205 Steem Dollars Writing Contest- My Entry

The best place to start most things in life is from the beginning

So let me tell you what this post is all about and who organized it.

This is my entry for the sponsored writing contest organized by @monajam. You can find the contest here.

Summary

MOBU is a decentralized framework that offers unlimited capabilities to any businesses that wants to offer security tokens by launching an ICO. The hurdles that restrict businesses from succefully creating an ICO includes strict government regulations, diifficult legal procedures and other technical requirements. These challenges are so difficulty that it prevent firms and businesses from either successfully completing a security token ICO or not starting at all. MOBU creates the unique environment to launch any ICO. It uses smart contracts and other blockchain technologies to enhance and simply the process of offering security tokens to the public to raise business capital for any organization.

Please find more information about what MOBU is from this introduction post

Launching a security token - not the easiest thing!

New firms and startups wanting to raise funds for their business have turned to ICO since the blochchain boom. While it is easier to build up capital by selling cryptocurrency to investors, the processes and procedures involved in launching an ICO is quite daunting.

In most places, if not all, Authorities and bodies like Securities and Exchange Commission (SEC) classify security tokens as securities and thus mandates the issuer to comply with all regulations governing securities. These regulations are usally complex and complicated. Most startups begin to go for all certifications required, but stop along the way because of difficult it is to do all that is required of them.

Technical challenges also pose a threat to successfully launching a security token. Most new businesses - especially the ones not under Information Technology - struggle to understand blockchain technology and find it hard to start one. To find the skilled blockchain developers who are willing to work on the project is also difficult as they are few or cannot accept the little pay offered by new startups. All these are challenges that have hindered businesses from successfully launching an ICO.

Understanding utility tokens and security tokens

The name utility suggest what utility tokens are. They give holders right or exclusive access to services offered by the issuer. Utility tokens can be exchanged for whatever services the company provides. They are not financial investments and as such, they are free from government regulations governing securities.

A very good example of a utility token is (GNT) issued by Golem. Golem is a decentralized computing network that offers its utility coin (GNT) to users in need of processing power. The token (GNT) is then used to pay individuals who share their computing resources on the platform for others to use.

On the other hand, security tokens are financial investments with a view to making profit from it. Security tokens represents an opportunity to contribute funds and to share in any profits the issuer made from the money contributed by all investors. People that buy security tokens are shareholders of the company or issuer.

The major difference is in the purpose of the token purchased. While utility tokens are purchased to access services offered by the issuer, security tokens are bought to enable the buyer share from the profit made from doing business with their money.

There are several examples of security tokens. Byteball is a very good example of security token

Why MOBU will facilitate launching of ICOs.

MOBU creates a unique environment and a level playing ground that removes all the challenges of successfully launching an ICO.

1. Brings Validated investors and Security tokens ICOs under one roof: MOBU cuts out the middle man between securities marketplace and ICOs. This ensures efficiency and transparency when buyers are dealing directly with the sellers.

2. MOBU banks partnerships: MOBU established great working relationships with banks to ensure smooth conversion of fiat to cryptocurrency. This gives users the freedom to change their money to whatever form they deem appropriate for each transaction.

3. A unique Escrow service: The escrow service includes preventing issuers from having access to total funds contributed by investors. In a situation where the issuer abandons its original roadmap. Escrow allows investors to exit the ICO. This escrow service also ensures higher Returns on Investment. So with this valuable feature, MOBU protects its investors securely from financial fraud.

**4. Easy entry: ** Unlike the difficult legal, technical and financial obligations involved in launching an ICO, MOBU makes it easy for startups to launch an ICO. It provides many competing legal and technical service providers; ensuring that users receiver pocket-friendly charges on services rendered on the platform.

Find out more about MOBU

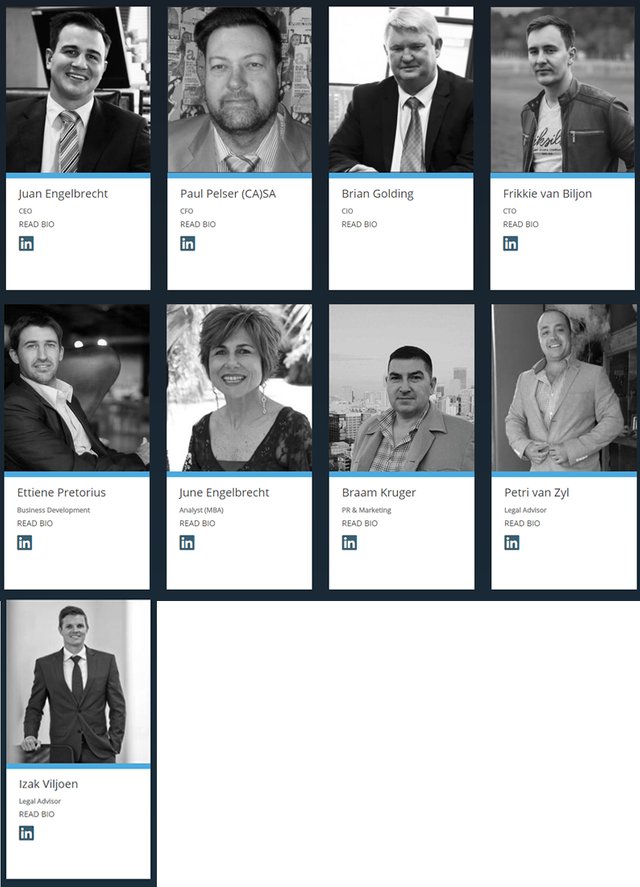

MOBU Team

MOBU Partners

Great piece of work, @kennyblaq

But I need to ask you some question?

So far it seem that MOBU is one of very few ICOs that are completly launched as security token. I wonder why. Wouldn't it be better to come up with some utility to their tokens and launch ICO as a utility token?

And also how will they maintan the price? Does MOBU offer Masternodes or POS to attract hodlers? If I cannot use those tokens and on top of that if there is no POS/masternodes introduced into their structure ... then what would make price go up or at least stay on stable level?

Upvote on the way! :D

Yours

Piotr