Currency contortions - the fragility of FIAT

12/08/2018/15:40CET

How will the Swiss national bank react to the weakness in the Euro?

Not many know that the Swiss National Bank (SNB) is a private bank partially owned by the individual Kantons of Switzerland.

They act as the Central Bank of Switzerland tasked in their own special way to manage the Swiss currency - the Franc

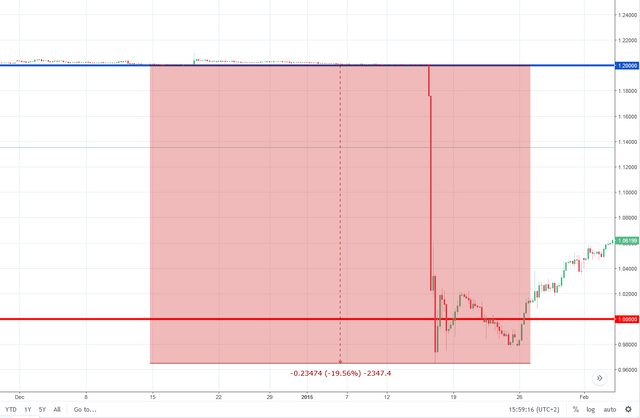

It is well remembered in Switzerland that on 15 Jan 2015, that the 1.2 to 1 peg to the Euro, which most of the population was unaware of, came to a spectacular end!

And for more dramatic effect, the 4h chart (cannot get the hourly resolution any more)...

In fact I remember the morning it happened and the rise of the Swiss franc against the Euro, all 19.5% of it happened at the start of trade that day and took all of about 15 min to unwind!

Many a Forex trader was crushed!

So, Yes, you get that right ladies and gentlemen!

2 of the most stable and important currencies in the world, the Swiss franc and the Euro had a Forex SNAP of almost 20% in 15 min!!!!

The SNB had been actively intervening in the forex market since August 2011 (the yellow box in the first forex chart) to defend Swiss exporters from the appreciating franc.

They did this by buying Euros hand over fist to keep the desired exchange rate.

It WORKED till DIDN'T anymore.

And the pent up economic forces were allowed to SNAP back to their equilibrium.

Actually following this snap, it is assumed among certain circles that, even though not openly talked about, that the SNB panicked and began a new intervention immediately afterwards. So it has been quietly continuing to buy up Euros to hold down the Franc.

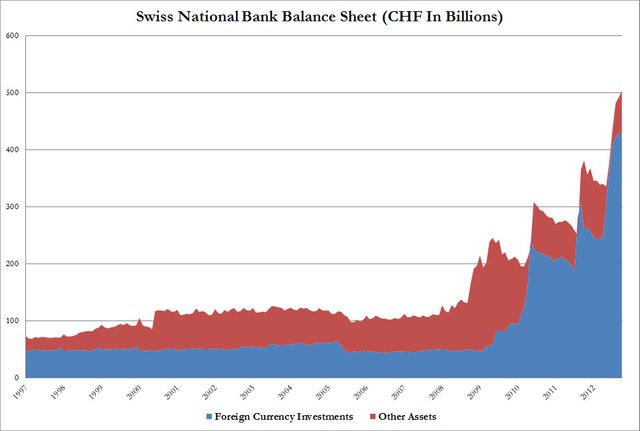

Check out the expansion of the SNB Balance sheet!

Yes that is almost a 5 fold increase in 5 years! (2008-2013)

This chart ends in 2013 - in the middle of the intervention phase.

It has been hard to find a chart that shows the time period crossing over the intervention time up to latest data.

I wonder if it is to keep the news of the continuing interventions as hidden as possible?

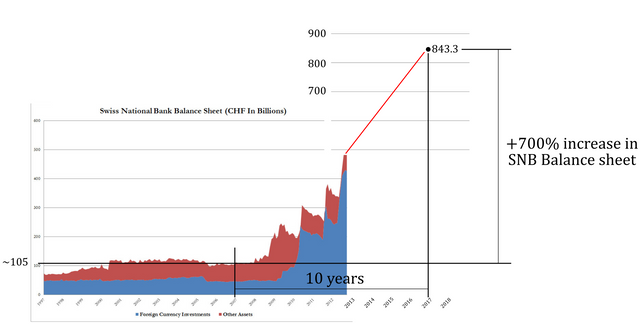

I found on the SNB website the latest balance sheet figures for 2017. The size of the SNB Balance sheet is 843.3 billion Francs

So I took the liberty to amend the cahrt with the new data to see how it looks...

Yes a 703% increase in the balance sheet in the space of 10 years!

And it does not stop in Jan 2015!

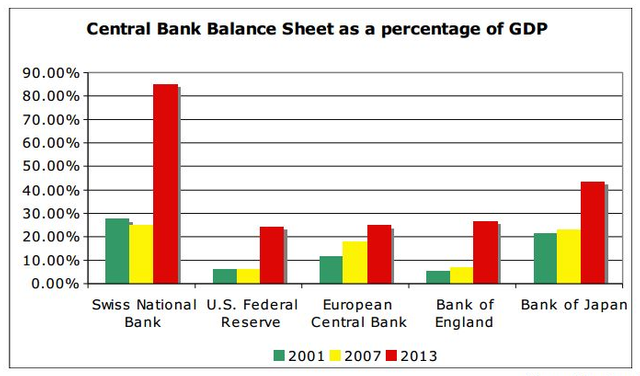

Just to put this into perspective internationally...

Here is a look at the SNB Balance sheet vs GDP against other major economies.

Why do I tell you this now?

Because as we look at the monthly chart again, we see that the Swiss franc is again picking up power, or conversely the Euro is losing ground. My feeling is the Turkish currency problems are spilling over into some of the larger European banks and this is weighing on the Euro.

Often it is hard to see currency debasement when those that are doing it do not want you to see it, but they cannot hide all the signs.

I think this is one of them.