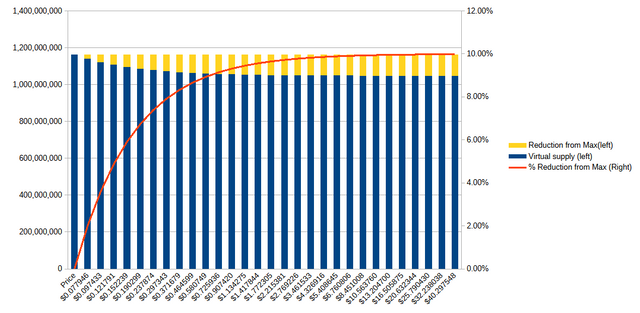

Typical for me, I started this exploration with a spread sheet, a table and a graph. Here's the behavior I found for virtual_supply at a variety of prices when holding the current_supply and current_sbd_supply constant (523905835.714 and 9074780.845, respectively).

Observations about the virtual supply:

- The

virtual supplyis highest when the STEEM price is at or below the haircut threshold. - About 80% of the possible reduction can be realized by raising the STEEM price to about $0.93.

- The maximum reduction possibility is 10% off from the max.

- The haircut price is $0.156.

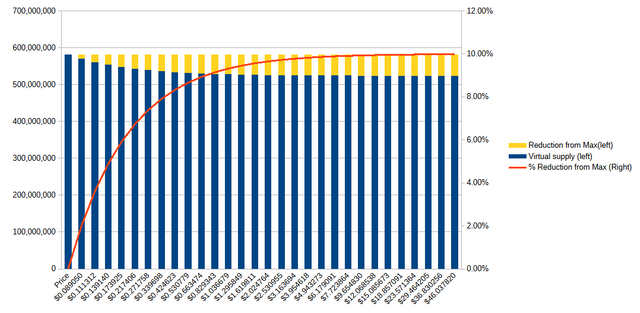

STEEM Supply at today's value, SBD Value based on the SPS wallet.

Let's suppose that it were somehow possible to burn all of the SBDs outside of the SPS ($5,183,743.585). How would that effect the virtual_supply behavior for STEEM prices above the haircut threshold? Here's what that looks like:

Observations about the virtual supply

- The maximum is still at the haircut price (no surprise)

- 80% of potential reductions can be achieved at about $0.53

- The maximum reduction is still 10% of the minimum.

- The haircut price would be $0.089.

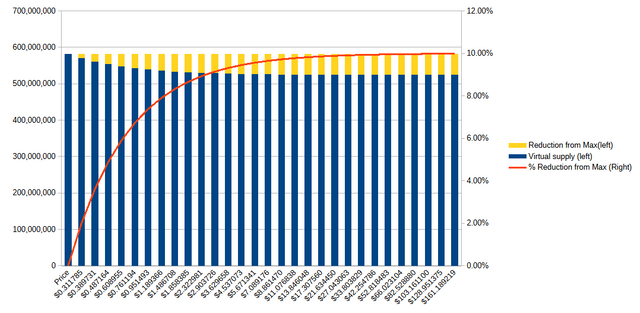

What if the number of SBDs is doubled?

Instead of reducing the SBD supply, what if we double it (18,149,562)? Here's what that looks like:

Observations about virtual supply

- The max is still the max.

- 80% of max reductions can now be achieved at about $1.85.

- The max reduction is still 10% below the maximum

virtual_supply. - The haircut price is about $0.312

What if we double the STEEM supply?

So, now let's go back to the actual current_sbd_supply and double the current_supply of STEEM (1,047,811,671.428). Here's what that looks like:

Observations about virtual supply

- The max virtual supply also doubled.

- The max reduction is still 10%, but it's 10% of a much bigger number.

- The haircut price would be $0.078

- The 80% of possible reduction threshold would be around $0.46.

Summary

I don't think we need to do another one by halving the current supply to get a cursory understanding of what's going on here.

Obviously, these visuals will be different for any possible pairing of current_supply and current_sbd_supply, but the overall shape should always be similar. When we're on the left side of the curve, the effects of price changes are strong. On the right side of the curve, the effects are weak.

As a rule of thumb, the threshold where 80% of potential reductions have been accomplished seems to sit at roughly 6 times the haircut price. (it's actually a little below 6, maybe around 5 2/3 or 5 3/4, but it looks like 6 from the 10,000 foot level ;-).)

| STEEM Supply | SBD Supply | Min Virtual Supply | Max Virtual Supply | 80% Threshold | Haircut price |

|---|---|---|---|---|---|

| 523,905,835.714 | 9,074,780.845 | 523905835.714 | 582,117,595 | $0.93 | $0.156 |

| 523,905,835.714 | 5,183,743.585 | 523905835.714 | 582,117,595 | $0.53 | $0.089 |

| 523,905,835.714 | 18,149,562 | 523905835.714 | 582,117,595 | $1.85 | $0.312 |

| 1,047,811,671.428 | 19,074,780.845 | 1,047,811,671.428 | 1,164,235,190 | $0.46 | $0.078 |

And we can summarize, directionally, how changes to current_supply and current_sbd_supply drive the haircut threshold, the 80% threshold, and the virtual_supply (assuming no other changes).

| Parameter | Direction | haircut threshold | 80% threshold | virtual supply |

|---|---|---|---|---|

| STEEM supply | up | down | down | up |

| STEEM supply | down | up | up | down |

| SBD supply | up | up | up | up (until the haircut threshold is reached) |

| SBD supply | down | down | down | down (when above the haircut threshold) |

One last point, and perhaps its obvious, but the reason that the minimum value for the virtual_supply is always 10% below the maximum, and it always matches the current_supply is that as the STEEM price gets higher the number of steem_per_sbd goes towards zero. In turn, that drives the 2nd term of the equation 1 towards 0, too.

Update:

In that last table, there may be(?) interesting implications for SBD conversions. Converting from SBD to STEEM involves reducing the SBD supply and increasing the STEEM supply. The first reduces the virtual_supply and the second increases it. I would have presumed those changes would offset each other. However, it's interesting to note that both changes tend to push the haircut price and the 80% threshold in the same direction (down), so maybe not(?)...

End update

Thank you for your attention!

Thanks for the new input on Steemonomics. I've now had time to look at it in more detail.

I would confirm your observations.

I also found it astonishing why the virtual supply decreases by a maximum of 10%. However, if you consider the term

1 / xwithx = steem_price, the limit forx → ∞is equal to 0 (it's a pity we can't use LaTeX). This leads to your observation that in this case only the first summand ofequation 1has an influence on the virtual supply.I assume that the maximum reduction of 10% results from the haircut rule, which defines that the debt ratio may not exceed 10%. If the debt ratio were to be increased with a hard fork, a larger reduction would be possible. But what would happen to the haircut threshold then?

At first, I thought that we had already clarified the effects. But when I looked for your post on this topic, I noticed that we had only dealt with this below the haircut threshold.

However, a sample calculation showed that even here, with the price unchanged (above the haircut threshold), the

virtual_supplydoes not change. This is also immediately apparent, as the changes to the STEEM supply and the SBD supply each depend on the current (unchanged) price.However, this actually reduces the haircut threshold. In this respect, I think your assumptions are correct and behave in the same way as below the haircut threshold.

I just thought of an example of your second case (lower SBD supply):

If we did a hard fork to take the SBD in the DAO out of the debt calculation, it would have the same effect you showed.

0.00 SBD,

6.16 STEEM,

6.16 SP

I agree. The haircut rule creates a 10% buffer above the

current_supplythat can be filled with SBD debt, and that's the only space wherevirtual_supplyis eligible for reduction.I guess the behavior after such a hardfork would also depend on other parameters, too. If it were just linear scaling like we have now, then I guess it would be more or less the same, just with the new cap. I haven't kept up with Hive, but I have the impression that they made some additional changes besides just increasing the max debt ratio. If we were to implement more complicated changes like that, I think it would probably need a whole new/different analysis.

True. I agree. It lowers the haircut price, but if the actual price is unchanged, then the lower haircut price doesn't matter for calculating the

virtual_supply. By lowering the 80% threshold, it would move the reduction percentage to the right on the curve, which just means that thevirtual_supplywould be less sensitive to future price changes.Yeah, that's a far more realistic example than the one I used. It might actually be useful to think about implementing that. I guess it would knock the haircut price down by more than 50%, and it's probably justifiable, since those SBDs are all locked up, indefinitely.

0.00 SBD,

4.50 STEEM,

4.50 SP

Yes, they have definitely made changes. I have seen that the start and stop thresholds are now 20% there. So there is no longer an intermediate range. However, I do not know whether there are any further changes in relation to economic aspects.

Ah, yes, I see.

I think too. That's something I would shortlist for a hardfork.

0.00 SBD,

0.21 STEEM,

0.21 SP

Thank you, it is great to see a visual effect of the various combinations of Steem and Steem supply. Thank you for the graphs and explanation of the effects! What can we do to increase the Steem price? do we have any control over price? Would it be better to covert all SBD, or increase Steem supply?

0.00 SBD,

0.21 STEEM,

0.21 SP

I wish I knew. I'm not sure there's anything that can be done, directly. In another comment, @moecki mentioned the idea of removing the SPS wallet from the debt calculation. That might be worth considering. Another possibility is to support the "Reduced Inflation Proposal #21" proposal, which would start burning 1000 SBDs per day if it were to get funded. At today's prices, that's about 6400 STEEM. Not a huge amount, but it's something.

Your post has been supported by SC-05. We support quality posts, quality comments anywhere, and any tags